Opportunities & Growth Potential

Textile and Apparel industry has witnessed significant growth over the past few decades. The global T&A trade stood at a value of 818 Bn USD in the year 2019 having grown at a CAGR of 3% over the last 10 years. Of the 818 Bn USD global trade, majority share is claimed by apparel with a total of 470 Bn USD. Fabric and yarn are the second and third largest traded categories.

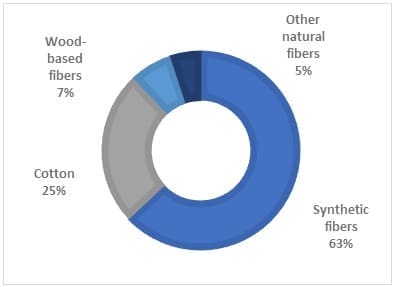

Global Fibre Consumption 2019

Source: Lenzing.com

In terms of fibre, 2016 marked a milestone as global consumption crossed the 100 Mn MT mark and has been growing with 2019 recording consumption of 108 Mn MT. Majority of the fibre demand is met by synthetic fibres (63%), followed by cotton (25%).

As per the 2020 Lenzing report, 3-4% annual demand growth is expected for synthetic fibre during the years 2019-24.

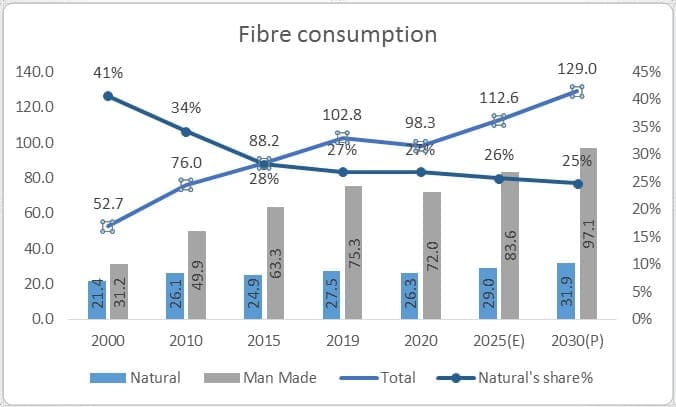

It is estimated that by the year 2030, the global fibre consumption would increase to approximately 140 Mn tons with the Man-made fibres constituting to ~108 Mn tons.

According to the Fibres Global Supply Demand report 2018 published by Wood Mackenzie, while cotton contributes only 26% of the total fibre consumption, Polyester contributes around 56%, Polypropylene – 4.9%, Nylon – 4.8%, Acrylic – 1.6% and the remaining by other fibres. The global fibre consumption growth for the period 2010 to 2020 was recorded at around 3.3% annually with the Asian countries having a higher consumption rate.

Global Fibre Consumption – Mn Tons

| Fibre | 2000 | 2010 | 2015 | 2019 | 2020 | 2025(E) | 2030(P) |

| Cotton | 20.0 | 25.0 | 23.8 | 26.4 | 25.2 | 27.9 | 30.8 |

| Wool | 1.5 | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | 1.2 |

| Cellulosic | 2.3 | 3.6 | 5.4 | 6.5 | 6.2 | 7.6 | 9.2 |

| Acrylic | 2.6 | 1.9 | 1.8 | 1.6 | 1.6 | 1.6 | 1.6 |

| Nylon | 4.0 | 3.7 | 4.1 | 4.9 | 4.7 | 5.4 | 6.3 |

| Polyester | 19.3 | 37.1 | 47.8 | 57.2 | 54.7 | 63.4 | 73.5 |

| Polypropylene | 2.9 | 3.6 | 4.3 | 5.1 | 4.9 | 5.6 | 6.5 |

Source: Wood Mackenzie Chemicals Report 2018

The share of natural fibers, which was at 41% two decades back, has declined to around 26% now. This makes it evident that the Man-made fibres will be the mainstay for fulfilling the growing demand for fibre.

Factors driving the growth of the man-made textiles and apparel industry globally

With the increasing global population, fibre consumption is expected to rise. While the demand for cotton may also be increasing, its supply base has inherent limitations. Man-made fibres fulfil the gap and are increasingly becoming a fibre of choice.

Cost competitivity offered by MMF has also been a factor in boosting its adoption by the industry. Changing attitude towards traditional textile products and increasing acceptability has contributed to increasing consumption of MMF based textile products and apparel.

As the global consumer mood shifts towards sustainability and circularity, MMF’s unlimited recyclability adds to its overall appeal.

Lastly the versatility of MMF in end-use categories such as sportswear, leisurewear, women dresses, home textile, automotive, carpets and other industrial sectors makes it an ideal ‘fibre of the future’.

Bangladesh’s MMF Textile & Apparel Industry

Bangladesh has established itself as a strong producer in the Ready-made garment sector with more than 4600 garment factories operating. In the spinning sector, around 430 mills are operating out of which only 27 mills are producing man-made yarn, in particular polyester. The production facilities for other man-made fibres like polypropylene, nylon, acrylic etc. are yet to be established in Bangladesh

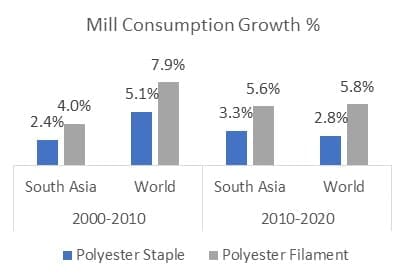

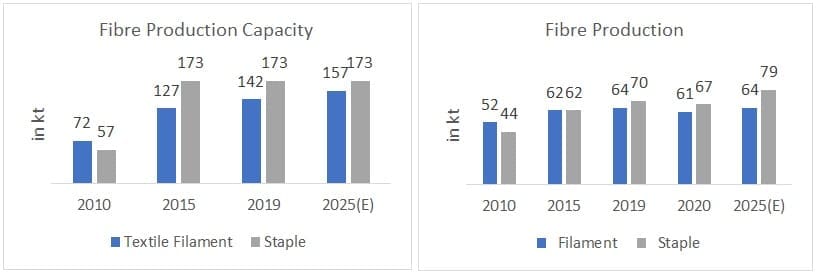

From the Wood Mackenzie Chemicals report 2018 and TTS analysis, the textile mill consumption of polyester staple fibre and filament in South Asia* has increased over the past decade. At the same time, it can be noticed that the actual production of polyester staple fibre and filament is only half of the production capacity in Bangladesh. There is still untapped potential for the production of man-made fibre in Bangladesh if it can utilize the existing resources and build on it.

*South Asia (excl. China, India) – Bangladesh, Indonesia, Malaysia, Pakistan, Philippines, Sri Lanka, Thailand, Vietnam

Source: Wood Mackenzie Chemicals Report 2018

Man-made Apparel Exports

In the last decade, Bangladesh has emerged as one of the leading apparel suppliers, second only to China. The growth of the Bangladesh textile and apparel industry has been tremendous owing to factors such as vast workforce, lower energy and power cost, etc. Bangladesh’s apparel exports have increased from 27 Bn USD in 2015 to 41 Bn USD in 2019 with a growth rate of 11% over the years 2015-2019 while the textile exports have seen a growth of 2% over the same period.

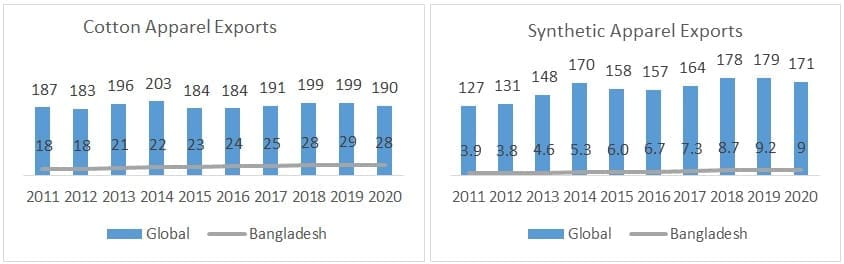

Bangladesh’s man-made apparel exports are low when compared to the cotton apparel exports.

In the year 2019, the global man-made apparel trade stood at around 179 Bn USD with Bangladesh holding approx. 5% market share. At the same time, Bangladesh market share was close to 15% in the global cotton apparel market of 199 Bn USD.

Interesting to note that Bangladesh being very strong on the garmenting part of the value chain can easily pivot to making high value garments.

Export values in Bn USD

Source: ITC Trade map, TTS Analysis

Bangladesh’s Exports Share in Global Man-made Apparel Trade

Trade value in Bn USD. Categories arranged in descending order of Global trade in 2019.

| Categories | 2011 | 2015 | 2019 | CAGR % 2011-2015 | CAGR % 2015-2019 | ||||||||

| Global trade | *BD exports | BD’s share | Global trade | BD exports | BD’s share | Global trade | BD exports | BD’s share | Global | BD | Global | BD | |

| Trousers | 14.64 | 0.50 | 3% | 20.53 | 0.92 | 4% | 25.55 | 1.53 | 6% | 9% | 16% | 6% | 14% |

| Sweaters | 18.59 | 1.60 | 9% | 20.59 | 1.88 | 9% | 24.90 | 2.62 | 11% | 3% | 4% | 5% | 9% |

| Dresses | 10.84 | 0.12 | 1% | 15.25 | 0.17 | 1% | 18.74 | 0.49 | 3% | 9% | 8% | 5% | 30% |

| T-Shirts | 11.56 | 0.18 | 2% | 15.98 | 0.62 | 4% | 15.05 | 0.86 | 6% | 8% | 36% | -1% | 8% |

| Overcoats | 6.24 | 0.19 | 3% | 6.85 | 0.24 | 4% | 10.54 | 0.37 | 4% | 2% | 6% | 11% | 12% |

| Jackets | 9.48 | 0.05 | 1% | 13.59 | 0.14 | 1% | 10.09 | 0.22 | 2% | 9% | 28% | -7% | 13% |

*BD – Bangladesh

Source: ITC Trade map, TTS Analysis

From the secondary research conducted, it is clear that Bangladesh’s share in the Global Man-made apparel trade keeps on increasing over the years. Bangladesh has established a strong presence in the category of sweaters, having a share of 11% in the year 2019.

Opportunities and Growth Potential

As the consumption of man-made fibre is increasing globally, Bangladesh needs to increase the number of factories dedicated to the production of man-made fibre textiles and apparel so as to increase its exports in this sector. Out of the 433 spinning mills in Bangladesh, only 27 spinning mills are producing man-made yarn. The production from the mills can meet only 20 percent of the national demand for the product. If Bangladesh can invest in the backward linkage of the man-made textile value chain, it has the opportunity to capture the remaining 80% of the demand.

Currently, countries such as China, Viet Nam, Indonesia, South Korea, Thailand etc., are leading the man-made fibre production. The export of apparel items produced from man-made fibre (MMF) from Bangladesh has remained stuck at 20 percent for many years although the production of such garment items has crossed 40 percent worldwide, according to a study of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). Though it is stuck at 20%, Bangladesh has the potential to pivot to the production of man-made fibre based textile and apparel thus realizing greater per unit values.

The government should also ease the rules to attract FDI to man-made fibre textile and apparel production as the country has very low capacity in this segment.

Recently, the Government of Bangladesh has planned to diversify the apparel export basket and strengthen its backward linkages industries by extending the tax holiday facilities for the manufacturing of man-made fibres.

According to the Chairman of BTMA, in order to utilize the tax holiday advantage to the maximum, the government should also allow importing the raw materials under a duty-free facility. Otherwise, the cost of production will be higher. This move was very much welcomed by the entrepreneurs and business leaders as this would help in attracting more foreign direct investments in the apparel sector.

Given the business scenario globally vis-à-vis the COVID-19 situation and the growing apparel sourcing diversification, the time is opportune for the industry in Bangladesh to invest in the Man-made fibre textile Industry and take the leap to up the value chain.

Article By:

Mr. Ameet Kaul – Head (Business Development) – Texcoms Worldwide

Ms. Anusuya (Research Associate) – Texcoms Textile Solutions