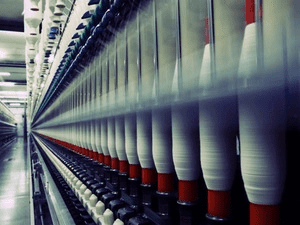

Textiles have a very long history in India. Known as the land of beautiful fabrics over the ages, India is home to a textiles industry that has been a very important part of the country. However, the country’s recent performance in global trade has not been commensurate with its abilities. Exports declined by 3 percent during 2015–2019 and by 18.7 percent in 2020. And yet during the same period, other low-cost countries such as Bangladesh and Vietnam have gained share.

A variety of factors have contributed to India’s recent trade performance. India has factor cost disadvantages (for example, power costs 30 to 40 percent more in India than it does in Bangladesh). Lack of free or preferential trade agreements with key importers, such as the EU, UK, and Canada for apparel and Bangladesh for fabrics, put pricing pressure on exporters. The high cost of capital and high reliance on imports for almost all textiles machinery makes it difficult to earn the right return on invested capital. Longer lead times than for Chinese manufacturers make India uncompetitive, especially in the fashion segment. The trend of nearshoring in western economies has not helped either.

However, COVID-19, which has triggered a recalibration of sourcing patterns (China-plus-one sourcing), has provided a golden opportunity for Indian textiles to regain a leadership position as a top exporting economy. India should strive to grow exports at a CAGR of 8 to 9 percent exports during 2019–2026, which should take exports to $65 billion by 2026. The Ministry of Textiles has set an even higher export target of $100 billion over the next five years. Achieving these targets could help 7.5 million to 10 million direct new jobs in textiles. For a sector that employs almost 45 million people in direct jobs across industry and farming, generating these many jobs will be a staggering achievement and will provide a big boost to the overall economy.

A variety of factors have contributed to India’s recent trade performance. India has factor cost disadvantages (for example, power costs 30 to 40 percent more in India than it does in Bangladesh). Lack of free or preferential trade agreements with key importers, such as the EU, UK, and Canada for apparel and Bangladesh for fabrics, put pricing pressure on exporters. The high cost of capital and high reliance on imports for almost all textiles machinery makes it difficult to earn the right return on invested capital. Longer lead times than for Chinese manufacturers make India uncompetitive, especially in the fashion segment. The trend of nearshoring in western economies has not helped either.

However, COVID-19, which has triggered a recalibration of sourcing patterns (China-plus-one sourcing), has provided a golden opportunity for Indian textiles to regain a leadership position as a top exporting economy. India should strive to grow exports at a CAGR of 8 to 9 percent exports during 2019–2026, which should take exports to $65 billion by 2026. The Ministry of Textiles has set an even higher export target of $100 billion over the next five years. Achieving these targets could help 7.5 million to 10 million direct new jobs in textiles. For a sector that employs almost 45 million people in direct jobs across industry and farming, generating these many jobs will be a staggering achievement and will provide a big boost to the overall economy.

Achieving the $65 billion exports target up from $36 billion in 2019—will require India to double down in five key areas:

- Apparel: Target a $16 billion increase by riding the China-Plus-One sentiment. India is suitably positioned on this, thanks to its relatively large strategic depth compared to Vietnam or Bangladesh.

- Fabrics: Target a $4 billion jump by positioning India as a regional fabric hub, starting with cotton wovens and then extending to other sub-categories.

- Home textiles: Target a $4 billion increase by building on existing advantages to expand the global customer base.

- Man-made fiber and yarn: Target a $2.5 billion to $3 billion jumps with a focus on gaining share in MMF (man-made fiber) products

-

- Technical textiles: Target a $2 billion jump by building capabilities in select key sub-segments on the back of potential domestic demand growth.

The path to achieving these targets will entail both government and industry taking crucial steps. And the government seems geared up for the challenge. The recent launches of multiple schemes such as MITRA, PLI, RoDTEP highlights this commitment. It will be critical for government to follow up these launches with efficient implementation and for industry players to leverage these schemes effectively.

- However, much more needs to be done. Achieving growth targets may require fresh investments of $20 to $25 billion. And attracting new investments will entail ensuring attractive returns on those investments. While PLI and MITRA are the right steps to achieve the same, India must also explore either reduction in import duties on machinery or promoting indigenous manufacturing to bring down the cost of CAPEX. Another critical area will be to keep pursuing free-trade / preferential-trade agreements with key importers (example – UK, EU, Canada) so as to make the landed costs more competitive.

Additionally, in order to ensure that businesses are able to scale up effectively and operate profitably, India must take necessary steps to not only boost factor cost competitiveness but also to optimize service levels, adopt digitization, build design capabilities and invest in sustainability & traceability to enhance global competitiveness

If India wants to truly differentiate itself for global consumers, India must aim to protect the country’s textiles industry as a one-stop destination for products that are manufactured in a sustainable manner in transparent value chains with best-in-class quality at competitive costs and lead times. India’s performance over the next five years could set the pace for many years to come. With the country’s global positioning and millions of jobs at stake, India will have to move—and move fast—on all identified frontiers.