It is now too common to claim that the COVID-19 virus has shaken up business around the world. It has had devastating consequences on all business functions, business units, and the core employees of every company in Dubai and UAE. These difficult times require the crucial role of certified internal audit in Dubai agents. They provide trusted risk perspectives and help their UAE organizations reach greater heights.

We surveyed professionals from all industries and countries to gain insight into the role of internal auditors under the new norm. We wanted to find out how well-prepared internal audit companies in UAE were to help organizations recover from ongoing crises. We created a comprehensive audit plan that gives insight and allows us to take action.

These are the main takeaways of the survey

Following the pandemic, 67% of internal audit firms in UAE were required to review and reprioritize their audit activities.

39% of respondents stated that they implement continuous monitoring and/or auditory and that they use them regularly.

60% of internal audit services in Dubai do not use agile internal auditing.

82% of companies in the country use point or office productivity solutions. 10% of respondents indicated that they use integrated solutions to manage policy and audit, risk, compliance, among other areas.

While changing business priorities, compliance landscapes, and risk are the main issues facing internal auditors, 27% of respondents said that they would invest in future solutions that address audit, risk, and policy.

Although the future may seem uncertain, an internal audit can help companies navigate this new normal. According to the report, internal audit services dubai has on offer can help UAE companies recover after crises by being flexible, open to change and anticipating the future.

These are the Key Points for Internal Audit

Survey results show that most organizations in Dubai and UAE lack key attributes like agility, continuous monitoring, and auditing in their approach towards IA. These attributes are essential for companies to be able to respond quickly to risks and make informed business decisions.

Effective Internal Audit Process

When auditing, it is essential to use a risk-based approach. In today’s uncertain and volatile business environment, it is crucial that we shift our focus from minimizing potential risks to preventing them. Internal auditing that is risk-based can improve an organization’s ability accept risk. This gives board members and executives more information to help them make better investment decisions and business decisions.

Aligning with the Business Objectives and ERM Framework. Business priorities, risks, and strategies can change due to constantly changing external and internal factors. The internal audit team will be able to update their internal audit function plans regularly to help identify high-risk areas and maximize time and resources for pressing issues. This will allow them to make informed decisions.

Rapid Assurance Model

This model represents a critical step in the post-pandemic era. This model requires a new approach in assurance. This model breaks down an audit cycle into smaller segments or cycles that have shorter timelines for review and insights. This model will allow organizations to provide real-time assurance, and enable them to be more flexible in their work processes.

Adopting Quantitative Approach

Considering quantitative techniques to risk assessments: determining risk scores and converting risks into monetary terms is important for calculating the probability and effect of every uncovered risks. As such, UAE companies can swiftly prioritize risks and modify their business approach and internal audit function approach.

Auditing internal compliance is crucial. This will allow you to assess the effectiveness and efficiency of internal controls. Failure to pass the audit means that the control was not effective in detecting and preventing risk. This makes the organization vulnerable. To remedy the situation, senior management should be notified immediately by the internal auditors.

Intelligent Tools and Technologies

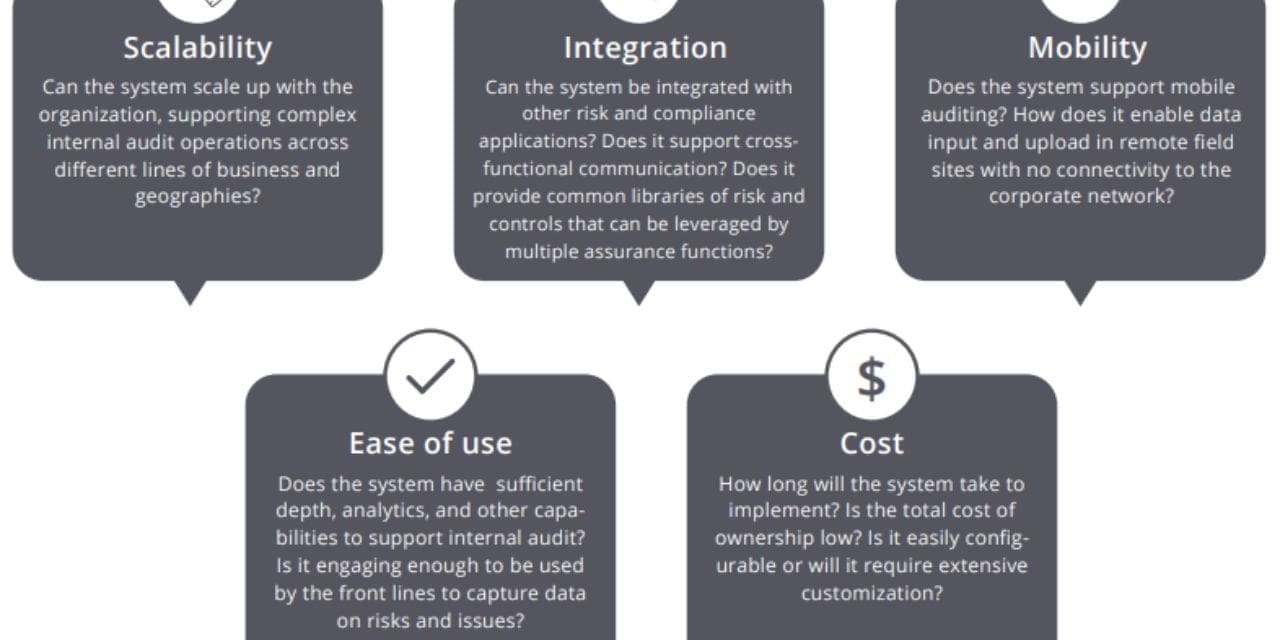

The key to audit plan effectiveness, relevance agility, effectiveness, and effectiveness is smart tools and technologies. The right software and audit management tools could be a huge benefit to your business. Software can automate, standardize and automate internal audit activities. This software can be used to empower executives to make data-driven, timely business decisions.

Dubai Internal Audit Management services can help internal auditors overcome challenges and streamline processes. This solution helps you create an agile internal audit program that aligns with your organization’s goals and is prepared for multi-dimensional risk. It also maintains trust among all stakeholders. We boast of a range of functionalities including cross-functional collaboration and collaborative authoring audit sample samples.

Top Audit Firm in Dubai, UAE | Bespoke Internal Audit Management Services in Dubai UAE

Are you looking for professionals you can entrust your internal audit function? Consider premium and professional accounting and auditing for your company in Dubai and UAE. certified internal audit in Dubai teams like Farahat and co are dedicated to ensure your growth.

By- Teeny Dozzy