Following the outbreak of the novel Covid-19 pandemic, Indian textile machinery manufacturers are hoping to capitalize on global anti-Chinese sentiments. One reason why the country’s textile machinery manufacturers are optimistic about their prospects post-Covid-19 is, that they see it as an opportunity to expand their share of the domestic market, which is dominated by imports. The bottom line is that textile machinery manufacturers are optimistic about their prospects in the domestic and global markets following the Coronavirus outbreak.

The export of textile machinery in FY 2021 was neither according to the expectations nor below the expectations. Textile machinery exports were expected to swell in the FY 2021, but it dwindled instead.

Bangladesh was the highest importer of fiber processing machineries from India in the FY 2019 with the import worth 60 million USD. Its import exhibited a constant and major shrinkage in the next couple of years. Bangladesh’s import dropped down to 31 million USD in FY 2020 and in FY 2021 this import was worth 15 million USD. Turkey was the highest importer of these machineries in the FY 2021 with the import value worth 32 million USD.

Turkey’s import was worth 14 million USD in the FY 2020 and 23 million USD in the FY 2019. Oman imported the least number of machineries among the top 10 importers. Its total purchase was worth 17 million USD. Germany’s purchase was worth 7 million USD in FY 2019, 6 million USD in FY 2020 and 5 million USD in FY 2021.

Vietnam imported the machineries worth 30 million USD in FY 2019 which subsequently dropped to 15 million USD in FY 2020 and gradually decreased to 6 million USD. Even Netherland’s import decreased from 20 million USD in FY 2019 to 6 million USD in FY 2021. Indonesia’s import dropped as well. They were 10 million USD in FY 2019 and decreased to 9 million USD in FY 2020. In the year FY 2021, the import was worth 7million USD. Malaysia was one of the top importers in the FY 2019 with the total import worth 35 million USD which fell to 4 million USD. This import increased to 18 million USD in the FY 2021. Benin’s import of these machineries swollen up in the FY 2021 from 2 million USD and 1 million USD in FY 2019 and FY 2020 respectively to 16 million USD. Uzbekistan’s import decreased from 19 million USD to 8 million USD.

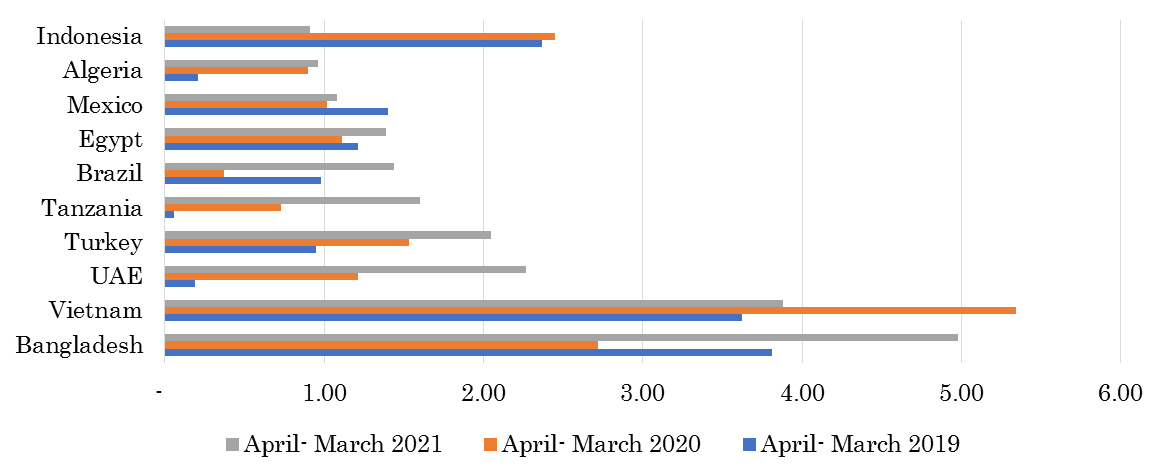

Vietnam was the highest importer of weaving machinery in FY 2020. Its import was worth 5 million USD in the FY 2020. In the FY 2019 and FY 2021, it imported the same machinery worth 3 million USD. UAE and Turkey imported these machineries worth 2 million USD in the FY 2021 and 1 million USD in FY 2020. UAE’s import of these machineries was worth 19 thousand USD and Turkey’s import was worth 95 thousand USD in the FY 2019. Bangladesh imported these machineries worth 3 million USD in FY 2019 but it’s import dwindled in FY 2020 to 2 million USD. In the FY 2021, Bangladesh increased its import to 4 million USD. Tanzania, Brazil, Egypt, and Mexico’s import of these machineries was worth 1 million USD each in the FY 2021. Indonesia’s import dwindled from 2 million USD in FY 2019 and 2020 to 91 thousand USD in the FY 2021.There was a small visible growth in Algeria’s import of weaving machinery from India between the FY 2019 and 2021. Its import was worth 21 thousand USD in the FY 2019 which swelled up to 91 thousand USD in the FY 2021.

India – Textile Machinery Exports (Weaving machines (looms) (Unit: USD Million)

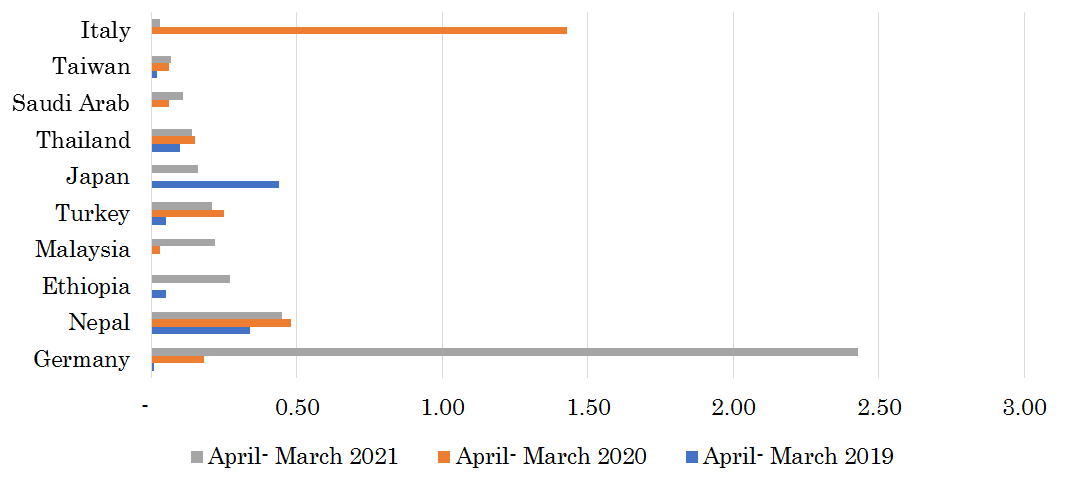

Germany was the highest importer of textile machinery for knitting, lace, embroidery, tufting, etc. in the FY 2021 with the import worth 2 million USD. Germany’s import was comparatively less in the past two years. It imported these machineries worth 1 thousand USD and 18 thousand USD in the FY 2019 and 2020, respectively. Nepal was the 2nd highest importer in the FY 2021 with the purchase worth 45 thousand USD. There was a decline 3 thousand USD in FY 2021’s purchase. Ethiopia’s purchase was worth 27 thousand USD in the FY 2021. It did not make any purchase of these machineries in the FY 2020. Malaysia imported the machinery worth 22 thousand USD in the FY 2021. Turkey’s import was more in FY 2020 than FY 2021. It imported machineries worth 25 thousand USD in 2020 which was 3 thousand USD more than FY 2021’s import. Japan imported these machineries worth 44 thousand USD in FY 2019. Its imports dwindled and was 16 thousand USD in FY 2021. Italy’s import drastically fell in FY 2021 from 1 million USD in FY 2020 to 3 thousand USD in FY 2021. Thailand, Saudi Arabia and Taiwan’s imports were worth 14 thousand USD, 11 thousand USD and 7 thousand USD respectively.

India – Textile Machinery Exports (Machines for knitting, lace, embroidery, tufting, etc) (Unit : USD Million)

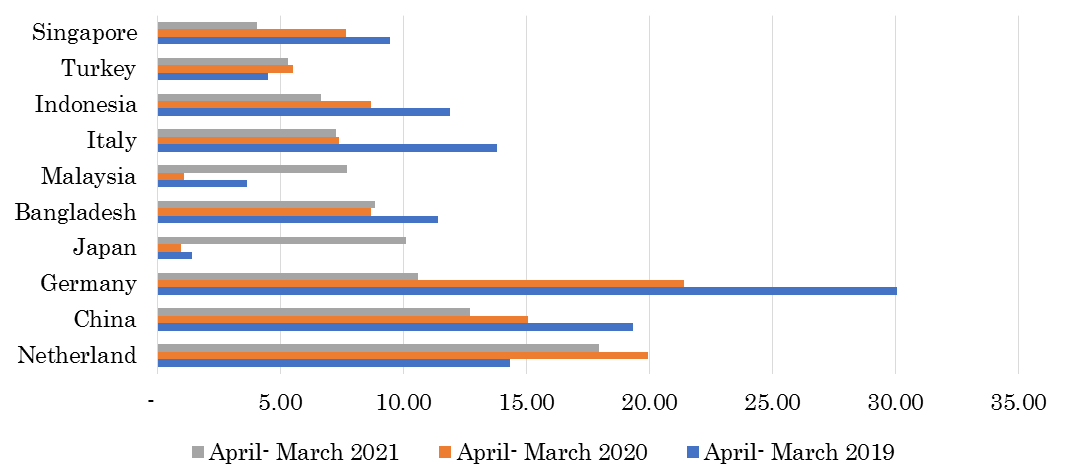

Germany was the highest importer of auxiliary machines and parts for textile machinery from India in FY 2019 as well as FY 2020. Netherland was the highest importer in FY 2021. Germany’s import was worth 30 million USD in FY 2019 which declined to 10 million USD in FY 2021. Netherland’s import increased from 14 million USD in FY 2019 to 19 million USD in FY 2020. In FY 2021, it dropped to 17 million USD. There was reduction in China’s import from 19 million USD in FY 2019 to 12 million USD in FY 2021. Japan’s import surged in FY 2021 and was worth 10 million USD which was 10 times more than previous year. Bangladesh imported the machineries worth 11 million USD in FY 2019. Its import dwindled in the following couple of years and was worth 8 million USD in both the years. Malaysia’s import hiked unexpectedly in FY 2021 from 1 million USD in FY 2020 to 7 million USD in the following year. Italy’s import that was 13 million USD in FY 2019 fell down to 7 million USD in the next financial years. Indonesia, Turkey and Singapore’s import of the given machinery was 6 million USD, 5 million USD and 4 million USD respectively which was less than the previous year.

India – Textile Machinery Exports (Auxiliary machinery and parts for textile machinery) (Unit : USD Million)

Coronavirus pandemic has widely affected all the global industries and business. Though textile industry is also among the most affected industries of the world, Indian textile industry undoubtedly can consider immense growth post the pandemic. While China is facing a lot of decrease in their demand and supply, it is expected that India will be one of the leading exporters of the above machineries in the FY 2021.