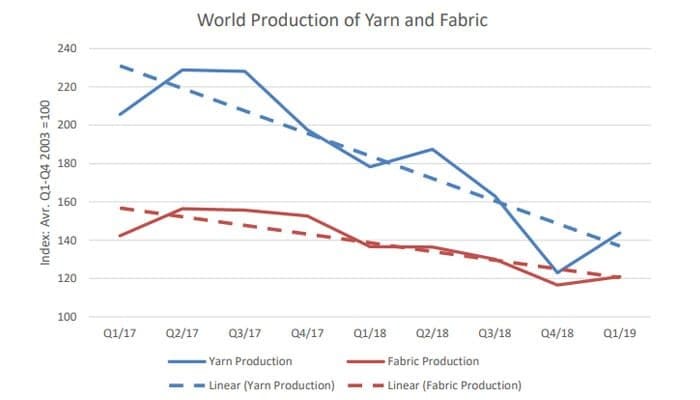

Global yarn production increased by +17% between Q4/18 and Q1/19. Higher output levels where observed in Asia (+18%), Brazil (+18%), the U.S.A. (+3.2%) and Europe (+1.6%). The overall Asian result is due to a +27% increase in Chinese yarn production which outperformed the contraction registered in Japan (-1.7%), India (-3.1%) and Korea, Rep. (-9.2%). A decreasing trend has further been observed in South Africa (-5.3%) and Egypt (-7.9%). Forecasts for Q2/19 are optimistic in Japan, Chinese Taipei, and Turkey. Global yarn stocks increased by +6.3% worldwide. This results from a +27% improvement in Egypt, +7.7% raise in Brazil, and +3.8% increase in Asia. The latter is the consequence of stock growth in Japan and India, stability in Pakistan and decrease in Korea, Rep. and Chinese Taipei. Altogether, yarn stocks reached 97% of their previous year’s level for the same quarter. Global yarn orders increased by +12, led by Brazil (+18%), Egypt (+11%), and Asia (+9%).

Global fabric production increased between Q4/18 to Q1/19 by +3.8%. This reflects an output raise of +19% in Brazil and an overall +3.6% improvement in Asian countries. Europe saw its production shrink by -0.85% with the biggest drop registered in Spain (-10.1%). A strong decrease of -42% was also witnessed in Egyptian fabric production. The world output level now reaches 88% of its Q1/18 level.

Output levels are expected to further decrease in Q2/19 in Asia, Africa, and Brazil, stay constant in the U.S.A. and increase in Europe. Production should stagnate in Q3/19 in all regions but Asia, which should register an improvement. The global fabric stock level has stagnated between Q4/18 and Q1/19. This resulted from raises registered in Egypt (+16%) and Brazil (+3.3%) and decreases of -1% to -2% observed in Asia, Europe and the U.S.A. In Q1/19, global fabrics stocks were 1% above their Q1/18 level. Global fabric orders have dropped by -19% in Q1/19, led by a decrease of -32% in Egypt and – 25% in Brazil. Global fabric orders were 8% above their Q1/18 level.