- Strong operating result: EBITDA at EUR 217.8 mn, cash flow from operating activities at EUR 199.8 mn ⬤ Major strategic projects continue fully on track – production start of the lyocell plant in Thailand in the fourth quarter of 2021

- Start of strategic cooperation agreement for textile recycling with Södra

- New milestones in the implementation of group-wide carbon neutrality: EUR 200 mn investment in existing locations in Asia

- Guidance 2021: Lenzing expects EBITDA of at least EUR 360 mn

Lenzing – The Lenzing Group reported a significant improvement in revenue and earnings in the first half of the year. Growing optimism in the textile and apparel industry and the ongoing recovery in retail caused a substantial increase in demand and prices on the global fiber market, in particular at the beginning of the current financial year.

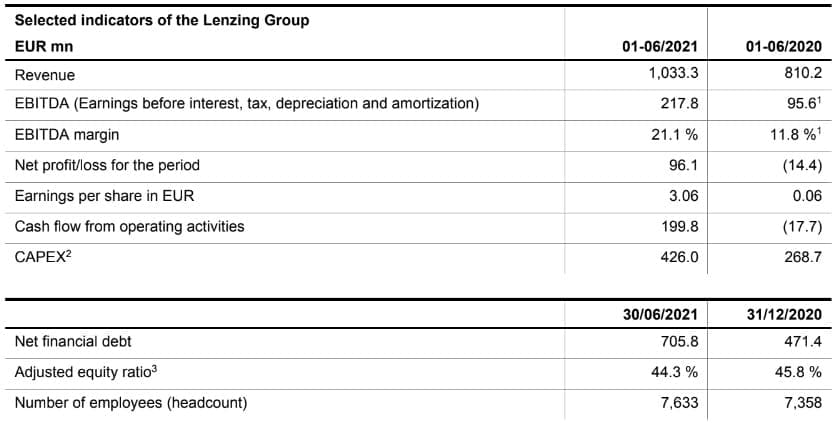

Revenue rose by 27.5 percent to EUR 1.03 bn in the first half of 2021. This increase is primarily attributable to higher viscose prices, which stood at more than RMB 15,000 in May thanks to significantly higher demand for fibers, especially in Asia. The focus on wood-based specialty fibers such as TENCEL™, LENZING™ ECOVERO™ and VEOCEL™ branded fibers also had a positive impact on the revenue development; the share of specialty fibers in fiber revenue rose to 72.8 percent in the reporting period. The negative impact of more unfavorable currency effects was consequently more than offset. The earnings development essentially reflects the positive market development and was additionally reinforced by measures to improve efficiency. Energy and logistics costs increased significantly throughout the entire reporting period. EBITDA (earnings before interest, tax, depreciation and amortization) more than doubled and amounted to EUR 217.8 mn in the first half of 2021 (compared to EUR 95.6 mn in the first half of 2020). The EBITDA margin rose from 11.8 percent to 21.1 percent. Net profit for the period amounted to EUR 96.1 mn (compared to a net loss of EUR minus 14.4 mn in the first half of 2020) and earnings per share to EUR 3.06 (compared to EUR 0.06 in the first half of 2020).

“Lenzing had a very strong first half-year. The demand for our sustainably produced specialty fibers once again developed excellently,” says Stefan Doboczky, CEO of the Lenzing Group. “Strategically, we remain fully on track. The largest investment program in the company’s history is proceeding according to plan and we still expect to start up the new lyocell plant in Thailand in the fourth quarter. The cooperation with Södra and our significant investment in the existing locations are the next milestones on our path towards a carbon-free future. With our climate goals, we are a frontrunner in the production industry and in the fiber industry in particular,” Doboczky adds.

Gross cash flow more than tripled to EUR 199.5 mn in the first half of 2021 (compared to EUR 63.9 mn in the first half of 2020). This increase was above all due to the earnings development. Cash flow from operating activities amounted to EUR 199.8 mn (compared to EUR minus 17.7 mn in the first half of 2020). Free cash flow amounted to EUR minus 224.3 mn (compared to EUR minus 285.7 mn in the first half of 2020) due to the investment activities related to the projects in Thailand and Brazil. CAPEX (expenditures for intangible assets, property, plant and equipment and biological assets) increased by 58.5 percent to EUR 426 mn during the reporting period, of which roughly half was financed out of cash flow from operating activities. The renewed strong increase in investments is attributable to the implementation of the key projects.

Strengthening specialty fiber growth

The construction of the pulp mill in Brazil continues to proceed according to plan despite the challenging developments related to COVID-19. The start-up of the pulp mill is still scheduled for the first half of 2022. The new mill will strengthen backward integration and, consequently, Lenzing’s specialty fiber growth in line with the sCore TEN strategy.

Specialty fibers are Lenzing’s great strength. The objective is to generate more than 75 percent of fiber revenues from business with wood-based specialty fibers such as lyocell and modal fibers by 2024. The focus of this strategic target is on the construction of a new state-of-the-art lyocell plant in Thailand. The investment for the new plant with a capacity of 100,000 tons amounts to roughly EUR 400 mn. Construction work started in the second half of 2019 and went according to plan in the reporting period. The recruiting and onboarding of new employees is also progressing successfully. Production is scheduled to start towards the end of 2021.

In addition, Lenzing is investing more than EUR 200 mn in its production sites in Purwakarta (Indonesia) and Nanjing (China) to convert existing standard viscose capacity into capacity for environmentally responsible specialty fibers. In Nanjing, Lenzing will establish the first wood-based fiber complex in China that is independent from coal as an energy source. At the same time a line of standard viscose will be converted to a TENCEL™ branded modal fibers line making the Chinese plant a 100 percent wood-based specialty fiber site by the end of 2022. Investments in Lenzing’s site in Indonesia will make this facility fully compliant with the EU Ecolabel standards. As a result, the site will become a pure specialty viscose supplier as of 2023. Upon completion of these investments Lenzing will boost its share in specialty fibers as a percentage of fiber revenues to well above the targeted 75 percent already by 2023.

Vision of a zero-carbon future

With the implementation of its science-based targets, the Lenzing Group actively contributes to combating the problems caused by climate change. In 2019, Lenzing made a strategic commitment to reducing its greenhouse gas emissions per ton of product by 50 percent by 2030. The vision is to be climate-neutral by 2050. The two key projects in Brazil and Thailand are important milestones on this journey. Thanks to its excellent infrastructure, the location in Thailand can be supplied with sustainable biogenic energy. In addition, the mill in Brazil will feed more than 50 percent of the electricity generated into the public grid as renewable energy. The investments at

the existing Asian locations are also in line with Lenzing’s decarbonization goals.

In the first half of 2021, the company announced the construction of the largest ground-mounted photovoltaic plant in Upper Austria on an area of 55,000 m² at the Lenzing site. Construction is scheduled to start in the second half of 2021. In addition, Lenzing is investing GBP 20 mn (equal to EUR 23.3 mn) to build a new, state of-the-art wastewater treatment plant at its site in Grimsby (United Kingdom). The investment is part of the company’s plans to reduce wastewater emissions by 2022.

The cooperation with Södra, a Swedish pulp producer, marks another milestone in Lenzing’s efforts to achieve its ambitious climate and sustainability goals. The two leading global suppliers, which have been proactively driving circular economy in the fashion industry for many years, are joining forces to give the issue another boost and to make a decisive contribution to addressing the global textile waste challenges. A capacity expansion for pulp from post-consumer waste is also planned. The goal is to recycle 25,000 tons of textile waste per year by 2025.

The presentation of the first TENCEL™ branded lyocell fiber made of orange pulp and wood sources as part of the new TENCEL™ Limited Edition initiative with the Italian company Orange Fiber as well as the introduction of the first carbon-neutral cellulosic fibers on the global nonwovens market under the VEOCEL™ brand are other recent results of product innovation, which serve as examples for the ambitious efforts of Lenzing and its partners on the issues of climate change and circular economy.

Momentum through legislation

Pollution of the environment – especially marine pollution – is one of the biggest problems of our time. The fashion industry has an extremely negative impact on the environment with its fast fashion business model and the growing consumption of fossil resources. The use of fossil-based synthetic fibers in textiles has roughly doubled over the last 20 years. More than half of all textiles worldwide contain polyester today, and the share keeps increasing. This is also demonstrated by a report of the non-profit organization Changing Markets Foundation.

Consequently, Lenzing welcomes specific measures taken by the EU in fighting plastic waste, for example those related to the Single-Use Plastics Directive (EU) 2019/9041. The EU Commission specifies in the recently issued guidelines for implementation of the directive which products fall within the scope of the directive, thus providing clarity in the joint fight of the EU member states against environmental pollution from plastic waste. Lenzing’s wood-based, biodegradable cellulosic fibers such as those of the VEOCEL™ brand comprise a sustainable and innovative solution to this man-made problem. The Single-Use Plastics Directive stipulates uniform labelling requirements for some of the single-use plastic products on the packaging or the product itself starting in July 2021. They encompass feminine hygiene products and wet wipes for personal and household care containing plastic.

EcoVadis Platinum status

Lenzing received several awards for its achievements during the reporting period, most notably in the field of sustainability: The Corporate Social Responsibility rating by EcoVadis deserves particular mention. Lenzing achieved Platinum status for the first time and now ranks among the world’s top one percent of the companies evaluated with regard to the environment, fair working conditions and human rights as well as ethics and sustainable procurement. The non-profit environmental organization CDP once again recognized Lenzing’s efforts to tackle climate change. Lenzing earned a place on CDP’s Supplier Engagement Leaderboard for its role as a supplier engagement leader.

New divisional structure

To prepare the Lenzing Group for the challenges and opportunities arising from the investment projects and the changed market environment, the Managing Board presented a new organizational structure, which supports the goals of the sCore TEN strategy focusing on profitable, organic specialty fiber growth and will further increase Directive (EU) 2019/904 of the European Parliament and of the Council of June 5, 2019 on the reduction of the impact of certain plastic products on the environment efficiency and transparency. The organization of business was consequently adjusted and structured in two new divisions, “Fiber” and “Pulp”, as well as “Others”2.

Guidance for 2021

The International Monetary Fund expects global growth of 6 percent for 2021. However, the economic recovery after the deep recession caused by COVID-19 is subject to risks and largely depends on the vaccination progress and successful containment of the pandemic. The currency environment is expected to remain volatile in the regions relevant to Lenzing.

The global fiber and pulp markets came under considerable pressure as a result of the COVID-19 crisis. The significant recovery of demand from the third quarter of 2020 onwards, starting in China, continued into the first quarter of 2021. In February/March of this year, the market turned again and has since moved sideways. In the cotton market, a shortage in production volume is anticipated in the current 2020/2021 harvest and, consequently, a slight decline in inventory levels. The prices for dissolving wood pulp remain at a high level.

Lenzing expects a continued increase in demand for sustainably produced fibers for the textile and apparel industry as well as for the hygiene and medical industry. This trend is likely to continue unabated after the COVID 19 pandemic, not least due to a number of legislative initiatives.

With the prospect of a progressing active immunization of a broad population against COVID-19, optimism and confidence in an early return to normality are also growing within the textile value chain. However, the currently positive environment is still characterized by a high level of uncertainty, also due to the increased occurrence of virus mutations and the extreme occurrence of infections in countries such as Brazil and India. Therefore, the visibility remains limited.

Taking into account the above factors and due to the very positive development of the first half of the year, the Lenzing Group expects the EBITDA in 2021 to reach at least a level of EUR 360 mn.

In view of these developments, Lenzing considers itself well-positioned with its sCore TEN corporate strategy, and will continue to drive the completion of the major strategic projects, which will make a significant contribution to earnings from 2022. In addition to its targets for EBITDA (EUR 800 mn) and ROCE (>10 %3), Lenzing also confirms its four other medium-term targets for 2024: net debt/EBITDA (<2.5 x), share of specialty fibers (>75 % 2 Note 3 to the condensed interim consolidated financial statements as at June 30, 2021 3 To be adjusted for assets under construction of fiber revenue), internal production of dissolving wood pulp (>75 %), decarbonization (>40 % fewer CO2 emissions per ton of product).

Net financial debt 471.4 Adjusted equity ratio3 45.8 % Number of employees (headcount) 7,633 7,358

1) As of the beginning of the 2021 financial year, the Lenzing Group prepares the consolidated income statement according to the cost-of sales method rather than the total cost method, thus increasing international comparability with peer group companies. Some amounts previously recognized in EBIT/EBITDA are reclassified to the financial result (see note 1 of the consolidated interim financial statements of the Half-Year Report 01-06/2021)

2) Capital expenditures: expenditures for intangible assets, property, plant and equipment and biological assets as per consolidated statement of cash flows

3) Ratio of adjusted equity to total assets in percent