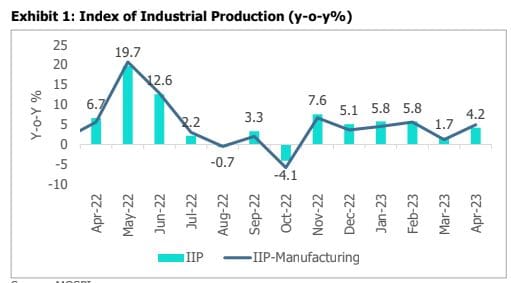

India’s industrial production recorded a growth of 4.2% in April rebounding from a growth of 1.8% in the previous month. The IIP growth during the month has come much better than our estimate of around 1% growth.

Encouraging performance in the mining and manufacturing sectors aided this performance, while weakness in the electricity output weighed.

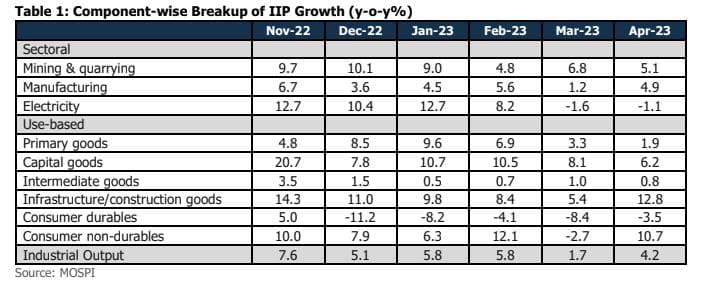

The manufacturing sector output grew by 4.9% in April, rebounding from a five-month low of 1.2% in the previous month. Within the manufacturing sector, 12 out of 23 categories recorded growth in output on a year-on-year basis. Despite the encouraging performance of the manufacturing sector, the export-intensive sectors such as textiles (-6.3% growth), wearing apparel (-29.1%), and leather & related products (-6.5%) remained pressured amid external demand weakness. Electricity output continued to contract for the second straight month with a de-growth of 1.1% in April as against a de-growth of 1.6% in the previous month.

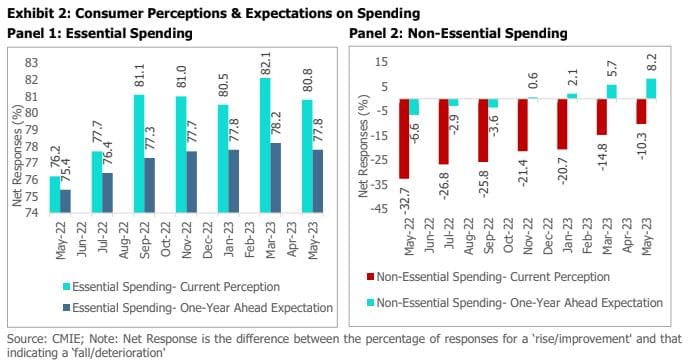

Within the use-based classification, the output of consumer durable goods fell by 3.5% in April, staying in the contraction zone for the fifth month in a row. On the contrary, the output of consumer non-durables recorded an upbeat growth of 10.7%, rebounding from a 2.7% contraction in the previous month. However, we will have to wait and see if this momentum is sustained. The output of capital and infrastructure-related goods grew by a healthy 6.2% and 12.8% respectively. Going ahead, several factors such as the Centre’s sustained capex push, improving private sector intent to invest and RBI’s decision to hold the interest rates steady bodes well for the capex revival in the economy. On the consumption front, the RBI’s consumer confidence survey (May 2023) pointed to continued pessimism among consumers about spending on non-essential items which can explain the muted performance of consumer durable goods. However, it is important to note that sentiments towards non-essential spending have witnessed improvement. A durable pick-up in consumption demand-including rural consumption remains critical for domestic industrial activity, especially given the weakness in external demand.

Way Forward

The performance in industrial output fared better than expected in April on the back of an improvement in the manufacturing output and robust growth in the construction sector. However, the disappointing performance in the consumer durable goods segment continued to be a drag on the overall growth. Going ahead, a durable pick-up in domestic consumption-including rural consumption- remains critical for the growth in industrial output. The easing of domestic inflationary pressures is a positive for demand in the economy. However, challenges from an uncertain global economic scenario and weak external demand are likely to persist.