Pune’s real estate sector saw an influx of USD 194 million in private equity investments during 2022. Pune’s abundance of talent, thriving IT industry, improved connectivity, and quality of living have created ample opportunities for investment, making it a prime destination for institutional investors. These investors have recognized the potential for growth in Pune and established a strong foothold in the city’s office market according to the latest report by Savills India, a global property consulting firm.

The report suggests that Pune has witnessed robust private equity investments in real estate, totalling USD 1.8 billion since 2017. This represents a 6% share in overall India private equity investments. This trend has been on the rise in the past few years, with Pune’s share of overall India PE investments doubling from 4% in 2017 to 8% in 2021. The report also highlights that institutional investors have established a strong presence in Pune’s office market, owning approximately 30 million sq. ft. of office space which is equivalent to 45% of Pune’s overall Grade A stock. This shows that Pune is considered a lucrative market for real estate investments, specifically in the office segment, with institutional investors recognising the potential for growth and investing in the city’s real estate sector.

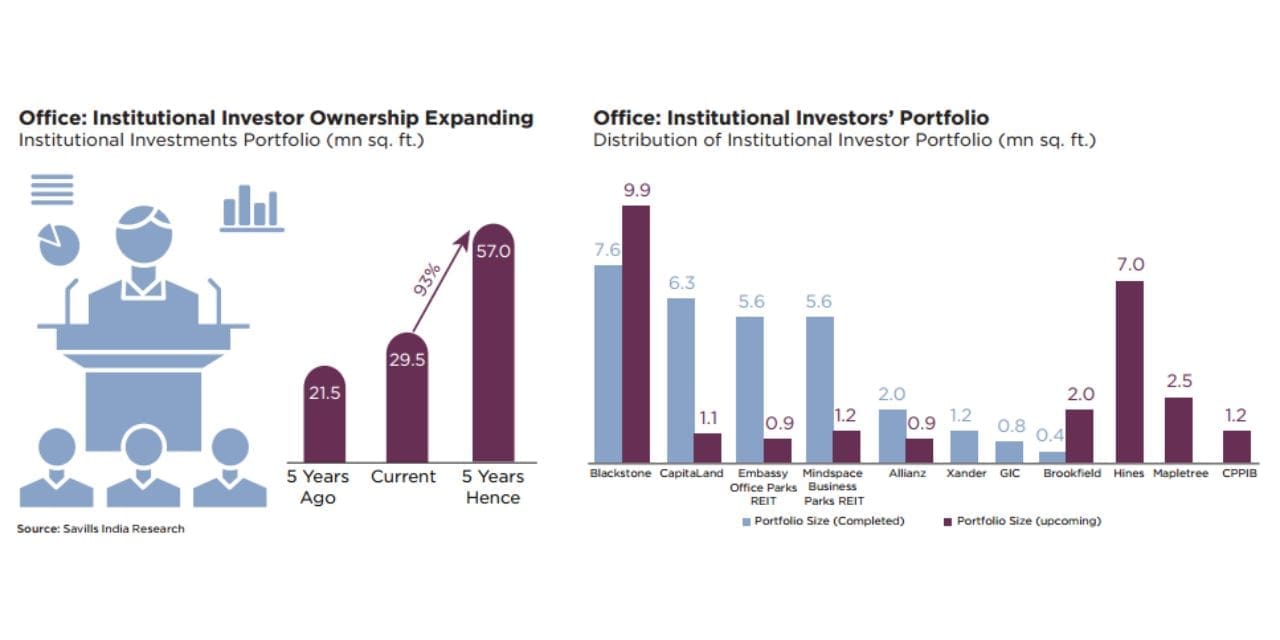

According to Savills India, the overall portfolio of institutional investors in Pune’s real estate market is expected to almost double by 2027, with an additional 27 million sq. ft. of office assets being added to the current 30 million sq. ft. portfolio, bringing the total to 57 million sq. ft. In addition to office, about 29 million sq. ft. of assets owned by institutional investors are spread across retail, hospitality, and industrial & warehousing sectors. This diversification of institutional investors’ portfolio highlights that there is a wide range of opportunities available in Pune’s real estate market.

East Pune is currently more popular among investors and has a larger share of institutionally owned office space than West Pune. Of the total current institutionally owned office stock, 62% lies in East Pune, while the remaining is in West Pune. Despite this, newer locations in West Pune such as Wakad and Tathawade are becoming more popular due to improving infrastructure and increased connectivity within the city.

“Pune’s real estate market is poised for significant growth in the coming years and is attracting attention from institutional investors. The city’s improving infrastructure, including the expansion of highways and the development of industrial parks, have contributed to this growth. Its proximity to India’s financial capital, Mumbai, makes it an ideal location for companies to establish their operations. Furthermore, Pune’s reputation as an educational and research centre has led to an influx of students and professionals which in turn provides a ready pool of skilled workforce for companies.” said, Praveen Apte, Managing Director – Pune, Savills India.

In the future, Savills expects new institutional investors to enter Pune’s real estate market, while current investors will expand their presence as quality assets grow. The city’s growth will be further boosted by various infrastructure projects currently under construction or in the planning stages. These projects include the Smart City development, Ring Road construction, Bus Rapid Transit System, metro rail, new airport, multiple subways, and flyovers.