Synopsis

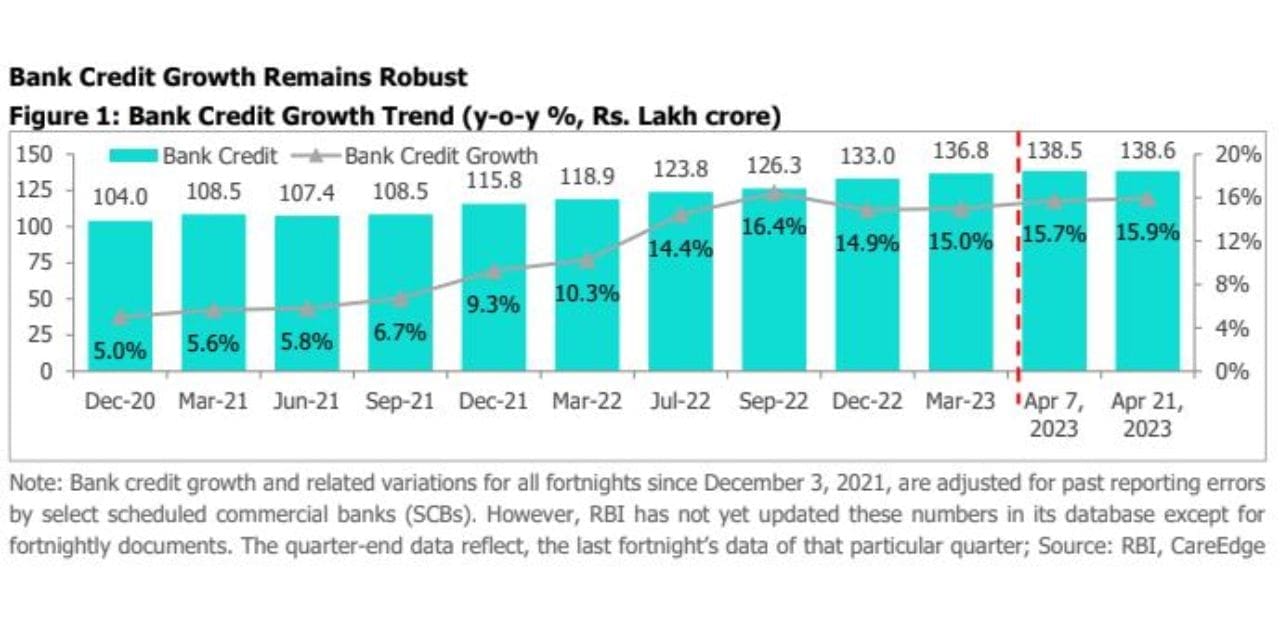

• Credit offtake rose by 15.9% year on year (y-o-y) for the fortnight ending April 21, 2023. In absolute terms,

credit offtake expanded by Rs.19 lakh crore to Rs.138.6 lakh as of April 21, 2023. The growth has continued

to be driven by personal loans, NBFCs, and higher working capital requirements.

• Deposit witnessed a slower growth at 10.2% y-o-y compared to credit for the fortnight ended April 21, 2023.

The short-term Weighted Average Call Rate (WACR) has reached 6.70% (as of April 28, 2023) from 3.63% as

of April 29, 2022, due to a rise in policy rates and lower liquidity in the system.

• The Credit to Deposit (CD) Ratio as of April 21, 2023, rose sequentially to 75.7% from 75.0% in the previous

fortnight due to incremental credit offtake at Rs 0.1 lakh crore compared to a fall in incremental deposit at Rs

1.4 lakh crore.

• Credit offtake rose by 15.9% y-o-y for the fortnight ended April 21, 2023, compared to 11.2% from the same

period in the last year (reported April 22, 2022). Sequentially, it increased by 0.1% for the fortnight. In absolute

terms, credit outstanding stood at Rs.138.6 lakh crore as of April 21, 2023, rising by Rs.19 lakh crore from April

2022 vs 12.8 lakh crore in the same period from the last year. The credit growth continued to be driven by a

lower base of the last year (which will likely abate in FY24), unsecured personal loans, housing loans, auto

loans, higher demand from NBFCs, and higher working capital requirements.

• Credit offtake has remained robust even amid the significant rise in interest rates, and global uncertainties

related to geo-political, and supply chain issues. The growth has been broad-based across the segments.

Personal Loans and NBFCs have been the key growth drivers, while other manufacturing-oriented segments

could also drive growth. Meanwhile, credit growth is expected to be in sync with the GDP growth in FY24. A

slowdown in global growth due to elevated interest rates, and geopolitical issues could impact credit growth,

however, the Indian financial system is on more robust footing, vis-a-vis its global peers.

• Deposits stood at Rs.183.1 lakh crore for the fortnight ended April 21, 2023, registering a growth of 10.2% y-

o-y. Time deposits grew by 10.6% y-o-y, while demand deposits rose by 7.2% in the reporting fortnight vs. 9.1% and 15.4% y-o-y, respectively, reported in the fortnight ended April 22, 2022. Meanwhile, in absolute terms, bank deposits have increased by Rs.16.9 lakh crore from April 2022. Meanwhile, it decreased by Rs.1.4 Lakh crore from the immediate previous fortnight (reported April 07, 2023). With liability franchise gaining importance, due to a high gap in credit-deposit growth, fresh bank deposit rates continue to rise.

• According to CareEdge report titled “Monthly Debt Market Update”, the banking system saw an average monthly

surplus of around Rs 1.5 lakh crore in April, compared to an average monthly deficit of Rs 1,271 crore in March.

Surplus liquidity conditions for most of the month were triggered by government spending and RBI intervention

in the FX market.

• The Credit to Deposit (CD) ratio has been generally trending upward since the later part of FY22 and reached

75.7% in the fortnight, expanding by ~370 bps y-o-y from April 22, 2022, due to continued faster growth in

credit as compared to deposits. The CD ratio has been hovering near the pre-pandemic level of 75.8% in Feb

2020 and 75.7% in March 2020.

• If sequential movements of credit and deposit in Rs lakh crore are considered, the above figure presents a

slightly different picture, with only the 12-month period showing an increase of credit over deposits, while for

other periods, deposit accretion has been higher than credit offtake in absolute numbers. Meanwhile, deposits

fell sequentially, while credit grew.

• Credit growth generally began picking up in H2FY22 and surpassed deposit growth in Q4FY22, since then it

has continued the momentum. A part of the funding gap has been met via Certificates of Deposits (CDs). A

wide gap in credit and deposit growth, lower liquidity and strong credit demand has been driving for higher

issuance of CDs. Banks are keeping their CD issuance elevated to meet short-term requirements amid lower

liquidity and focusing on shoring up the deposits to meet robust credit demand. Fund mobilisation through CDs

issuances was strong at Rs 6.7 lakh crore during FY23, higher than Rs 2.3 lakh crore in the previous year. The

outstanding CDs stood at Rs 3.0 lakh crores as of April 21, 2023, compared to Rs. 2 lakh crore a year ago.

• The share of bank credit to total assets increased by 15 bps y-o-y and 25 bps sequentially to 67.4% in the

fortnight. Total assets of banks rose by 15.7% y-o-y in the last one year and remained marginally behind credit

growth.

• The proportion of government investment to total assets fell by 36bps y-o-y for the fortnight ended April 21,

2023, compared to a similar fortnight in the last year (reported April 22, 2022) as assets growth was faster

than the growth in investments. The Govt. investments stood at Rs.54.5 lakh crore as of April 21, 2023,

reporting a 14.1% y-o-y growth, while it declined by 1.4% over the previous fortnight.