The handkerchief, often referred to as a hanky or kerchief, is a simple yet ubiquitous item with a rich history. More than just a practical tool, handkerchiefs have transcended their utilitarian purpose to become a symbol of elegance, hygiene, and even cultural identity. This unassuming square of fabric has accompanied humanity through centuries, evolving alongside fashion and societal norms.

Our journey begins with the ancient civilizations of Greece and Rome, where soft linen handkerchiefs were used for wiping sweat and blowing noses. Fast forward to the Middle Ages, and kerchiefs became more elaborate, often worn on the head as a symbol of status. By the 16th century, Europeans began carrying kerchiefs in their pockets, designated explicitly for personal hygiene. This shift marked the birth of the modern handkerchief, a convenient and portable companion.

Today, handkerchiefs continue to be used for their original purpose, but their role has somewhat diminished. The rise of disposable tissues offers a convenient alternative, particularly in fast-paced modern life. However, handkerchiefs are experiencing a resurgence, particularly among those embracing sustainability and a more mindful approach to consumption. The reusable nature of handkerchiefs makes them a more eco-friendly choice.

- PRODUCT CATEGORY: Personal Care Category

- PRODUCT BENEFITS AND PURPOSE: The primary purpose of a handkerchief is personal hygiene. They are used for blowing noses, wiping sweat, or cleaning up minor spills. They can also be used for:

- Removing makeup pr

- Cleaning glasses

- Creating a pocket square

- Emergency bandage

- DURATION OF PRODUCT: 6 months – 1 year

- MARKET SIZE: The worldwide handkerchief industry reached a market value of USD 9.68 billion in 2020 and is projected to grow steadily at a compound annual growth rate (CAGR) of 4.8% from 2021 to 2028. (Source: Million Insights)

- MARKET: Eco-conscious consumers, Fashion enthusiasts, People with allergies, and Traditionalists.

Overview of Handkerchiefs Manufacturing Process

The process of transforming raw materials into a pocket-sized companion, the handkerchief, can be broken down into several key stages:

The process of transforming raw materials into a pocket-sized companion, the handkerchief, can be broken down into several key stages:

- Material Selection

- Fabric Preparation

- Cutting

- Hemming (Optional)

- Quality Control

- Packaging and Labelling

- Distribution

1. Material Selection

- Fibre Considerations: Beyond the common choices of cotton, linen, and hemp, handkerchiefs can be made from various materials depending on desired features:

- Microfiber: Excellent for cleaning glasses due to its soft, non-abrasive nature.

- Tencel (Lyocell): A sustainable option made from wood pulp, offering a soft and absorbent feel.

- Bamboo: Another eco-friendly choice known for its breathability and hypoallergenic properties.

- Silk: Luxurious choice for handkerchiefs, often used for special occasions or as a fashion statement. Requires delicate care.

- Yarn Choices: For woven handkerchiefs, the selection of yarn type and thickness can influence the final feel and absorbency.

- Colour and Design:

- Plain Fabrics: Opting for solid-coloured fabrics simplifies the process.

- Printed Fabrics: The design can be printed onto the fabric using various techniques like rotary printing or digital printing.

- Woven Designs: For a more intricate look, different coloured yarns are woven together to create patterns directly in the fabric.

2. Fabric Preparation

- Greige Goods Inspection: The raw fabric (greige goods) undergoes a thorough inspection to ensure there are no defects like tears, uneven weaves, or colour variations.

- Washing and Desizing: The fabric might be washed to remove any sizing agents applied during weaving, which can affect absorbency.

- Preshrinking (Optional): Some manufacturers might pre-shrink the fabric to minimise shrinkage after the handkerchief is produced. This is particularly important for cotton fabrics.

3. Cutting

- Large-Scale Production: Automated cutting machines precisely cut the fabric into squares based on the desired handkerchief size. This ensures consistent dimensions and minimises waste.

- Smaller-Scale Production: Hand shears or smaller cutting machines might be used for more artisanal production runs.

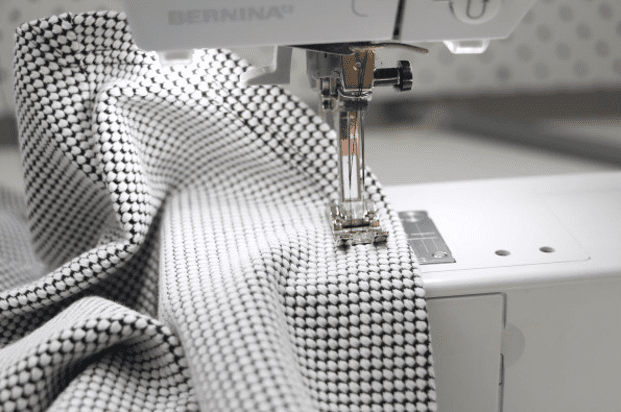

4. Hemming (Optional)

- Hemming Technique: Sewing machines equipped with a special hemming attachment are used to create a clean and finished edge around the handkerchief. Hemming styles can vary, with some featuring decorative stitching for a more unique look.

- Alternatives: Handkerchiefs with a more rustic aesthetic might skip the hemming step for a frayed edge. This can be achieved through a controlled fraying process to prevent excessive unravelling.

5. Quality Control

- Meticulous Inspection: Trained personnel visually inspect each handkerchief for:

- Accurate dimensions

- Consistent fabric quality (weave, texture)

- Absence of sewing defects (for hemmed handkerchiefs)

- Any blemishes or printing errors

- Rejection and Repair: Handkerchiefs failing inspection might be rejected or repaired if possible, depending on the severity of the defect.

6. Packaging and Labelling

- Folding Techniques: Handkerchiefs are skillfully folded using traditional methods to create a compact and visually appealing shape for presentation in packaging. Common folds include the envelope fold, the continental fold, and the diagonal fold.

- Labelling: Small tags or labels are attached to the handkerchiefs, often containing:

- Care instructions (washing, drying)

- Brand logo

- Material information

- Country of origin (optional)

- Bulk or Individual Packaging: For wholesale distribution, handkerchiefs might be packaged in bulk quantities. Retail packaging involves individual boxes, wrappers, or other presentation methods depending on the brand and target market.

7. Distribution

- Distribution Channels: The finished handkerchiefs are distributed through various channels:

- Wholesale: Manufacturers sell handkerchiefs in bulk to retailers at a discounted price.

- Retail: Handkerchiefs are sold directly to consumers through department stores, speciality stores, or online retailers.

- Direct-to-Consumer: Some manufacturers might have their online platforms where they sell handkerchiefs directly to customers.

Leading Companies Operating in the Global Handkerchiefs Industry

- Kamawanu (Japan)

- Libeco (Belgium)

- Louis Vuitton (France, Italy)

- Dior (France, Italy)

- Levi Strauss & Co. (USA)

- Adidas (Germany, USA)

- Nike (USA, Denmark)

- Versace (France, Italy)

- The Dapper Tie (UK)

- Ted Baker (UK)

- Chanel (France, Italy)

- Prada (France, Italy)

Best Handkerchief Brands In India

- Peter England

- Van Heusen

- Allen Solly

- Louis Philippe

- The Raymond Shop

- Park Avenue

- Jockey

- S. Polo Assn.

- KK Clothiers

- The Bombay Store

SWOT Analysis of the Industry

This SWOT analysis summarises the key Strengths, Weaknesses, Opportunities, and Threats impacting the handkerchief industry.

STRENGTHS

- Classic and Timeless: Handkerchiefs offer a timeless and elegant alternative to disposable tissues.

- Sustainability: Reusable handkerchiefs are an eco-friendly choice, reducing waste compared to disposable tissues.

- Versatility: Handkerchiefs can serve multiple purposes beyond blowing your nose, including wiping sweat or cleaning glasses (depending on the material).

- Fashionable: Handkerchiefs can be a stylish accessory with designer options and an element of vintage charm.

- Durability: Well-made handkerchiefs can last for years with proper care, making them a cost-effective option in the long run.

WEAKNESSES

- Perception of Convenience: Disposable tissues are often seen as a more convenient option, especially in fast-paced environments.

- Hygiene Concerns: Some users might perceive handkerchiefs as less hygienic than disposable tissues, especially if they are adequately laundered.

- Social Stigma (in some regions): In some cultures, using a handkerchief in public might be seen as less desirable than using a tissue.

- Limited Marketing and Awareness: Compared to disposable tissues, handkerchiefs often need more marketing focus, leading to lower awareness among some consumers.

- Competition from Disposable Alternatives: The readily available and heavily marketed disposable tissue industry creates significant competition.

OPPORTUNITIES

- Sustainability Trend: The growing awareness of environmental issues can lead to increased consumer interest in sustainable products like handkerchiefs.

- Fashion Revival: Handkerchiefs can be positioned as a vintage fashion accessory, appealing to those who appreciate classic style.

- Performance Fabrics: Innovation in materials like moisture-wicking or antibacterial fabrics can enhance the functionality of handkerchiefs.

- Premiumization: Luxury handkerchiefs made from high-quality materials and featuring intricate designs can target a niche market willing to pay more for a premium product.

- E-commerce Growth: Online platforms can provide broader access to a diverse range of handkerchiefs for consumers, overcoming geographical limitations.

THREATS

- Economic Downturn: In economic downturns, consumers might prioritise affordability, potentially leading to decreased spending on non-essential items like handkerchiefs.

- Fluctuations in Fabric Costs: The cost of raw materials like cotton or linen can fluctuate, impacting production costs and potentially leading to price increases for consumers.

- Competition from Low-Cost Producers: Handkerchief production in some regions might face competition from countries with lower labour costs.

- Shifting Consumer Preferences: Changing consumer habits and preferences could lead to a decline in the overall demand for handkerchiefs.

- Regulations on Material Use: Government regulations on specific materials or dyes used in handkerchief production could disrupt the supply chain or increase production costs.