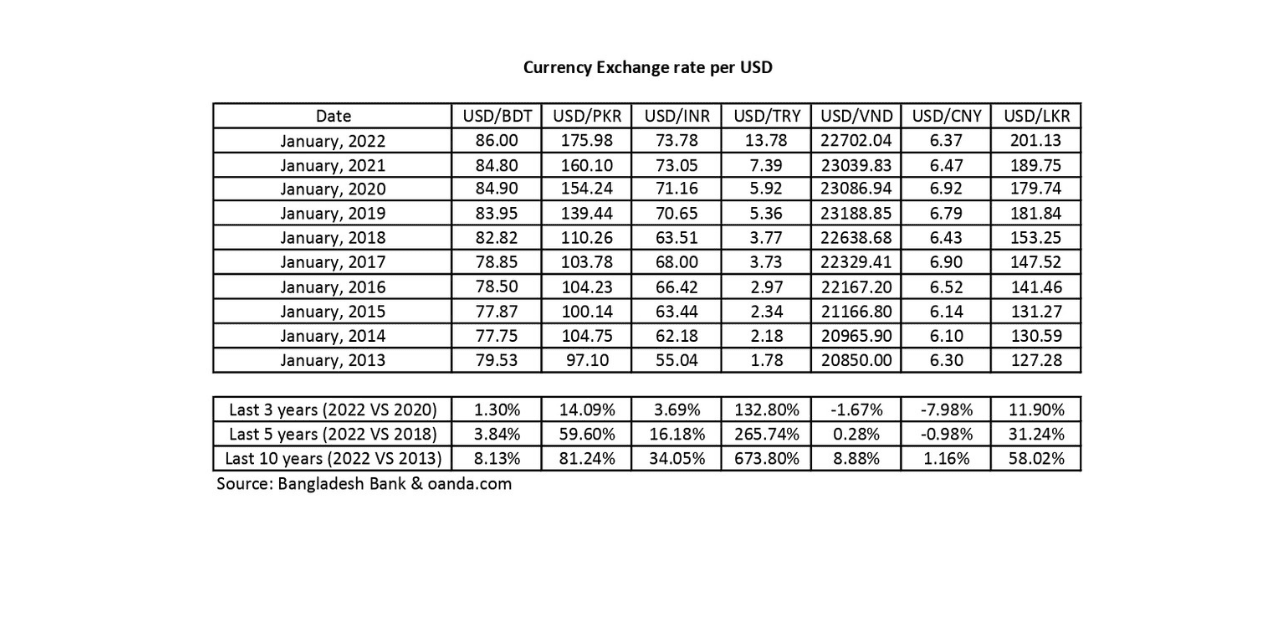

Today I am writing to share with you the data and analysis of the recent exchange rate movement of some of the currencies of major apparel exporting countries. Since currency movement has a direct link to trade competitiveness, it is important for us to follow the trend. Please find 10 years exchange rate of selected currencies against the US dollar in the attachment, particularly Chinese Yuan, Pakistani Rupee, Indian Rupee, Vietnamese Dong, Turkish Lira, and Sri Lankan Rupee.

If you take a look at the data you can see that Bangladeshi Taka (BDT) has depreciated by 3.84% aggregated in the last 5 years (Jan 2018- Jan 2022), that is exchange rate per dollar increased from 82.82 Taka to 86 Taka as per the data of Bangladesh Bank. Please be noted that we used the source oanda.com to track other currencies.

During the same period of time, the Turkish Lira saw the highest depreciation by 265.74%, followed by the Pakistani Rupee with 59.60% among our competitive countries. Srilankan Rupee, Indian Rupee, and Vietnamese Dong were depreciated by 31.24%, 16.18%, and 0.28% respectively. During this period, the Chinese Yuan remained quite stable with 0.98% appreciation against the dollar cumulatively.

If we run a 10 years analysis (Jan 2013 to Jan 2022), we can see that Bangladeshi Taka was depreciated by 8.13% cumulatively whereas the Turkish Lira depreciated 673.80%, Pakistani Rupee of 81.24% depreciation. Other competitor countries like Srilanka, India, and Vietnamese currencies faced devaluation by 58.02%, 34.05%, and 8.88% respectively. During this period, the Chinese Yuan was depreciated by 1.16% aggregated.

I have also mentioned a 3 years growth calculation in a separate row in the attached file for your information. However, in the last year, Taka has seen some devaluation against the dollar after maintaining quite a stronger and stable position over the past few years (from 84.80 Taka in Jan 2021 to 86 Taka in Jan 2022, 1.42% depreciation of Taka). Depreciation is favorable for exports, especially it adds to our breathing space in this trying time, however without comparing the Real Effective Exchange Rate (REER) across the competitors (inflation controlled exchange rate), it is difficult to comment about actual gain on the competitive edge.

In 2021, amid the pandemic, Bangladesh received a whopping $22 billion as inward remittance which has led to breaking the record for the FOREX reserve. The government has also increased incentive on remittance to keep this momentum in remittance. Despite the fact, the recent devaluation of Taka is certainly supportive of the export industries and reflects the prudence of the regulatory authorities.

However, the question is to what extent such devaluation actually helps the industry. On one hand, our unit price of garments is not increasing while considering the hike in production cost particularly due to rising in the price of raw materials, freight, fuel, and so on. On the other hand, competitor currencies have gained higher than us.

While currency is an important factor in foreign trade, the exchange rate of a currency has a wider implication across the broader economy including inflation, the balance of payment, and FDI. So while we, the export-oriented industries, gratefully appreciate the role played by regulatory bodies, we also need to consider the global currency trend to safeguard our industries. At the same time, let’s also keep our efforts continued in the area of efficiency enhancements of our factories, optimizing the use of resources, investing in supply chain management and automation, and technology upgrading of the factories. We need to give more emphasis on waste recycling to ensure circularity in the industry. In the coming days, we have to focus on these issues to remain competitive.