10-yr exemption from rule that bars cos from raising deposits over 100% of their paid-up capital.

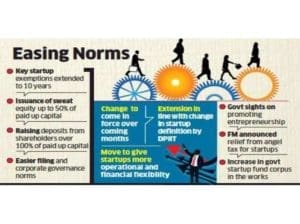

India proposes to let startups issue sweat equity and grant additional exemptions as it eases norms for them under the Companies Act with a view to boost entrepreneurship in the country. The ministry of corporate affairs plans to allow startups to issue 50% of their paidup capital as sweat equity and extend the period of exemptions from other regulatory filings for up to 10 years instead of five now.

They will be exempted for 10 years from a rule that bars private companies from raising deposits exceeding 100% of their paid-up share capital.

“Exemptions already given to startups for five years will be available for 10 years, in line with the revised definition by the Department for Promotion of Industry and Internal Trade,” a government. The DPIIT expanded the definition of startups earlier this year to state that entities would be considered startups for up to 10 years from the date of their incorporation.

The official said a notification would be issued soon to put into effect the proposed changes, although relaxation of norms on financial filings for startups would require an amendment to the Companies Act. Provisions to exempt startups from filing cashflow statements in their annual filings and allowing them to hold only one board meeting every six months instead of four every year may need parliamentary approval. “These exemptions help startups that are under 10 years old in raising funds for expansion plans and provide flexibility to compensate employees or directors using sweat equity,” said AnkitSinghi, a partner at law firm Corporate Professionals. Kunal Arora, joint partner at law firm Lakshmikumaran&Sridharan, said the extensions would provide startups operational and financial flexibility and the relaxations would “reduce the time and costs involved in undertaking the onerous compliances and enable the young companies to focus on the growth of their businesses.”

The government has taken several measures to boost the startup ecosystem, including giving them relief from what was popularly dubbed angel tax, which is levied when companies get investments at higher than their fair market value. It is looking to enhance the startup fund of funds, which invests in venture capital and alternative investment funds that in turn invest in startups.