Sanjay Arora, Business Director Wazir Advisors Pvt. Ltd.

Textile industry plays a major role in the Indian economy. It contributes 14% to industrial production and 4% to GDP. With over 45 million people involved, it is one of the largest source of employment generation in the country. The textile industry accounts for nearly 15% of India’s total exports. Indian weaving industry has traditionally been one of the most thriving sectors for mass employment. Abundant supply of raw materials and availability of cheap labor have been major contributor to its success. India is the only country that still creates hand-made fabrics and is able to maintain its cultural heritage. The world has lost the hand-weaving and loom process, along with the natural and organic processes of fabric manufacturing. Mill-made fabrics largely dominate fashion markets, with China as the biggest example. This article talks about the existing scenario of weaving industry in India in terms of installed capacities, production volumes and fabric qualities being manufactured in India. Furthermore, it gives an overview of major weaving clusters across the country, challenges faced by the industry and the measures to overcome the same.

Weaving sector of India: An overview

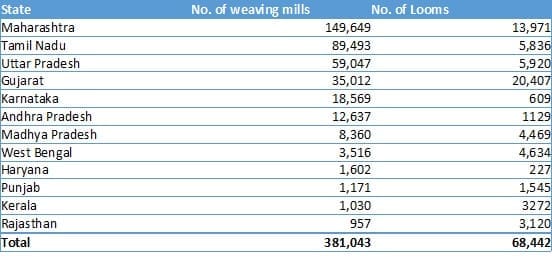

India’s weaving sector comprises of three distinct sectors viz. organized mills, power loom and handloom sector. India have an installed capacity of ~68,000 looms (shuttle-looms-67%, shuttle-less-33%), 2.52 Million power loom 2.38 Million handloom. Approximately, 95% of the weaving sector in India is un-organized in nature. Decentralized power-loom and hosiery sector contributes ~85% of total fabric production. Processing segment is dominated by large number of independent, small-scale enterprises i.e. ~95% standalone units. There are about 3.8 Lakh weaving mills across India with majority of the mills situated in Maharashtra (39%), followed by Tamil Nadu (23%) and Uttar Pradesh (15%).

Figure 1: State-wise installed capacity in weaving sector

Data Source: Office of Textile Commissioner

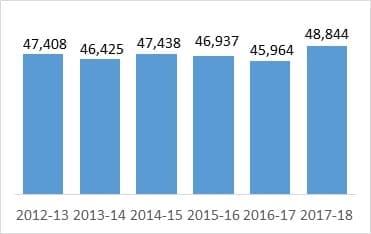

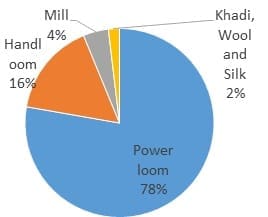

Production of woven fabric stood at 48,844 Million Square meters in 2017-18. The same has grown at a CAGR of 1% since 2012-13. Powerloom sector dominated the woven fabric production in India, accounting for 78% share followed by Handloom (16%), Mill sector (4%) and Khadi, wool & silk (2%).

Figure 2: Production of woven fabric in India (Values in million square meters)

Data Source: Office of Textile Commissioner

Figure 3: Breakup of woven fabric production in India (2017-18)

Data Source: Office of Textile Commissioner

As per International Textile Manufacturers Federation (ITMF) estimates, there are about 2.8 million looms installed globally, out of which 54% are shuttle-less. Installed capacity of shuttle-less looms has been rising continuously since 2000 (CAGR of 5%). Asia has the largest number of shuttle-less looms with 78% share, followed by Europe (12%) America (9%) and Africa (1%). India has 2% share in global shuttle-less looms installed capacity. China has the largest capacity of shuttle-less looms i.e. 8.43 Lakh and 56% share, while India is positioned at 11 number with 22,821 looms. Top ten countries account for ~85% share of global shuttle-less loom capacity. India have a tough competition from other Asian countries like Thailand, Indonesia, Pakistan and Bangladesh which have much larger capacities as compared to India.

Sector-wise production of woven fabric

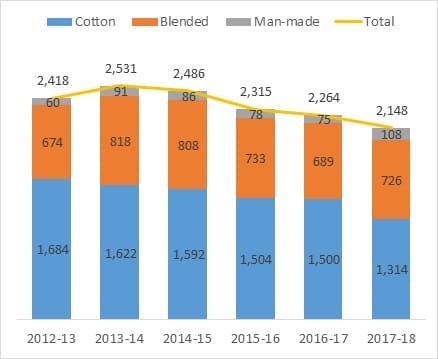

Mill sector (organized): Mill sector of India has intrinsic strengths in terms of economies of scale, higher productivity, superior technology, better technical and skilled man power and integrated working, and has the capability to supply high value added, superior quality goods both for domestic and overseas markets. The total production of woven fabric in mill sector stood at 2,148 mn. sq. m. in 2017-18, accounting for 3% of the total woven fabric production in India. Production of woven fabric in mill sector is dominated by cotton with a share of 61%. This is followed by blended fabric with a share of 34% and man-made fabric with a share of 5%. Over last six years, the production has gone down at a CAGR of 2%.

Figure 4: Production of woven fabric in India in Mill sector (Values in mn. Sq. m.)

Data Source: Office of Textile Commissioner

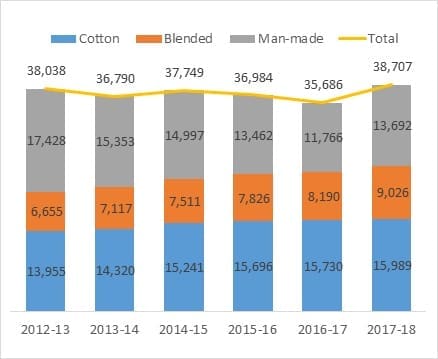

Power loom sector: The power loom industry has traditionally been one of the cornerstones of the Indian economy in terms of fabric production and employment. The technology level of this sector varies from obsolete plain loom to high tech shuttle less looms. The readymade garments and home textile sectors are heavily dependent on the power loom sector to meet their fabric requirement. With a production 38,707 mn.sq. m of fabric, power loom sector accounts for 58% of the total woven fabric production. Production of woven fabric in power loom sector is dominated by cotton with a share of 41%. This is followed by man-made fabric with a share of 35% and blended fabric with a share of 23%. Over last six years, the production has witnessed marginal growth of 0.3%.

Figure 5: Production of woven fabric in India in Power loom sector (Values in mn. sq. m.)

Data Source: Office of Textile Commissioner

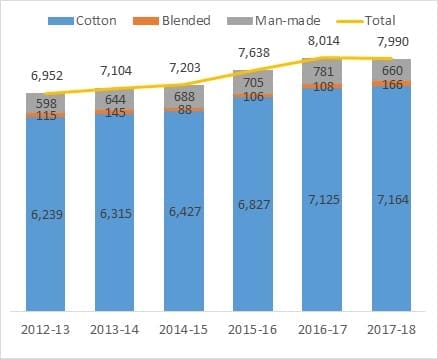

Handloom sector: Handloom weaving constitutes one of the richest and most vibrant aspects of the Indian cultural heritage. In 2017-18, handloom industry produced 7,990 mn. Sq. m. of fabric which accounted for 12% of the total woven fabric production in the country. The production of hand woven fabric has grown at a CAGR of 3% in last 6 years. Production of woven fabric in handloom sector is dominated by cotton with a share of 90%. This is followed by man-made fabric with a share of 8% and blended fabric with a share of 2%.

Figure 6: Production of woven fabric in India in Handloom sector (Values in mn. sq. m.)

Data Source: Office of Textile Commissioner

Weaving clusters across India

Textile and apparel manufacturing is spread across India largely in cluster format, mostly in the form of natural clusters. There are more than 50 weaving clusters in India accounting for majority of the fabric production in India. Gujarat, Maharashtra and Punjab are most important polyester based woven fabric clusters. Surat in Gujarat is the biggest cluster for man-made fiber (MMF) industry. Top 9 states accounts for about 90% of the total looms in India. Details of clusters in different states are given as follows:

-

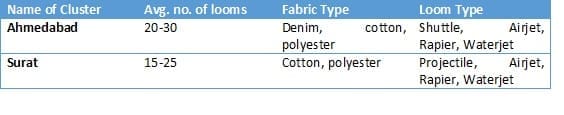

Gujarat : Gujarat houses 47 composite mills and ~35,000 weaving units. Having an installed capacity of ~20,000 looms, Gujarat accounts for ~30% share in India’s total installed loom capacity. Out of the total loomage, shuttle looms accounts for 60% share while shuttle-less looms have a share of 40%. Ahmedabad and Surat are the main weaving clusters in Gujarat. Mill sector of Gujarat produced about 620 Million Sq. m. of woven fabric during 2016-17.

Gujarat : Gujarat houses 47 composite mills and ~35,000 weaving units. Having an installed capacity of ~20,000 looms, Gujarat accounts for ~30% share in India’s total installed loom capacity. Out of the total loomage, shuttle looms accounts for 60% share while shuttle-less looms have a share of 40%. Ahmedabad and Surat are the main weaving clusters in Gujarat. Mill sector of Gujarat produced about 620 Million Sq. m. of woven fabric during 2016-17.

Figure 7: Weaving clusters in Gujarat

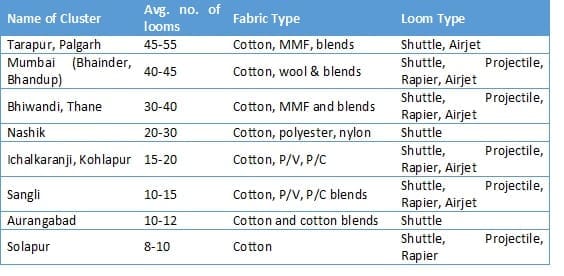

2.Maharashtra: Maharashtra houses about 36 composite mills and ~1.5 Lakh weaving units. Having an installed capacity of ~14,000 looms, Gujarat accounts for ~20% share in India’s total installed loom capacity. Out of the total loom age, shuttle looms accounts for 73% share while shuttle-less looms have a share of 27%. Major weaving clusters include Tarapur, Mumbai, Bhiwandi, Nashik and Ichalkaranji. Mumbai’s organized fabric sector produced about 137 Million Sq. m. of woven fabric during 2016-17.

2.Maharashtra: Maharashtra houses about 36 composite mills and ~1.5 Lakh weaving units. Having an installed capacity of ~14,000 looms, Gujarat accounts for ~20% share in India’s total installed loom capacity. Out of the total loom age, shuttle looms accounts for 73% share while shuttle-less looms have a share of 27%. Major weaving clusters include Tarapur, Mumbai, Bhiwandi, Nashik and Ichalkaranji. Mumbai’s organized fabric sector produced about 137 Million Sq. m. of woven fabric during 2016-17.

Figure 8: Weaving clusters in Maharashtra

3.Tamil Nadu: There are about 48 composite mills, ~90,000 weaving units and ~5,800 looms in Tamil Nadu. Mill sector fabric production stood at 162 Sq.Mtr. In 2016-17. The state holds ~9% share in India’s total installed looms capacity. Tamil Nadu is known as the largest producer of cotton yarn and for availability of abundant good quality cotton. Madurai, Karur, Salem, Dindigul and Erode are the main weaving clusters based in Tamil Nadu.

3.Tamil Nadu: There are about 48 composite mills, ~90,000 weaving units and ~5,800 looms in Tamil Nadu. Mill sector fabric production stood at 162 Sq.Mtr. In 2016-17. The state holds ~9% share in India’s total installed looms capacity. Tamil Nadu is known as the largest producer of cotton yarn and for availability of abundant good quality cotton. Madurai, Karur, Salem, Dindigul and Erode are the main weaving clusters based in Tamil Nadu.

Figure 9: Weaving clusters in Tamil Nadu

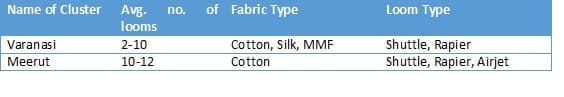

4.Uttar Pradesh: The state known for its Chikankari embroidery and brocade fabrics, contributes to 9% share in total installed loom capacity of India. Housing weaving units over ~60,000 and ~6,000 looms, the city produced around 4 Mn. Sq.Mtr. Fabric in the mill-sector (2016-17). About 90% of the looms are shuttle looms in Uttar Pradesh. By and large, weaving is concentrated in Varanasi and Meerut cities. Varanasi is known throughout India for production of fine silk fabric and Banarasi saris.

4.Uttar Pradesh: The state known for its Chikankari embroidery and brocade fabrics, contributes to 9% share in total installed loom capacity of India. Housing weaving units over ~60,000 and ~6,000 looms, the city produced around 4 Mn. Sq.Mtr. Fabric in the mill-sector (2016-17). About 90% of the looms are shuttle looms in Uttar Pradesh. By and large, weaving is concentrated in Varanasi and Meerut cities. Varanasi is known throughout India for production of fine silk fabric and Banarasi saris.

Figure 10: Weaving clusters in Uttar Pradesh

5.Madhya Pradesh: Famous for Chanderi fabrics, the state contributes to about 7% share in India’s total loom age. It has an installed capacity of 16 composite mills, ~8,300 weaving units and ~4500 Looms. Total fabric production stood at 233 Mn. Sq.Mtr. in Madhya Pradesh. Fabric production is scattered in the cities of Indore, Ujjain and Burhanpur and is largely cotton focused. Ratio of Shuttle to shuttle-less looms is 70:30.

5.Madhya Pradesh: Famous for Chanderi fabrics, the state contributes to about 7% share in India’s total loom age. It has an installed capacity of 16 composite mills, ~8,300 weaving units and ~4500 Looms. Total fabric production stood at 233 Mn. Sq.Mtr. in Madhya Pradesh. Fabric production is scattered in the cities of Indore, Ujjain and Burhanpur and is largely cotton focused. Ratio of Shuttle to shuttle-less looms is 70:30.

6. Other Major Clusters

Other weaving clusters of India include Rajasthan, Punjab, Karnataka and Haryana. These states together accounts for ~8% share of the country’s total installed loom capacity. Punjab and Haryana houses the largest woolen fabrics manufacturers, while Karnataka is known for manufacturing of silk and Man-made fabrics.

Figure 11: Other major weaving clusters in India

Indian weaving industry has conventionally been one of the most promising sectors providing huge employment. However, challenges like inadequate know-how, low focus on research, innovation in new product development and low technology up gradation poses a threat to the growth potential of this industry. Other than that, low productivity and automation levels also remain one of the biggest woes for the weaving industry. Due to these factors, overall performance of fabric production in India is getting dampened. With more than 90% of the industry unorganized, weaving still remains one of the weakest links of the Indian textile and apparel industry. From technology perspective also, spinning sector in India has always been hailed as being technologically at par with world’s standards. As it has been recognized that the weaving and processing sectors have been lagging behind as compared to other textile sectors in India, continuous efforts are being undertaken by various stakeholders in order to upgrade and modernize this sector. Major challenges for the Indian weaving industry are discussed below:

-

Poor technology levels: Though India has one of the largest installed production base in the world, most of the machinery uses old technology with low productivity and quality levels.

-

Low scale of operations: Global manufacturing powerhouses like China have been putting continuous efforts for achieving large scale manufacturing set-ups. Large scale of operations facilitates production of good quality products at comparatively lower costs. However, India still lags behind in achieving higher economies of scale.

-

Export compliance: The demand for compliance is growing rapidly in today’s business scenario as the global buyers are now become more conscious towards ethically manufactured products. Indian textile industry lacks proper implementation and management of the compliance norms. Adherence to global norms can be achieved through development and implementation of tools that can help factories certify, monitor and improve universal standards.

-

Poor skill levels: The overall productivity levels in Indian textile sector, especially in fabric manufacturing, is relatively low as compared to its competing nations like China, Turkey, etc. The industry needs to improve its focus on training and skill development of the manpower.