The French Leather Industry has not been spared the drop in activity caused by the Covid-19 pandemic. Although imports and exports fell in 2020, there are encouraging signs thanks to a positive balance of trade. Notably due to an increase in sales to Asia, which has

helped to temper the fall in sales to Italy.

ACTIVITY HAS SLOWED BUT THE FRENCH LEATHER INDUSTRY SHOWS A POSITIVE BALANCE OF TRADE

The French Leather Industry saw exports drop by 9% in 2020. However, its imports fell further, by 15%, representing turnover of some 11.9 billion euros and 9.7 billion euros respectively. France is therefore exporting more than it is importing, and shows an increasingly positive balance of trade with a coverage ratio that has risen by 7 percentage points to stand at 124%. (As a reminder, the coverage ratio rose by 8 points in 2019).

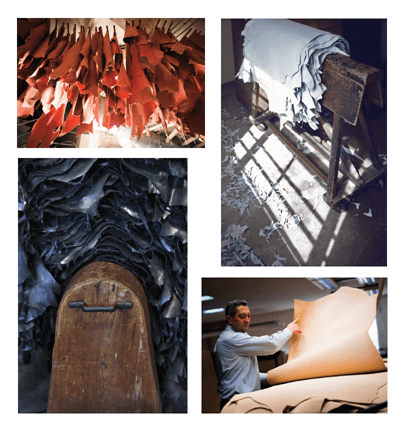

Three sectors are propelling France to the top of the list of global exporters: leather goods, and raw hides and skins, with France being the third largest exporter in the world (with coverage ratios of 273% and 149% respectively), and leather apparel, where France is the fifth largest exporter worldwide (with a coverage ratio of 119%).

FIGURES DRIVEN BY A STRONG RISE IN SALES TO CHINA…

China’s passion for French luxury grew even stronger in 2020: the country increased purchases from France by 80%, against 35% in 2019. In terms of leather goods, China is France’s fourth largest client (after Hong Kong, the United States and Singapore). Demand for leather goods has doubled in a year and has increased tenfold over a decade.

The same can be seen in the upstream sectors of the industry. China is the first client in the sector to restart trading with France since the beginning of the health crisis, with exports of leathers and raw hides to China increasing by 74%.

Sales to China have grown rapidly while imports have shrunk (-27% compared with 2015 and -19 % compared with 2019). The trade deficit remains but it is decreasing by the year.

… BUT ARE IMPACTED BY A SHARP FALL IN SALES TO ITALY

Demand from Italy, France’s biggest client (12 % of exports) fell by 19%. Sales of leathers and raw hides to Italy alone represent more than two-thirds of the industry’s exports. But with the slowdown in demand from Italian tanneries, sales fell by 35% in 2020 (-27 % for France’s exports of leathers and raw hides overall).

The same trend has been seen in finished leathers, with sales to Italy collapsing, down 45% in 2020, after already having fallen by 21% in 2019. This drop has severely affected the sector as Italy was the largest client for this type of product (representing around one third of exports).

Finished goods experienced a slightly smaller drop of 15%, compared to sales of raw materials that fell by 39%. Footwear also contracted by 11% while leather goods fell by 19%.

Frank BOEHLY, Presdent of the Conseil National du Cuir : « The health crisis has spared no-one. With leathers and raw hides, the upstream sector is just about keeping its head above water, with the reopening of borders between France and China. Sales of finished leathers are heavily reliant on Italy, which is struggling to restart its activity, so they are continuing to slow. Despite this exceptional situation, French luxury goods continue to shine and gain foothold in Asia, confirming the exceptional nature of the expertise of the French Leather Industry, a strategic advantage that it is working to preserve.