Synopsis

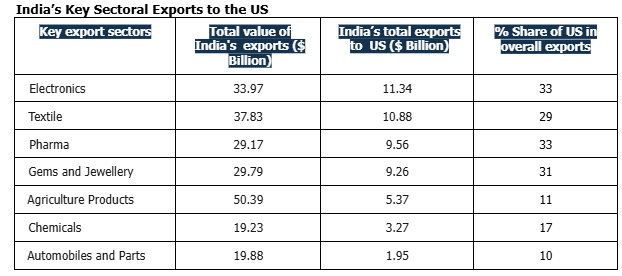

- During FY24, India’s aggregate merchandise exports to the US stood at $77.5 billion compared to our imports from the US at $42.2 billion. Out of India’s total exports to the US, the sectors in descending order of value are Electronics, Textiles, Pharmaceuticals, Gems and Jewellery, Agricultural products, Chemicals and Automobiles and parts.

- Till now, the US had been charging an average tariff of ~3.50% on imports of goods from India w.r.to above said sectors, which is now being increased uniformly to 26% in the form of reciprocal tariff. • Reciprocal tariff imposed by US on other nations who are India’s major competitors in most of the above sectors is higher than us – Vietnam at 46%, Bangladesh at 37%, China at 34%, Taiwan at 32%, Indonesia at 32% and Pakistan at 29%, which augurs well for key export sectors of India.

- The expected direct impact of US reciprocal tariffs would vary in nature for the sectors above, with no impact on pharmaceuticals since they are exempt from reciprocal tariffs for now. The impact is expected to be largely neutral for Electronics, Textiles, Agricultural products, Chemicals, and automobiles and parts. At the same time, it would be negative for Gems & Jewellery.

- The imposition of high reciprocal tariffs by the US on other competing nations raises the possibility of increased dumping by those nations in India, as well as in other export markets, which could negatively impact certain sectors.

Source: Commerce.gov.in

CareEdge Ratings’ View on Sectoral Impact

Electronics: The imposition of reciprocal tariffs could impact demand and pricing, as production of these goods can be shifted to other sources, especially China, which is currently a major exporter of electronics to the US. However, higher reciprocal tariffs on China would mean a neutral impact for India’s electronics exports. Additionally, smartphones are a key constituent of India’s electronics exports, and their manufacturing could shift to the US due to limited value addition in India, which could impact India’s electronics exports.

Textiles: Apart from India, the other major textile exporters to the US are China, Vietnam, Bangladesh, and Turkey. Except for Turkey, which has a 10% reciprocal tariff, other nations face reciprocal tariffs higher than 26%, which means the impact of reciprocal tariffs on India’s textile sector would be limited. Additionally, the majority of India’s exports are cotton-based garments and home textile products. India’s self-sufficiency in cotton production should enable it to largely pass on higher reciprocal tariffs.

Pharma: India has one of the highest numbers of US FDA-approved manufacturing facilities, which primarily caters to the generic medicine requirements of the US. This is crucial for meeting the healthcare needs of its population cost-effectively. Although the pharmaceutical sector is currently exempted from the purview of reciprocal tariffs by the US, with no immediate impact, even if tariffs are imposed, the sector should be well-positioned to pass them on significantly due to its inherent competitive strengths.

Gems and Jewellery: The prevailing weighted average tariff by the US on the import of gems and jewellery from India is 3.17%, which has been significantly enhanced to 26%. As a discretionary item for consumers, such a high tariff is expected to have an adverse impact on both demand and pricing, especially in the polished diamond segment, which is already under pressure from lab-grown diamonds.

Agriculture products: India’s overall exports of Agriculture and allied products to the US are not very high. Although, reciprocal tariff of 26% is imposed vis-à-vis prevailing weighted average tariff of 5.3%, the reciprocal tariff on the other major competing nations (viz. Vietnam, Indonesia, Thailand, Pakistan) on some of our key agri exports (sea food, basmati rice) is on the higher side which is expected to negate the impact of tariff imposed by US broadly. However, Ecuador being the second-largest exporter of shrimp to the US, it could result in competitive pricing pressure for Indian shrimp exporters, as the tariff imposed on Ecuador is lower at 10%.

Chemicals: India’s overall exports of chemicals to the US are very low, which means the impact of reciprocal tariffs would be limited. Further, apart from India, China is the major exporter of chemicals to the US and a higher reciprocal tariff is levied on China. Accordingly, the impact of reciprocal tariffs on the chemical sector in India is expected to be minimal. Some segments of the chemical sector could be beneficiaries of relatively higher tariffs on China compared to India, particularly in the US market. However, China is the world’s lowest-cost manufacturer and exporter of the majority of chemicals. Due to the reciprocal tariffs imposed by the US, China could even dump chemicals in India and other countries, which may have an indirect negative impact on India’s chemical sector.

Automobiles and Parts: Overall exports of auto and auto components to the US are very low, and accordingly, the impact of reciprocal tariff is expected to be minimal for the sector as a whole. Additionally, auto component exports to the US are crucial for OEMs in the US, and it may take time for them to replace these with other low cost, approved vendors from other nations, thereby improving India’s ability to mitigate the impact of higher tariffs in the short to medium term.

“However, counterparty risk remains a challenge, particularly concerning the effectiveness of the Payment Security Mechanism for over 38,000 e-buses from FY25 to FY29. India has approximately 11,000 e-buses in operation, with a goal of replacing 8 lakh diesel buses by 2030, including 5.5 lakh private buses. The private sector, which makes up 90% of India’s bus fleet, has seen minimal electrification due to a lack of incentives. Boosting e-bus adoption in the private sector will be crucial for driving future growth and remains a key factor to monitor,” said Arti Roy, Associate Director at CareEdge Ratings.