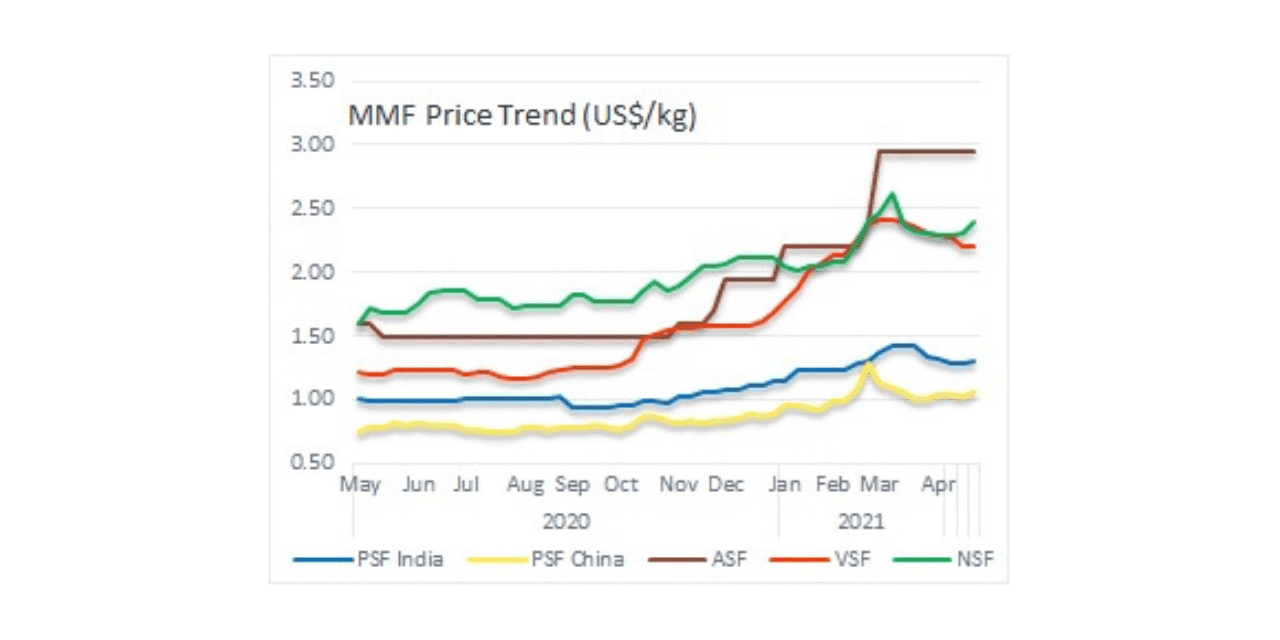

Manmade fibre prices eased across textile value chains, giving back most of the gains seen from post Lunar New Year holidays until end of March.

Polyester

Polyester staple fibre prices were down 3-4% in China as upstream cost was flat to down while downstream demand was moderate. In Jiangsu and Zhejiang, offers were and discussions for firm deals rested below March values. Trading prices were at around offer, indicating a low discount. The sale/production ratio was modest, ranging from 30-200%. Offers for 1.4D direct-melt PSF averaged 6.80-6.91 Yuan a kg (US$1.04-1.06 a kg, down US cents 1-4) in Jiangsu and Zhejiang while the same in Fujian and Shandong were down US cents 4-5 at US$1.05-1.08 a kg.

In Taiwan, offer for 1.4D were raised US cents 10 to US$1.15 a kg FOB.

In Pakistan, producers kept reducing their offers week on week in April and were down 3% compared to March values. 1.4D PSF offers were cut by PakRs15 or US cents 4 to PakRs.205-207 a kg (US$1.31-1.32 a kg).

In India, producers offers were also lowered as demand weakened significantly due to lockdown to contain pandemic spread. Local plants were reportedly running at around 60-70% capacity during the last two weeks of April, down from an average of 90% in end March. Offers were down INR7 to INR96.75 a kg (US$1.31 a kg) for 1.2D and at INR96 a kg (US$1.30 a kg) for 1.4D.

Nylon

In China, nylon staple fibre offers were down over 4% in China during April in comparison with March average. Downstream makers lowered that operation amid rigid end-use demand. Overall, nylon yarn sentiment was expected to hold stable. 1.5D offers were down to 15.12-16.00 Yuan a kg (US$2.32-2.46 a kg, down US cents 6).

Acrylic

Acrylic staple fibre prices stood stable at a low position in April in China, India, and Pakistan this April. Producers had limited room to adjust prices at the moment as feedstock acrylonitrile markets showed weakening signs in recent weeks, and some lower numbers were also heard being quoted. Taiwan origin offers for 1.5D acrylic fibre were rolled over on the week at US$2.95-3.10 a kg FOB Taiwan.

In China, the industrial run rate was reduced to 25% this week as a major producers had shut down units for maintenance while others kept on running at reduced rates. Downstream buyers were more actively buying acrylic fibre as prices dropped to a bottom. Fibre producers reported some improvement in fresh orders in late April. Prices for medium-length and cotton-type acrylic fibre 1.5D and 3D tow were kept steady at 19.30-20.00 Yuan a kg (US$2.97-3.07 a kg).

In Pakistan, overseas suppliers raised their offers in Karachi market back to late March levels in the last week of April. 1.2D ASF offers from overseas suppliers were lifted PakRs100 or US cents 66 to PakRs.450-455 a kg (US$2.94-2.97 a kg) in Karachi market.

Indian producers pegged their offers for April at INR248-250 a kg (US$3.35-3.37 a kg).

Going ahead, acrylic fibre producers are unlikely to lower prices due to still high production costs.

Viscose

Viscose staple fibre market in China was quiet with offers plunged in April although some stability was seen later. Traders had largely taking over the business while producers maintained or reduced their offers for medium-end and high-end goods. Liquidity at high-end producers was reported to be slow. In spot, selling prices for medium-end and high-end from traders were pegged lower than producers’ offers. Overall, markets remained stalemated going into May day holidays, while inventory at producers will pile up. In spot, average prices were rolled back for 1.5D to 14.58 Yuan a kg (US$2.24 a kg, down US cents 14 from March) and 1.2D to 15.17 Yuan a kg (US$2.33 a kg, down US cents 8).

In Taiwan, viscose fibre prices were raised in the last week of the month due to shortage of pulp shortage. Offers for 1.5D were hiked US cents 5 to US$2.10 a kg FOB.

In Pakistan, offers from overseas suppliers were lowered for four weeks in a row as demand seems to be lackadaisical amid sluggish cotton markets. Offers for 1.5D VSF in Karachi were down to average PakRs360-365 a kg (US$2.35-2.40 a kg).

In India, no change was reported in viscose fibre prices amid lockdown imposed to contain COVID-19 spread.

BY: NITIN MADKAIKAR