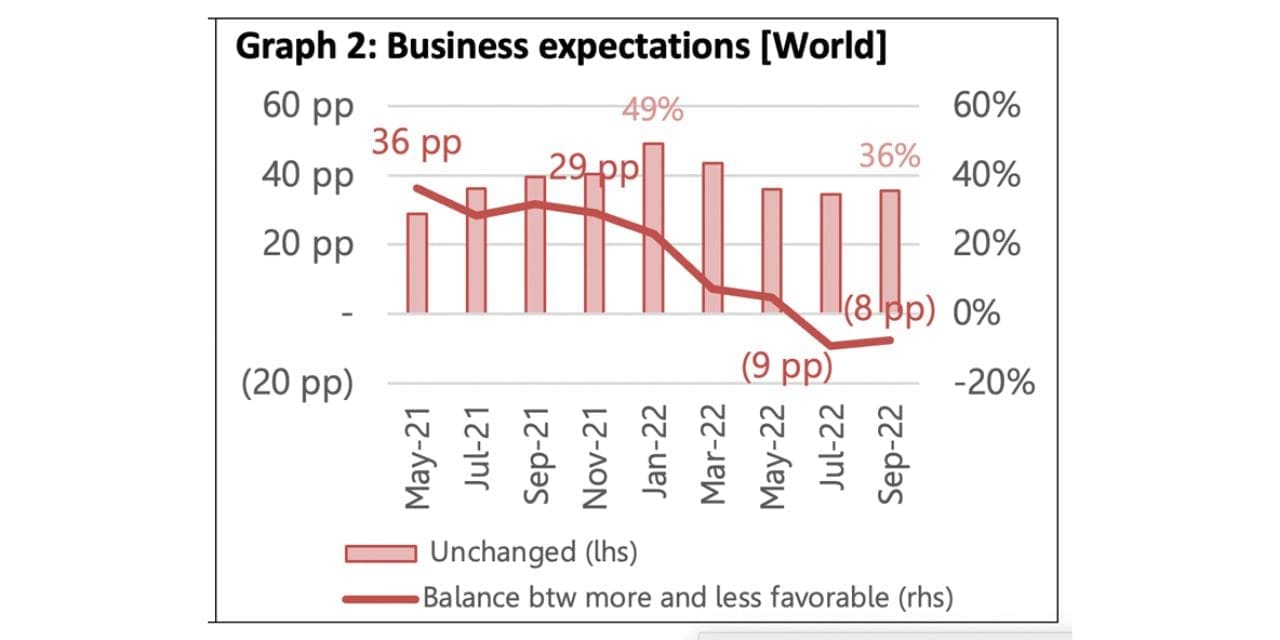

Since June 2022, the state of the textile industry’s global business has been bad and has continued to get worse . Businesses across all industries and market groups are confronted with a “perfect storm” scenario characterised by high production costs and comparatively weak demand. Additionally, starting November 2022, businesses’ expectations for the business climate in the next six months have improved. It’s unclear whether this rising optimism about the medium-term future stems from the conviction that things can’t get any worse or from expectations of a sound return to normalcy in the economy.

Since November 2021, order intake has also been steadily declining, mostly in accordance with the general downturn in the business environment. However, the rate of reduction has slowed in March 2023, most likely as a result of insufficient demand. Since July 2022, “weakening demand” has been identified as the top issue in the global textile value chain, and according to the most recent poll, its significance has increased. The second most pressing issue on the global agenda is inflation.

The second half of 2023 is likely to see improvements, and this is backed by stabilising inventory levels and a reasonably low rate of order cancellations. In the last four months, 53% of respondents to the 19th GTIS reported no order cancellations, down from 58% in January of last year. The problem is more prevalent and has a greater impact on weavers and spinners in South America. Inventory levels were assessed as average by 58% of respondents. Asia and Europe have more businesses reporting excessive inventory inventories. For the home textile segment, it is the highest.