Growth momentum back on trajectory with 25% growth in Q4 PAT clocked 2.6x sequential increase in Q4FY24 Order book increased by 30%

PDS Limited, the global fashion solutions and infrastructure company offering customized solutions to global brands and retailers across services like product development, sourcing, manufacturing, and brand management, has announced its financial results for Q4FY24.

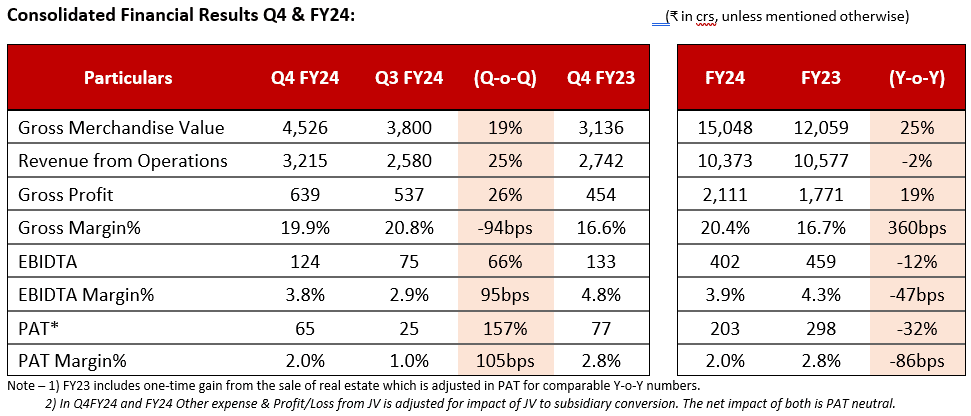

Key Financial Highlights Q4FY24 vs Q3 FY23

- Gross Merchandise value increased by 19% to ₹4,526crs

- Consolidated topline of ₹3,215crs increased by 25%

- EBITDA of ₹124crs increased by 66% with EBITDA margin increase from 2.9% to 3.8%

- Normalised EBITDA is ₹157cr translating into a margin of 5.1% vs 4.2% (post investment in growth)

- PAT increased by 157% to ₹65crs with 2.0% margins vs 1% in the previous quarter

Key Financial Highlights FY24

- Gross Merchandise value increased y-o-y by 25% to ₹15,048crs

- SAAS business delivering +240% growth in the FY24

- Consolidated topline of ₹10,373crs with gross margins of 20.4%, expansion of 360bps

- EBITDA of ₹402crs with EBITDA margin of 3.9%

- Normalised EBITDA is ₹502cr translating into a margin of 5.0% vs 4.7% last year (post investment in growth)

- Investment in growth and capability expansion is ~₹100cr

- PAT amounted to ₹203crs with 2.0% margins

- Declared dividend of ₹3.15 per share

In Fiscal Year 2024, recovery was projected to gain momentum in the latter part of the year despite various challenges encountered by the industry. Despite facing headwinds such as demand pressures, macroeconomic factors, and geopolitical conflicts, our core business remained resilient. In anticipation of the forthcoming recovery, operational expenses remained consistent and increased as usual. However, elevated interest rates resulted in higher interest costs. Additionally, opportunities emerged within the retail sector due to consolidation, prompting PDS to strategically invest in new verticals and teams. PDS invested ~₹100cr in teams and strategic opportunities which were accounted as expenses in the P&L, both at the platform and vertical levels. These investments were diversified, spanning design-led sourcing to broaden the reach across different regions and product categories, while also fortifying the procurement network. Additionally, resources were directed towards augmenting brand management capabilities. The Company anticipates that these investments will fuel growth and enhance profitability in the medium to long run.

Speaking on the developments during the year, Pallak Seth, Executive Vice Chairman, said, “In light of the current year’s performance, we perceive it as merely a transient phase in PDS’s continuous evolution. The disruptions being witnessed in the fashion landscape are unveiling numerous promising prospects, prompting us to expand our talent pool and capabilities to seize these opportunities. We are fortified with confidence in our capacity to harness strategic advantages within the global fashion value chain. Our paramount goal remains consistent: to position ourselves as the foremost and innovative solutions provider throughout the fashion value chain.”

Assessing the Company’s performance throughout the fourth quarter of Fiscal Year 2024, as well as the year in its entirety, Sanjay Jain, Group CEO, shared insights, stating, “As we reflect on our performance for both Q4 FY24 and the fiscal year as a whole, it’s evident that our journey has been marked by challenges amidst an environment of tepid demand. However, we are encouraged by the uptick in growth witnessed during the final quarter of the year. Looking ahead, our focus is squarely set on maximizing returns from the strategic investments made, with a keen emphasis on fostering synergies across our operations. We remain dedicated to unlocking the full potential of the PDS platform and leveraging synergies to drive sustainable growth in the years to come.”