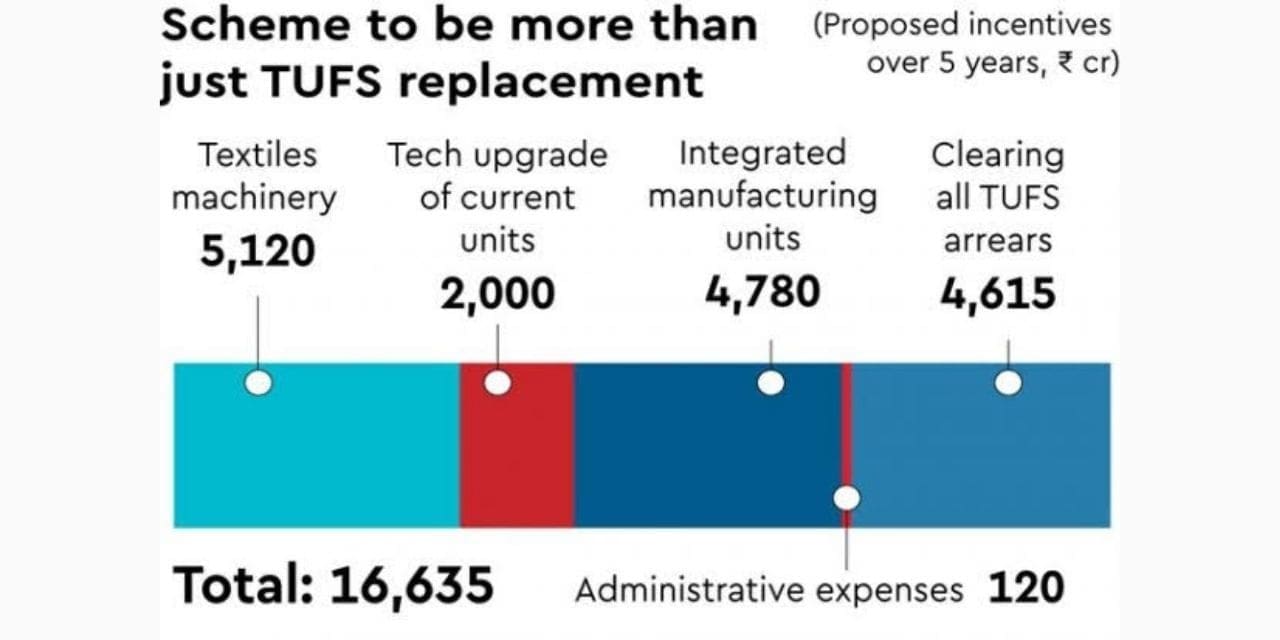

The government is firming up a Rs 16,635-crore programme that will not just replace its decades-old flagship incentive scheme for capital investments in textiles and garments but also promote integrated manufacturing facilities and technology adoption in a big way to enable India to regain its lost share in the global market.

The Textiles Technology Development Scheme (TTDS), a draft of which is reviewed by FE, will substitute the Technology Upgradation Fund Scheme (TUFS) that is valid until March 31, 2022. However, beneficiaries of a Rs 10,683-crore production-linked incentive (PLI) scheme for textiles won’t be able to tap the new scheme.

The second part of the scheme proposes incentives of Rs 4,780 crore for investors willing to set up integrated modern manufacturing facilities. It will also incentivise technology upgrade in existing clusters and micro, small and medium enterprises (MSMEs) at an additional estimated cost of Rs 2,000 crore over five years.

Through various forms of TUFS that have prevailed over the last two decades, investments in the textiles-and-clothing value chain have been given a boost, but the benefits largely went to the capital-intensive spinning sector, leaving the large capacity gaps in weaving and processing technologies unbridged. Economies of scale and integration continue to lack in the later stages of the textile value chain.

Interestingly, the new scheme also proposes to settle all pending subsidy claims of eligible beneficiaries of earlier versions of the TUFS, such as Modified TUFS, Restructured TUFS and Revised Restructured TUFS. It proposes to set aside Rs 2,479 crore for this.

Similarly, it wants all the claims under the current version of the TUFS —Amended TUFS — that was adopted four years ago. It will cost the exchequer `2,136 crore. These proposals will improve the cash flow of pandemic-hit firms and enable them to spur manufacturing as well as exports.

Senior industry executives that FE spoke to said the new scheme seeks to serve essentially three purposes: Address certain critical structural bottlenecks, improve the competitiveness of domestic units and nudge them to scale up operations, and reclaim lost market share globally.

The textile ministry also wants to align its policy intervention through this programme to complement two other critical programmes announced for the sector – the PLI scheme and mega parks, they added.

The share of the textiles and garment sector in the country’s overall merchandise exports was shrinking even before the pandemic struck. It had dropped to just 10.8% in FY20, the lowest in around a decade, from 13.7% in FY16. Globally, while China remains the most dominant player by a wide margin in both textiles and garments, India has been beaten by both Bangladesh and Vietnam in recent years in apparel exports.

The new scheme proposes to reimburse 30% of capital investment on textiles machinery and equipment. Similarly, the firms that want to set up new integrated units will be offered support to the tune of 25% of capital investment in plants and equipment. Exiting MSME units, too, will get up to 25% capital subsidy. The incentives, however, are subjected to caps that will be linked to investments.

Under the extant scheme (ATUFS), garments and technical textiles firms are provided a 15% subsidy on capital investments, subject to a ceiling of `30 crore for each investor. Remaining segments, such as weaving, processing, jute, silk and handlooms, get 10%, with a cap of Rs 20 crore.

A top executive of a large garment exporting firm, said: “The draft scheme looks promising and it will help the fragmented textiles and garments sector provided the ministry sticks to it.”

Raja M Shanmugham, president of the Tirupur Exporters’ Association, hailed key proposals of the new scheme, especially on the plan to extend only capital subsidy, instead of interest subventions or a mix of both capital and interest support.

Shanmugham, however, stressed the garment industry will seek more clarity on the proposed support to MSMEs under the scheme. “Without adequate help to MSMEs, the textiles and garment sector – dominated by such units — won’t flourish,” he added. Tirupur is the country’s largest garment cluster.