The Finance Minister announced an economic stimulus package today close on the heels of the Production-Linked Incentive (PLI) scheme for 10 sectors passed by the Cabinet yesterday. This has been termed as the Atmanirbhar Bharat 3.0 programme.

Today’s announcements contain measures to boost employment, making funds available to the MSME and stressed sectors, revival of the real estate sector, support to agriculture, ease of doing business, stimulate exports, financing of infra as well as towards R&D of Covid-19 vaccine.

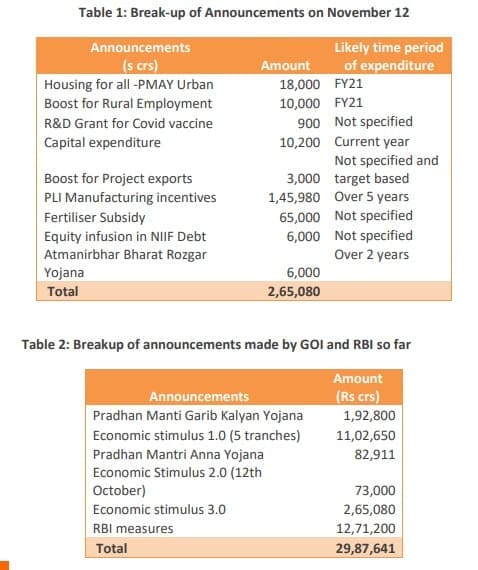

The Government has also increased allocations over the budgetary outlays for 2020-21 as a part of the stimulus programme. The total estimated spending based on today’s announcement is Rs 2.65 lakh crs. The total of all the announcements so far made by both Central government and the RBI is Rs 29.87 lakh crs, which as per the Finance Ministers’ estimate is 15% of GDP. The breakup of the announcements along with the breakup of the announcements so far has been detailed in Table 1 and 2 below.

CARE Ratings assessment: Likely impact on gross fiscal deficit of Central Government

Out of the total additional expenditure announced today of Rs 2.65 lakh crs, we expect additional total outlay in the range of Rs 70,000 crs to Rs 1.2 lakh crs to be undertaken in the remainder of FY21 (assuming Rs 30,000 cr is spent on fertilizers subsidy). We do not believe that this entire amount of Rs 2.65 lkh crore would be spent this year:

1. The PLI scheme for Rs 1.36 lkh crore is performance based and spread over 5 years’ time and hence no expenditure can be expected this year.

2. The allocation for NIIF and EXIM Bank may not be done this year and more likely to be allocated next year. The same holds for the R & D expense which will be spread over time and can go to next year.

3. The allocation of subsidy on fertilizers would not be incurred this year. Data up to September shows that out of allocation of Rs 71,345 crore the government has spent 78% or Rs 55,406 crore. Last year it was 70%. Hence the excess spent this year is around Rs 5500-6000 cr. We have assumed a maximum of Rs 30,000 crore being incurred this year as the sowing period will prevail for only another 3-4 weeks.

We had earlier estimated fiscal deficit to be at 9% of GDP in FY21. On account of this additional spending, we now expect fiscal deficit to widen by 0.35-0.5% of GDP (assuming Rs 30,000 cr is spent on fertilizer subsidy). If only Rs 6000 crore was spent on fertilizer subsidy, the deficit would increase by 0.25%.

Key Highlights:

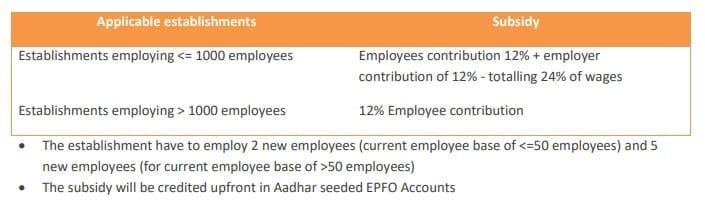

1. Boost for Employment under the Atmanirbhar Bharat Rozgar Yojana

- Central Government to provide subsidy for a period of 2 years in respect of new eligible employees engaged on or after 1.10.2020

- Applicability criteria for employees:

i. Any new employee joining employment in EPFO registered establishments on monthly wage less than Rs 15,000/-

ii. Employees who lost their jobs between 1 March 2020 and 30 September 2020 and is employed on or after 1 October 2020 with wages less than Rs 15,000

It needs to be highlighted that as this would apply to only those new employees with salary of less than Rs 15,000 per month, most medium to large size corporates may not be affected. It would affect those in the medium to smaller companies.

2. Funding support under ECLGS Scheme

- Extension of ECLGS 1.0: Rs 3 lakh crs existing ECLGS 1.0 scheme to be extended till 31st March 2021 from the current deadline of 30 November 2020.

- Launch of ECLGS Scheme 2.0

i. 100% guaranteed collateral free additional credit at capped interest rates to be provided to stressed sectors

ii. Applicable sectors: Guaranteed credit support to 26 stressed sectors (that were identified by the K V Kamath Committee) and the health care sector.

iii. Applicability based on outstanding credit: Entities of these sectors having a credit outstanding over Rs.50 crores and upto Rs.500 crores as on 29 Feb’20

iv. Additional credit up to 20% of outstanding as on 29 Feb’20

v. This credit would carry a tenor of 5 yrs with 1 yr moratorium of principal repayments

The scheme will apply to entities which were SMA-0 in these sectors which already have access to credit. Hence while the target of Rs 3 lkh crore will be achieved, these companies would be at a higher level than SMEs which faced hurdles when borrowing from banks. It would need to be seen if these companies find the interest cap of 9.5% of advantage or whether were borrowing anyway at a lower rate.

3. Incentivizing Manufacturing

- Rs.1.46 lakh crores boost via manufacturing production linked incentives (PLI) for 10 sectors. The spending is to be undertaken in the next 5 years. The incentive is given based on targets being achieved in investment and turnover.

4. Additional expenditure for revival of the real estate sector

- Rs 18,000 crs additional outlay over and above the Budget Estimates for FY21 for the Pradhan Mantri Awas Yojana (PMAY). The current budgeted expenditure under this scheme is Rs 8,000 crs for FY21.

- This is expected to generate additional jobs of 78 lakhs, production of steel : 25 Lakh MT and 131 Lakh MT cement

It will have positive impact on industries like cement and steel through backward linkages.

5. Ease of Doing Business

- Reduction in performance security on contract to 3% from 5% -10% for ongoing contracts which are free of disputes. It will also cover public sector enterprises

- Earnest money deposit (EMD) to be replaced by Bid security declaration

- This will free up capital by reducing the locked in capital of contractors/developers

6. Incentives for the residential real estate sector

- It has been decided to provided income tax relief to residential real estate sector by increasing the differential between circle rate and agreement value from 10% to 20%

- This will be applicable to primary sale of residential units and for residential property of value upto Rs 2 crs.

- Consequential relief of upto 20% shall be allowed to buyers of these residential units.

7. Infrastructure Financing – Equity infusion

- Rs. 6000 crores equity infusion in NIIF Debt platform

- This will facilitate creation of debt platform to raise money for infrastructure.

This has potential to raise debt of around Rs 1.1 lkh crore in the next five years and will provide a fillip to this sector. This will be good for the corporate bond market.

8. Fertilizer subsidies for Farmers

- Rs.65,000 crs fertilizer subsidy being provided to ensure adequate supply of fertilizers. We believe that not all will be spent this year and going by last year’s pattern around Rs 6000 cr could be this year’s share. At the outer limit Rs 30,000 cr could be the expenditure for the government.

9. Support for the rural economy

- Rs 10,000 crs additional outlay for rural employment under the PM Garib Kalyan Rozgar Yojana

- This additional money will either be spent on MGNREGA or PM Gram Sadak Yojana

10. Boost to Project Exports

- Rs.3,000 crs to be provided to EXIM Bank for promotion of project exports though Lines of Credit that would benefit railways, power, transmission, road and transport, auto components, sugar projects

11. Increase in Capital Expenditure

- Rs.10,200 crores additional outlay towards capital expenditure which is mainly towards domestic defense equipment, industrial incentives, industrial infrastructure and green energy.

As this will be spent this year, the capital goods segment can look forward to some boost. In the earlier stimulus the government spoke of spending Rs 25,000 cr on capex. Total capex for the year would hence be around Rs 4.45 lkh cr this year.

12. Funds for COVID R&D

- Rs.900 crores grant towards research and development for COVID-19 vaccine Development. This is to be granted to the department of Biotechnology

Concluding remarks

The announcements made by the Finance Minister to further support the economy in its recovery phase are a step in the right direction. These measures will help in boosting employment generation, provide additional credit to the stressed sectors, multiplier effects on undertaking additional capital expenditure and spending for the real estate sector and more spending towards the rural economy. We expect this economic stimulus to have an impact of around 0.25% – 0.6% of GDP on the fiscal deficit.