Nomura’s findings are based on the study of world’s 50 biggest economies from the first

quarter of 2018 (Q1CY18) till the first quarter of CY19 (Q1CY19)

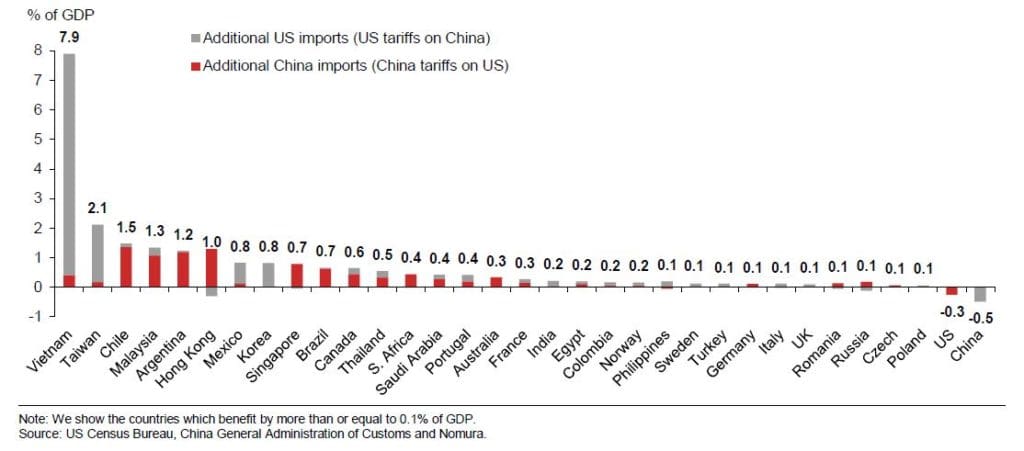

The ongoing trade war between the United States (US) and China is likely to benefit

Vietnam the most, followed by Taiwan and Chile, suggests a report by Nomura titled

“Exploring US and China trade diversion”, co-authored by Rob Subbaraman, Sonal

Varma and Michael Loo.

The findings are based on the study of world’s 50 biggest economies from the first

quarter of 2018 (Q1CY18) till the first quarter of CY19 (Q1CY19).

Besides these three, Malaysia, Argentina, Hong Kong, Mexico, Korea, Singapore and

Brazil are the other countries / economies among the top 10 that Nomura believes will

benefit the most. Canada, Thailand, South Africa Saudi Arabia, Portugal, Australia, France, India, Egypt and Colombia are ranked as the 11 – 20th world economies that will

stand to gain from this trade spat.

“US import substitution has benefitted Vietnam, Taiwan and Korea in electronics

products; Malaysia in semiconductors; and Korea and Mexico in motor vehicle parts.

China’s import substitution, has led to beneficiaries in copper (Chile), soybeans

(Argentina, Brazil, Chile and Canada); gold (Singapore, Hong Kong and South Africa);

natural gas (Malaysia, Australia); and aircraft (France and Germany),” the report says.

The study covers US tariffs on $250 billion worth of imports from China and Chinese

tariffs on $110 billion worth of imports from the US. Basis this, Nomura sees evidence of

US and China import substitution in 52 per cent of the 1,981 tariffed products.

Though the substitution effect may be small in relation to the size of US and China GDP,

analysts at Nomura believe that going ahead, the development can give a substantial

boost to exports of third-party countries with smaller economies.

The report pegs Vietnam as the biggest beneficiary, gaining 7.9 per cent of GDP (gross

domestic product) from trade diversion, followed by Taiwan (2.1 per cent of GDP), Chile

(1.5 per cent), Malaysia (1.3 per cent) and Argentina (1.2 per cent).

For India, the benefit is pegged at 0.2 per cent of 2019 GDP. Petrol, bitumen mineral,

articles of cement, concrete or stone, parts and accessories from motor vehicles, taps,

valves, pipe tanks carpets and other textile floor coverings are some of the products

where India stands to gain.

‘COLD WAR’ IN TECHNOLOGY

A major risk for the US, according to the Nomura, is the likely impact on the electronic

products it sources from China. If the US follows through on 25 per cent tariffs on the

remainder of $325 billion worth of products and if the US business restrictions on

China’s Huawei and ZTE technology companies escalate into a ‘cold war’ (in

technology), the impact on US companies could be severe.

“A striking statistic is that from US listed companies in the S&P 500, 12 of the top 20

with net sales in China are electronic companies with combined revenue of $144 billion

in 2018. That is larger than US total merchandise exports to China of $120 billion in

2018,” the report says.

Apple Inc, Intel Corp, Micron Technology, Qualcomm, Texas Instruments, Applied

Material and Western Digital are some of the US impacted companies, Nomura says, that had 19 per cent to 45 per cent share of sales to China as a percentage to their total

sales in 2018. Low-income states fare well on holistic fiscal performance: CII

(Source: The Hindu Business Line, June 05, 2019)

As per the CII FPI, expenditure on infrastructure, education, healthcare and other social

sectors can be considered beneficial for economic growth.

The financial performance of states with low income levels is better than those with

higher income, according to a study by the Confederation of Indian Industry(CII).

“At the individual States level, our analysis shows that the high-income States such as

Gujarat, Haryana, Maharashtra which are having low fiscal deficit to GDP ratio have

performed poorly on the Fiscal Performance Index (FPI) front, while low-income States

such as Bihar and Uttar Pradesh which have high fiscal deficit ratio have fared well on

the FPI front,”CII study said.

“High-income States have performed poorly mainly on the expenditure quality and own

tax receipts index as compared to their low-income counterparts. Though their

performance on the deficit prudence index has been above average. This clearly demonstrates the inadequacy of fiscal deficit to GDP ratio in analysing the fiscal

performance of States,” the CII study also pointed out.

This study is based on a new assessment of Fiscal Deficit that measures the

Government’s revenue and expenditure balance. The composite FPI developed by CII

uses multiple indicators to examine quality of Budgets at the Central and State level.

“It is important to study diverse sources of revenue and expenditure heads to truly

assess the fiscal situation of a nation. A single criterion such as the ‘fiscal deficit to GDP

ratio’ does not tell us anything about the quality of the Budget. Hence, the Government

should use multiple indicators to measure the quality of Budgets at the Central and the

State levels rather than a single indicator,” said Vikram Kirloskar, President, CII.

“This measure of fiscal conditions can better help target Government’s social and capital

expenditures keeping in mind fiscal stability. It would also contribute to strategy

formulation to manage economic development with macroeconomic prudence,” a CII

statement said.As per the CII FPI, expenditure on infrastructure, education, healthcare and other social sectors can be considered beneficial for economic growth. At the same time, tax revenues are sustainable sources of revenues for the Government as compared to onetime income sources.