Global cotton trade in 2019-20 is forecast at 44.2 million bales, 7.5 per cent above 2018-19, according to the US department of agriculture (USDA). As global cotton production is projected to exceed mill use once again, world ending stocks are forecast at 80.4 million bales in 2019-20, a 1.2-million-bale increase over stocks at the end of 2018-19 season. With total cotton trade up 3.1 million bales, exports from the United States and Brazil account for the majority of the increase. The United States is forecast to boost its shipments by 2.5 million bales (17 per cent), as increased supplies and higher foreign import demand in 2019-20 support higher exports. Brazil will also have increased supplies from its record crop in 2018-19, with exports there forecast to rise 1.8 million bales (29 per cent), the Economic Research Service of the USDA said in its latest ‘Cotton and Wool Outlook’.

Cotton exports from India are forecast at 4.4 million bales (+600,000 bales) in 2019-20, while shipments from Australia are projected to decrease by 50 per cent to 1.8 million bales as supplies decline significantly due to production shortfalls. Meanwhile, higher import projections for most of the leading importing countries are forecast for 2019-20. China—the leading importer—is expected to import 10.5 million bales of raw cotton, 13.5 per cent above 2018-19 and the highest in six years. Similarly, imports by Vietnam and Bangladesh are expected higher in 2019-20, as textile industries in these countries expand. For Vietnam, cotton imports are forecast at 7.8 million bales (+800,000 bales) in 2019-20, while Bangladesh’s imports reach 7.3 million bales (+400,000 bales). Imports for Pakistan (+100,000 bales) and Turkey (-200,000 bales) are each projected at 3.0 million bales.

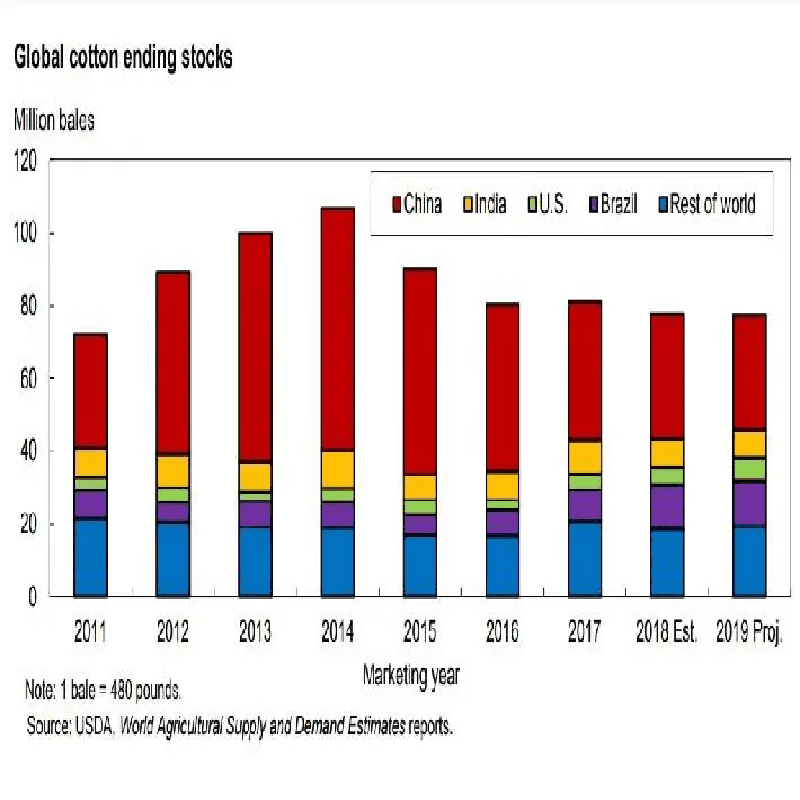

The global stocks-to-use ratio is forecast to remain flat at 65 per cent in 2019-20, which would equal the lowest ratio since 2010-11. Although China continues to hold the largest share (41 per cent) of world cotton supplies, 2019-20 ending stocks there are projected to decrease 2.4 million bales (7 per cent) to 33.0 million bales—half the level reached in 2014-15. However, stocks outside of China are expected to rise 8 per cent (3.5 million bales) in 2019-20, with a stocks-to-use ratio outside of China rising for the third consecutive season to 38 per cent, the highest since 2011-12. Consequently, the average world cotton price (A Index) in 2019-20 is expected to decline from the 2018-19 estimate of 84.5 cents per pound.