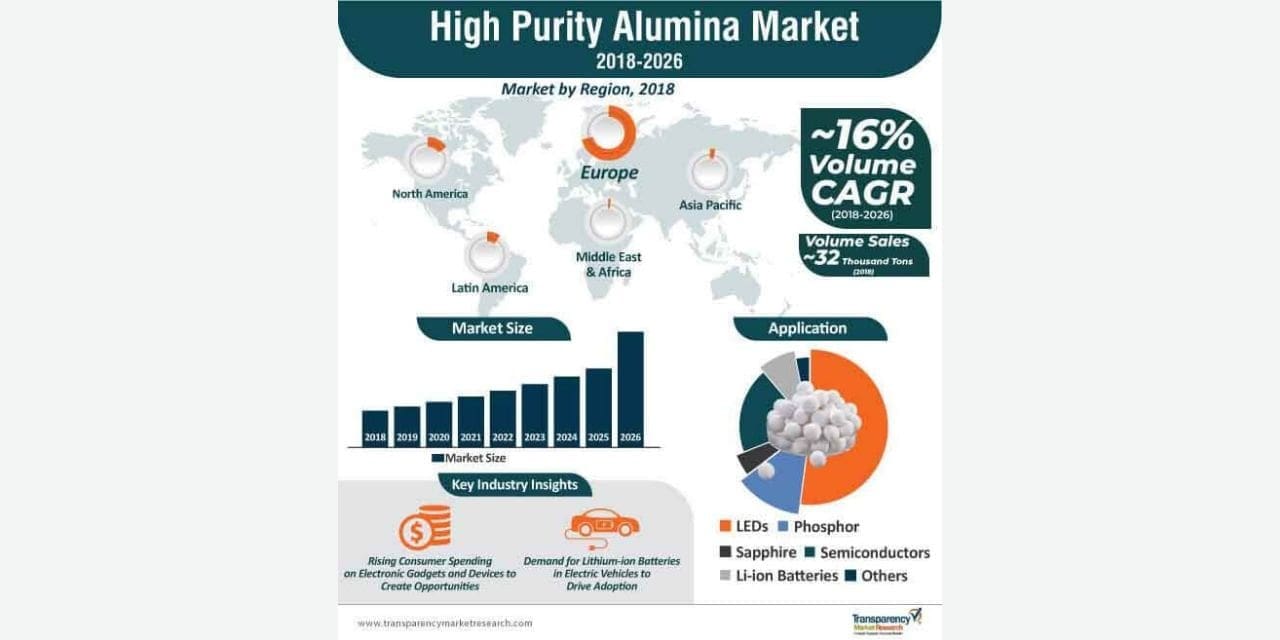

High purity alumina (HPA) is used in the making of LEDs. The strides in the electronics and automotive industries have propelled the prospects of the global high purity alumina market. The TMR study projects the market to advance at compound annual growth rate of approximately 15 percent during 2018–2026. High purity alumina is expected to rise in application due to high plasma corrosion resistance and relatively high strength. Worldwide, there has been extensive demand for high purity alumina for consumer electronics manufacturing.

High Purity Alumina Market – Scope of the Report

A latest study collated and published by Transparency Market Research (TMR) analyzes the historical and present-day scenario of the global high purity alumina (HPA) market, to accurately gauge its potential future development. The study presents detailed information about the important growth factors, restraints, and key trends that are creating the landscape for the future growth of the high purity alumina market, to identify the opportunistic avenues of the business potential for stakeholders. The report also provides insightful information about how the HPA market will progress during the forecast period of 2018-2026.

Share of Prominent HPA Market Players

- The high purity alumina market is dominated by a few major players, which generates intense competition. Key producers of high purity alumina depict a medium to low level of forward integration. This provides a distinct competitive advantage to market leaders in the HPA market. The entry of several small- to medium-scale manufacturers has intensified the competition in the high purity alumina market.

- Companies such as Hebei Heng Bo New Material Technology Co. Ltd., Zibo Xinfumeng Chemicals Co., Ltd., and Xuan Chen Jing Rui New Material Co., Ltd. are leading manufacturers in the HPA market in China.

- Sumitomo Chemical Co. Ltd., Nippon Light Metal Co. Ltd., and HMR Co. Ltd. have a wide presence in Japan and South Korea. Baikowski SAS and Sasol Ltd. are the major players operating in high purity alumina market in the U.S. and Canada. Polar Sapphire Ltd. has widespread operations across Canada.

High Purity Alumina Market: Key Highlights

- The high purity alumina marketwas valued at ~ US$ 1.1 Bn in 2017, and is anticipated to expand at a robust CAGR of ~15% during the forecast period.

- Expansion of the high purity alumina market is primarily driven by its rising demand from manufacturers of LEDs, lithium-ion batteries, and related products. The demand for LED products has increased significantly in developing economies such as China, Japan, Taiwan, and South Korea, due to increasing regulations pertaining to the use of incandescent bulbs.

- HPA is used in the coating of lithium-ion battery separators, found in electric vehicles and portable electronics. The rising use of sapphire glass by smartphone manufacturers is adding to demand for HPA.

Research Methodology – High Purity Alumina Market

The research methodology adopted by analysts for combining the high purity alumina market report is based on detailed primary as well as secondary research. With the help of in-depth insights of the industry-affiliated information that is obtained and legitimated by market-admissible resources, analysts have offered riveting observations and authentic forecasts of the high purity alumina market.

During the primary research phase of the HPA market report, analysts interviewed industry stakeholders, investors, brand managers, vice presidents, and sales and marketing managers. On the basis of data obtained through the interviews of genuine resources, analysts have emphasized the changing scenario of the high purity alumina market.

4N Grade HPA High on Demand

The various grades of high purity alumina covered in the report mainly include 4N, 5N, and 6N. Of these, the 4N accounted for the major share of nearly 64% of the sales of products in the high purity alumina market. The vast uptake of 4N products can be attributed to the rise in customized demand for the chemical for the manufacturing of LEDs and the proliferating demand for lithium-ion batteries among electronics manufacturers. The steady demand for scratch-resistant glasses of variety of consumer electronics and gadgets is a key trend bolstering the uptake of 4N grade. The 4N grade has purity of purity level of 99.99%.

On the other hand, the demand for 5N and 6N grades of high purity alumina are projected to rise at promising pace during the forecast period. The 5N grade segment is estimated to garner a CAGR of approximately 18% during the forecast period of 2018 – 2026.

Demand for 5N HPA Grade to Rise with Production of LEDs

The growing preference of LEDs over incandescent bulbs in several parts of the world is a key trend that added momentum to the expansion of the high purity alumina market. Some of the key regions where incandescent are being gradually phased out and LEDs are being adopted Europe, Malaysia, Argentina, Korea, the U.S., and Canada. The construction sector is witnessing massive potential demand for LEDs owing to growing implementation of green codes in the sector.

The 5N grade has purity level of 99.999%, while 6N has a purity level of 99.9999%. The demand for 5N is anticipated to increase rapidly due to use in liquid crystal displays (LCDs) and semiconductor industries for numerous thin film applications. Additionally, it has gained preference for sapphire, partly due to remarkably low concentration of trace impurities.

The global high purity market was pegged at approximately US$ 1.3 Bn in 2018 and is projected to climb to US$ 4 Bn in 2026. High purity alumina is extensively used in making of semiconductor wafer processing equipment.

The information presented in this review is based on a Transparency Market Research report, titled, “High Purity Alumina Market- Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 – 2026.”