The spread of Covid-19 has become more pandemic compared to the situation in December 2019 when it was restricted more to China. This has raised concerns of the impact being more serious for the world economy as it affects the prospects of all affected countries.

The extreme situation can be something like this: a halt to all economic activity with citizens being quarantined in their homes and all international activity such as trade coming to a standstill. As it has spread to Europe with traces being found in Latin America too, it is uncertain if it would snowball into a global epidemic.

Two things are important here. First is whether it will spread across the globe and impact several countries. The second is whether it will persist for a long time period or be short-lived. This will determine whether or not it will lead to a global recession. There is a sense that the virus may be less effective once summer descends and if it is so, the impact would be less severe.

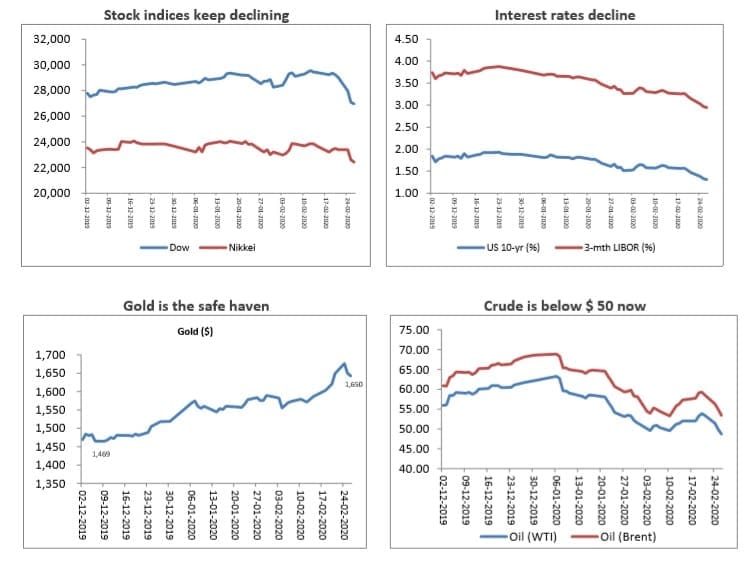

How have some of the leading indicators behaved against this potential epidemic?

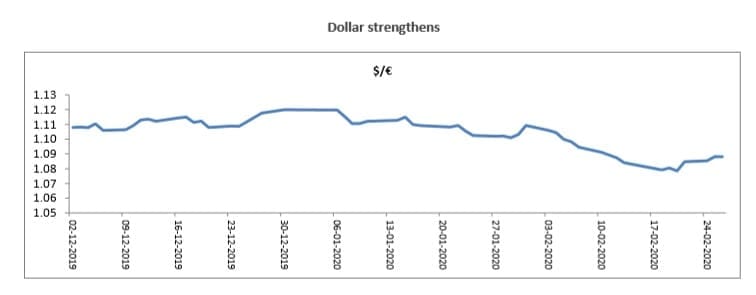

- Stock indices appeared to be quite agnostic till mid-February after which there have been distinct signs of panic as the spread has been interpreted to be a global rather than localized phenomenon. – Interest rates as indicated by US 10-years Treasuries have started moving downwards quite sharply from the region of 1.84% in December to 1.30%. Such a decline though initiated also by central banks going in for monetary easing across the world to prop up growth has received a further pull-down with the spread of covid-19. – Crude oil prices have declined quite sharply and contrary to the expectation that the OPEC would try and lift the price to the $ 60 plus region by invoking output cuts, the fear of recession has taken WTI to less than $ 50. This will go along with the expected slowdown in demand due to recessionary trends likely to emerge. – Gold has been the biggest gainer as funds are getting transferred to bullion in a regime typified by uncertainty with interest rates on the decline, stock markets getting volatile and growth prospects which were otherwise just about neutral now being revised downwards. – The dollar continues to be a strong currency which also means that others would tend to weaken over time.

Global reactions

The impact on the Indian economy too will depend on whether or not it spreads to other countries with which India has trade links and whether it is temporary or more permanent in nature. The impact on the Indian economy is examined here within a theoretical framework that has been defined which has limitations as it is based on several assumptions that may not necessarily hold all through the year. As it does look at a possible (though not probable) extreme situation the actual impact would be of a lesser intensity

- The exercise is only for the impact of the virus on China and the accompanying collateral effects on the Indian economy. While strains are seen in other neighboring countries the exercise here is restricted to only China. The same framework can however be used for other countries too.

- The exercise looks at only the direct economic impact on various sectors and the accompanying loss in GDP and does not take in other factors such as impact on human life, cost of treatment, loss of man days in terms of work foregone etc.

- The direct impact of covid-19 from the China point of view is loss of exports to the country. It is assumed that the exports that are foregone due to closing down of China does not fully lead to opening up of alternative markets, which would definitely be the case as other countries that were importing say textiles or pharmaceuticals from China would be able to do so from India. It is hence assumed here that 80% of the exports to China would be lost as they cannot be replaced.

- It has been assumed that the impact is for a full year with the Chinese economy shutting down (which is only a theoretical possibility) and hence the loss of GDP has been annualized. However, the number can be reduced to the monthly impact depending on the time period involved on a pro-rate basis.

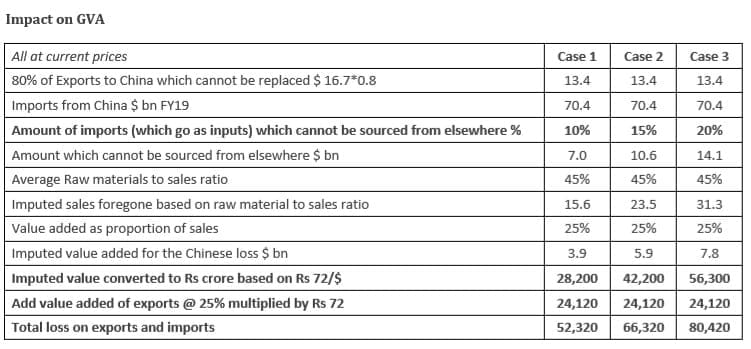

- The imports from China would have an impact on all related industries which use such goods as raw materials besides the final products that are used in India. In industries such as pharma and electronics, there could be fewer alternative sources of products to some extent. Hence the exercise separates the proportion of raw material imports which can be sourced from other countries from those which cannot so that the impact is sharper. Also, of the total imports made by the country, some portion goes as raw materials for the domestic manufacturing industry while finished products would be the other component. Assuming availability of alternatives the exercise draws up three scenarios where 10%, 15% and 20% of imports cannot be replaced by other countries which in turn will affect domestic production and hence GVA.

- Other service sectors such as tourism, software are also impacted in terms of our current account (invisibles) and hence the share of China has been highlighted.

- The loss of GDP has been arrived at by looking at the value added lost from production due to theoretical irreplaceability of imports as well as exports.

Impact on Trade

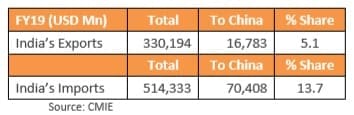

India exported a total of USD 16.7 bn to China in FY19. Considering that total exports in FY20 remain at the same level as FY19 and based on out earlier stated assumption of 80% loss in Indian exports to China, the total export loss would be around $13.4 bn. Exports to China witnessed a CAGR growth of about 28% between FY17 and FY19.

Industry Insights I Covid-19 and Impact on India

Assuming nominal GDP in FY20 at Rs 204.4 lkh crore, the potential loss of nominal GDP on an annual basis would range between Rs 52,300 – 80,500 crore, which is 0.26-0.39% of total. In real GVA terms this would be between Rs 37,800-58,000 cr. This can reduce real GVA growth rate by around 0.29-0.43% at the extreme limit of 12 months shutdown of China based on FY20 estimates. For a single month total shutdown, the impact would be 0.02-0.03% under the assumptions outlined above.

Impact on invisible flows – Services

A. Travel

Foreign tourist arrivals (FTAs) stood at 10.9 million during 2019 of which FTAs from China accounted for about 3.1% while the Foreign exchange earnings (FEE) stood at USD 30 bn. Assuming equal earnings from each arrival, India is expected to lose $ 0.9 bn during the year in absence of tourist arrivals from China.

B. Transport

India’s total trade stands at about $ 844.5 bn as of FY19 of which trade with China stands at about $ 87.2 bn, accounting for about 10.3% share of the total trade, thereby losing the share in case of a total shutdown by China for a year. The loss of inflows on trade account which bring in dollars under the heading transport would be around $ 1.5 bn.

C. IT

As per the Reserve Bank of India (RBI) data, software (including computer services and IT enabled services) amounting to USD 9 bn was exported to East Asia from India. India is expected to lose about USD 2-3 billion assuming about 20-30% share of this goes to China.

Industry Insights I Covid-19 and Impact on India

In conclusion

This exercise provides a theoretical framework for reckoning the possible impact of a total shutdown of China for one year under certain extreme assumptions to conjecture the worst-case scenario. These include only primary impact and not the secondary effects. The impact under these extreme stress conditions show:

- Exports would fall by around $ 13.4 bn in case of an annual shutdown by China.

- The non-availability of imports from China has been reckoned under three scenarios and the potential loss incurred on account of lower exports to China shows that the impact on real GVA/GDP (based on FY20 numbers) can vary between 0.29-0.43% in the simulated scenario on an annual basis.

- The current account will get impacted by decline in receipts on travel ($ 0.9 bn), transport ($ 1.5 bn in freight) and possible $ 2-3 bn in IT.