Overview

- In April 2023, fresh lending, as well as deposit rates, decreased, with lending rates dropping faster than deposit

rates. Meanwhile, the rates on outstanding business continued to climb. - The weighted average lending rate (WALR) on fresh rupee loans of SCBs reduced by 23 basis points (bps)

to 9.09% in April 2023 from 9.32% in March 2023. Meanwhile, WALR on outstanding rupee loans of SCBs

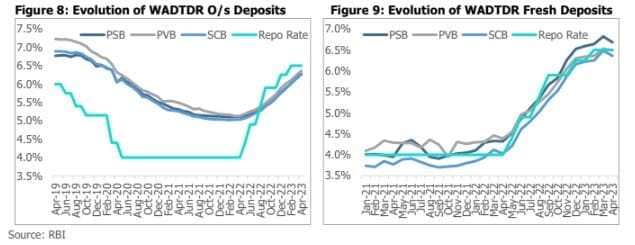

increased by 4 bps to 9.76% in April 2023 from 9.72% in March 2023. - Weighted average domestic term deposit rate (WADTDR) on fresh rupee term deposits of SCBs decreased

by 12 bps to 6.36% in April 2023 from 6.48% in March 2023. On the other hand, WADTDR on outstanding

rupee term deposits of SCBs increased by 12 bps to 6.28% in April 2023 from 6.16% in March 2023. - 1-Year median Marginal Cost of Fund based Lending Rate (MCLR) of SCBs remained steady at 8.60% in

May 2023.

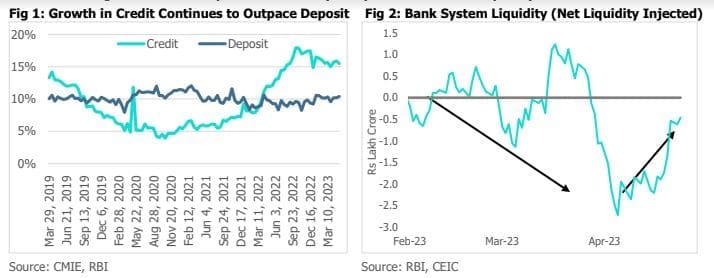

Continued Large Credit and Deposit Growth Gap Coupled with Lower Liquidity Levels

Credit demand has been recording double-digit growth driven by personal loans, increased working capital

requirements, and NBFCs. Meanwhile, comparatively lower deposit mobilisation and pick-up in credit offtake have

pushed the credit deposit ratio to nearly 75.4% as of May 05, 2023.

The banking system liquidity surplus has narrowed from Rs 6.3 lakh crore at the start of FY23 and had turned into

a shortfall near the end of FY23. Hence, liquidity had been injected into the system. Banking system liquidity turned

to a surplus in April on account of government spending and RBI FX intervention. Liquidity infusion was somewhat

offset by LTRO/TLTRO redemptions. To keep liquidity near neutral, RBI could continue conducting VRRR auctions.

The short-term Weighted Average Call Rate (WACR) has reached 6.76% (as of May 12, 2023) from 4.06% as of

May 13, 2022, due to a rise in policy rates and lower liquidity in the system.

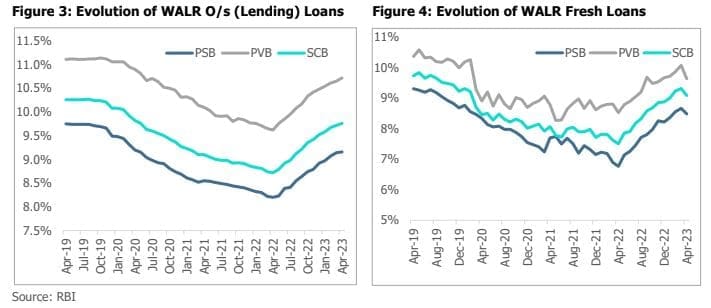

Lending Rates on Outstanding Portfolio Continue to Rise, while Fresh Rates Decline

WALR on fresh loans dipped m-o-m for PSBs (18 bps), PVBs (44 bps), and SCBs (23 bps). Meanwhile, WALR on

outstanding loans has continued to witness a m-o-m increase across all segments, PSBs (2 bps), PVBs (7 bps), and

SCBs (4 bps). Meanwhile, it is interesting to note, that the foreign banks have witnessed a fall in their o/s lending

rates and an increase in their fresh rates. On m-o-m basis, spread between WALR O/s loans and WALR fresh loans

for PSBs and PVBs increased as WALR on fresh loans fell and WALR on O/s loans continued to increase.

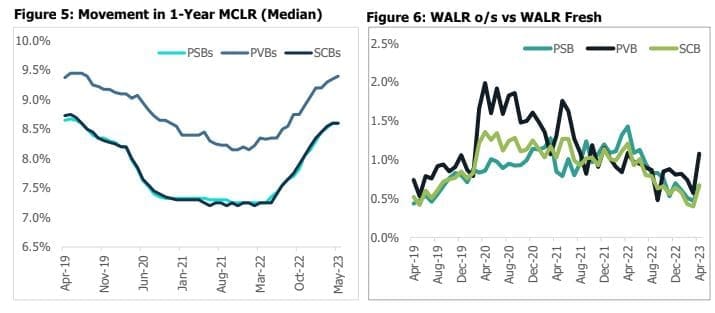

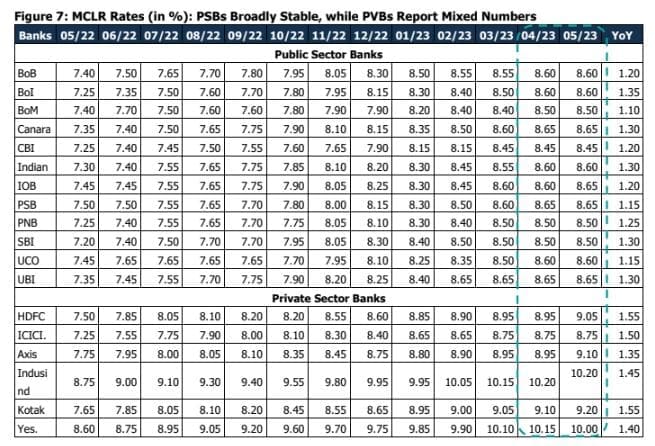

On a m-o-m basis, 1-Year median MCLR of SCBs remained unchanged at 8.60% in May 2023 as majority of the

PSBs held steady, while the PVBs reported mixed numbers with some holding steady, and others reporting a rise.

Despite a pause by the MPC, banks have continued to raise rates on their outstanding portfolio. Given the competitive intensity, pricing of fresh loans has reduced in April 2023. Consequently, the spread between WALR

O/s loans and WALR fresh loans which was broadly narrowing has expanded in April 2023.

The figures on interest rates and borrower mix continue to show that the loan portfolio is moving to higher interest

rate buckets compared to the rates that prevailed during the Covid pandemic. In the personal loans categories,

lending rates have broadly caught up with the pre-pandemic levels, while the rates in other categories are yet to

catch up with pre-Covid levels.

Deposit Rates: Fresh Rates Fall in Line with Lending Rates, while O/s Rates Continue Upward March

Fresh deposit rates for PSBs, PVBs and SCBs fell m-o-m by 14 bps, 5 bps and 12 bps, respectively, in April 2023 and continue to remain above their pre-pandemic levels (as of March 2020). PSBs have been more aggressive when compared with PVBs as the reduction has been higher. Further, the withdrawal of Rs.2,000 banknotes is likely to boost short-term liquidity in the banking sector thereby reducing the pressure on deposit rates.

On the other hand, outstanding deposit rates for PSBs, PVBs and SCBs rose m-o-m by 12 bps in April 2023, however,

they continue to be lower than their pre-pandemic levels (as of March 2020) by around 10-20 bps, indicating the

distance the deposit rates have yet to traverse to reach the repo rate as well as their pre-pandemic levels, let alone

move past the same and this gap has been reducing monthly (it was around 40 bps in February 2023).

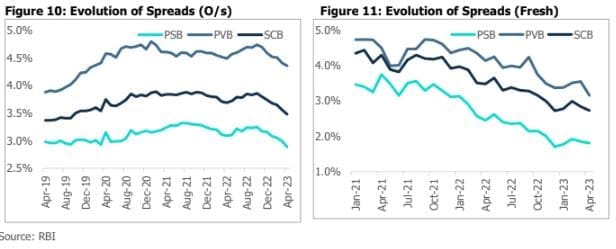

Movement in Spread between Lending and Deposit Rates

The spread of SCBs between WALR and WADTDR (the net interest rate spread) stood at 3.48% and 2.73% for

Outstanding and Fresh rates, respectively in April 2023. The spread broadly narrowed in April 2023 as fresh lending

rates fell faster than fresh deposit rates, while o/s deposit rates rose faster than o/s lending rates. On a y-o-y basis,

PSB and PVB spreads narrowed, while the spreads of both PSB and PVBs have continued to remain elevated

compared to the pre-pandemic levels. Additionally, the spread between Fresh WALR and WADTDR continues to be lower than the spread between Outstanding WALR and WADTDR. PVBs continue to maintain a higher spread given

that they charge more as compared to PSBs.

Conclusion

In April 2023, fresh lending, as well as deposit rates, decreased, with lending rates dropping faster than deposit

rates. On the other hand, interest rates on outstanding business continued to rise. Credit demand is lower at the

beginning of the fiscal year, hence pressure on deposit rates has eased. The rise in rates seems to have been

arrested for now at the end of May. The trajectory of rates on the deposit side will be shaped by the pace of credit

offtake, hence we would need to observe the rates movement over the coming months to conclude if the rates

have peaked or if further increases would continue.

Private Sector Banks (PVB) and Public Sector Banks (PSB) have maintained high spreads between lending and

deposit rates, with PVBs seeing higher spreads, as banks raised rates amid RBI’s tightening moves. Rate hikes and

subsequent resets in lending rates vs. deposit rates have led to NIM expansion in the near term which was expected

to be followed by NIMs staying stable with deposit rates climbing faster as lending rates stayed stable. The withdrawal of Rs. 2,000 banknotes is likely to boost short-term liquidity in the banking sector thereby reducing the

pressure on deposit rates. The banks may use incremental deposits to increase credit growth. This is likely to

reduce the pressure on NIMs.