(New Delhi, 25 June 2024) The Committee on Cotton Production and Consumption (COCPC) has announced its cotton forecasts for the 2023–24 season. According to these estimates, cotton consumption will rise from around 330 lakh bales in 2022–2023 to 351 lakh bales in 2023–24.

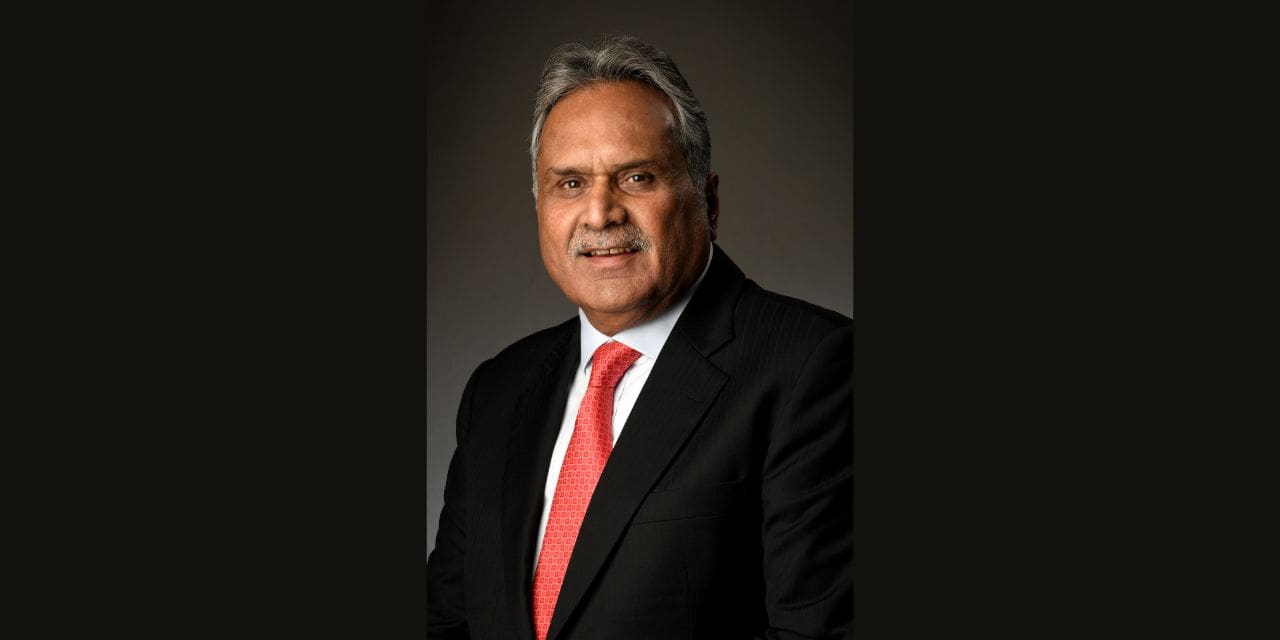

The Confederation of Indian Textile Industry (CITI) Chairman, Shri Rakesh Mehra, acknowledged the government’s efforts to improve the traceability of Indian cotton. The individual mentioned that in the upcoming years, there could be a potential increase in demand and consumption due to enhanced traceability and efforts to provide higher-quality, contamination-free “Kasturi Cotton.”

In expressing his concerns, Shri Mehra stated that although the industry is preparing for a US$ 350 billion market by 2030, more cotton demand is expected. This is due to decreased production and smaller acreage for the cotton season 2023–24 compared to 2022–23. But the Indian textile industry is quite concerned about the acreage stagnation and ongoing lower yield in comparison to other major cotton-producing countries.

The industry is pleased to learn, he added, that the Ministry of Agriculture and the Ministry of Textiles have joined forces to improve the productivity of the Indian cotton sector and have launched a “Pilot Project on Cotton” that would encompass all of the main cotton-growing regions. This study, in which CITI is also involved, has demonstrated that improved agronomic methods are the only way to produce a notable increase in cotton yields. Although Shri Mehra expressed optimism that such focused initiatives will continue to boost productivity, he also asked the government to declare the Technology Mission on Cotton 2.0 (TMC) as soon as possible, with a particular emphasis on seed technology.

He went on to say that the MSPs for long- and medium-staple cotton had been raised by the government by 7.1% and 7.6%, respectively. Although this move is welcomed by the industry because it will encourage more farmers to grow cotton and implement better agronomics practices to increase productivity, growing price differences between MCX and ICE, which reached as high as 29% in June 2024 due primarily to import duties on Indian cotton.