India represents around 33% of worldwide cotton territory. Inside India, the focal cotton-developing zone produces 66% of the nation’s cotton yield, which incorporates the territories of Maharashtra, Madhya Pradesh, Gujarat, and Odisha, where a large part of the harvest is taken care of. The northern zone, which comprises the territories of Punjab, Haryana, and Rajasthan, produces cotton under watered conditions and records for around 12% of creation. In the south, the provinces of Andhra Pradesh, Karnataka, and Tamil Nadu represent 25% of creation. The Focal and Southern zones regularly develop long term cotton that permits ranchers to procure various harvests.

While the quantity of pickings has declined as conventional assortments are supplanted by biotech half and halves, ranchers can in any case oversee up to five pickings for every plant contingent upon climate conditions. Interestingly, the watered cotton in the northern zone is for the most part a short season crop that finds a way into a cotton-wheat trimming framework.

Cotton, a prevalent rainstorm season or Kharif crop, is planted from the finish of April to September, and gathered in the fall and winter. As per MOAFW, 6.14 percent of complete gross harvest region in India is under cotton. Cotton yields have leveled throughout the most recent five years with a normal of around 490 kilograms for every hectare.

Moreover, yields in India are lower since ranchers give more line space between cotton plants to cross with a bullock and cultivator for weed control purposes. This lower plant thickness in the field is balanced somewhat by the numerous picking’s ranchers complete through manual as opposed to machine gathering. To battle this, scientists are chipping away at creation plans with higher plant populaces that could improve yields.

There are an expected 6,000,000 cotton ranchers with a normal homestead size of 1.5 hectares. Little land possessions limit the capacity to receive capital-concentrated creation innovations and framework. Indeed, even without changing area possessions, yields would probably profit by improved water system, compost, micronutrients, and bugs and sickness the executives. Future development in cotton creation is bound to come from more significant returns as opposed to territory extension. As indicated by the MOAFW, nearly 33% of the complete cotton region is under water.

Different bureaucratic and state government offices and examination organizations are occupied with cotton varietal improvement, seed dispersion, crop reconnaissance, coordinated irritation of the board, augmentation, and advertising exercises. In 1999, the public government dispatched the Innovation Mission on Cotton (TMC) to improve the accessibility of value cotton at sensible costs, improve profitability, modernize showcasing foundation and ginning and squeezing manufacturing plants through examination and innovation.

The Indian textile sector is the sixth largest exporter of textiles and apparels in the world. The share of India’s textiles and apparel exports in mercantile exports is 12 percent for the year 2019-20. The United States is the top market for Indian apparel exports. The GOI is implementing various policy initiatives and schemes for supporting the development of the textile industry. These schemes and initiatives which promote technology upgrades, the creation of infrastructure, skill development to enable conditions for textile manufacturing in the country.

Scheme for Remission of Duties and Taxes on Exported Products (RoDTEP). Taking a major step to boost exports, the GOI has recently decided to extend the benefit of the Scheme for Remission of Duties and Taxes on Exported Products (RoDTEP) to all export goods including Readymade Garments (RMG) and made ups in January 2021.

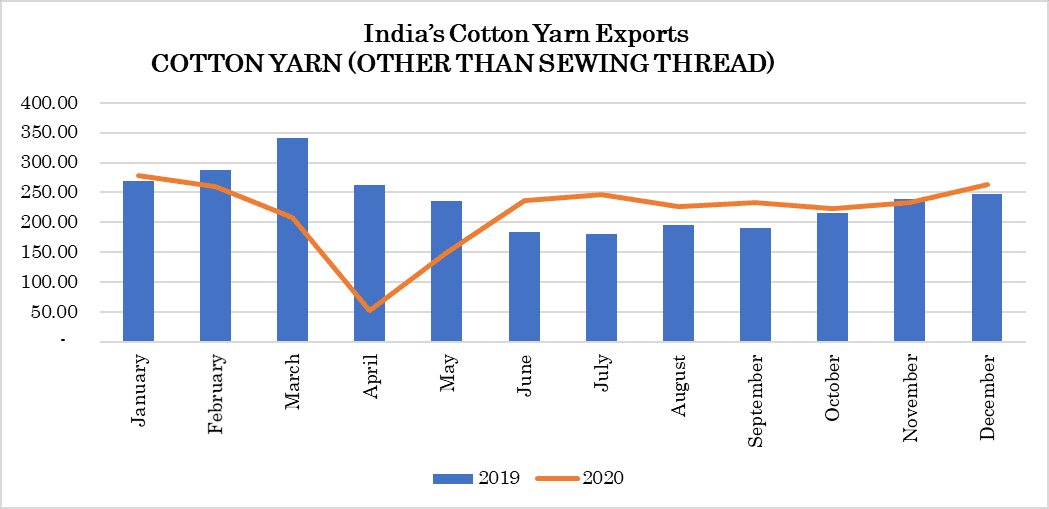

India’s cotton yarn export of cotton yarns other than sewing thread dwindled in the year 2020. India exported the cotton yarns worth $2.8 million in the year 2019. This export decreased in the year 2020 and was only worth $2.6 million. the export of cotton yarns apart from sewing thread was less in the months of February, March, April, May, and November when compared with respective months in the past year. This export was highest in January for the year 2020 and was highest in the month of March for the year 2019. The first quarter of 2021 witnessed the lowest export in that respective quarter in the past 6 years. The lowest export during the mentioned period was in the month of April 2020. It was worth $0.5 million only. The highest export was in the month of March and January in the year 2019 and 2020, respectively.

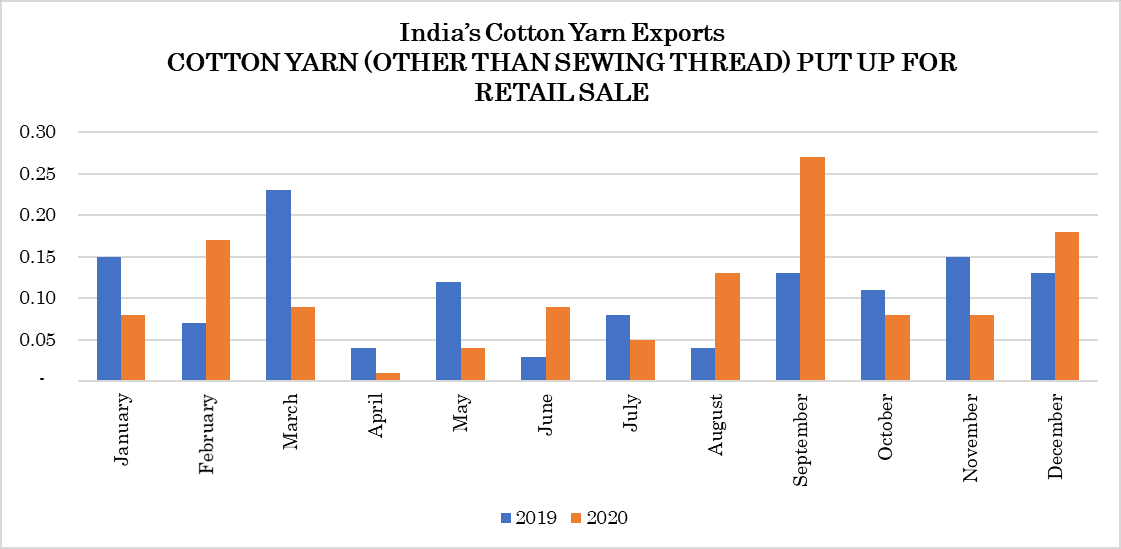

Figure no. 2 represents India’s cotton yarn exports of yarns other than sewing thread. The export of these yarns was highest in the month of March and September in the year 2019 and 2020, respectively. Export of these yarns was lowest in 2020 and witnessed a major drop in April same year that was possibly due to covid-19 pandemic across the globe. April 2020 witnessed the lowest export in both the years. That export was worth $0.1 million.

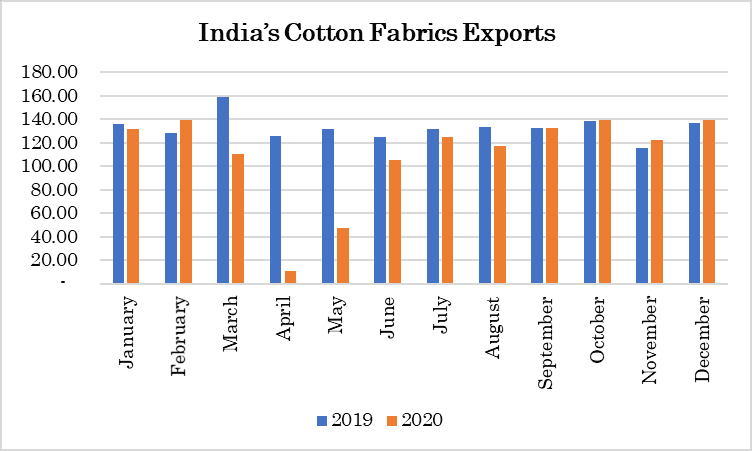

Since ages, India is one of the leading producers of cotton fabric. India’s export of cotton fabrics was highest in the year 2019 while in 2020 it dropped and was lowest when compared with the export between 2016-2020. In 2019, India’s export was worth $1.5 million but it dwindled to $1.3 million in 2020. Among both the years, highest export was done was worth $0.15 million in March 2019.