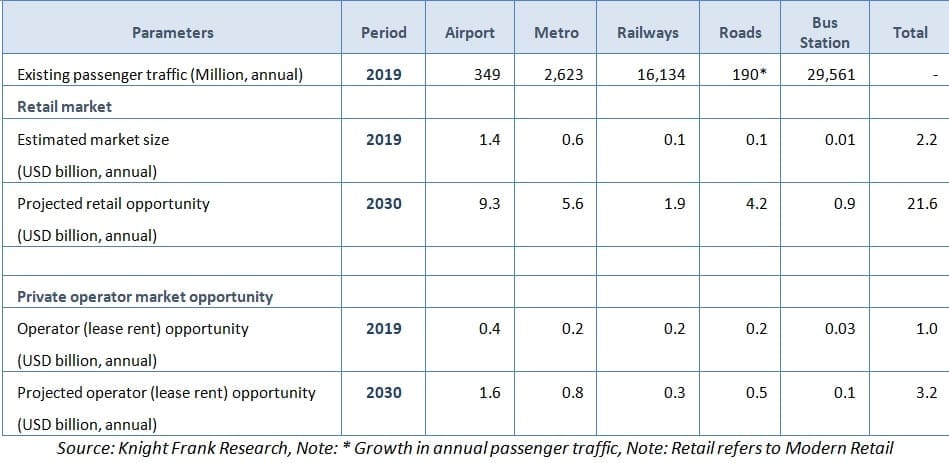

Transit Retail opportunity projected to see three-fold growth by 2030 to USD 21.6 billion: Knight Frank India

- Current retail size of transport nodes is estimated at USD 2.2 Billion

- Private operators expected to see lease rental opportunity of USD 3.2 billion by 2030

Mumbai, February 25, 2020: Knight Frank India, leading international property consultancy, in its latest study titled ‘Catch Them Moving’ , Report on Transit Retail – projects that the total retail opportunity across various transport hubs in India, such as airports, highways and bus stations, metro, railways, will grow manifold in new decade. Backed by a potentially healthy growth in passenger traffic and transport infrastructure, this Transit Retail opportunity is estimated to grow to USD 21.6 billion by 2030.

While the retailing potential is best tapped at airports, it is still at a nascent stage for other modes like metros, railways, highways and bus stations. The report estimates the current size of Transit Retail in India at USD 2.2 billion. A large part of the retail opportunity at transit hubs is currently untapped due to lack of retail infrastructure at these nodes.

The large retail potential translates into lease rental opportunity of USD 1 billion, currently which is estimated to grow to USD 3.2 billion by 2030. Considering the current lease rent opportunity, the government can potentially monetise these transit – oriented retail assets to generate funding to the tune of USD 10 billion. Such monetisation will reduce dependencies on passenger tariffs and develop the retail eco-system for a largely unexplored territory. This will also open a new revenue stream for future infrastructure developments.

Shishir Baijal, Chairman and Managing Director, Knight Frank India, said, “India is going through an infrastructure revolution. The Government’s focus on developing and modernising the transport modes including airports, railway stations, metro and highways is opening up unprecedented opportunities for the organised retail segment in India. The development of retail infrastructure at key transportation nodes through a public private partnership has presented huge opportunities to operators and retailers to monetise the potential of guaranteed footfalls with ‘wait time’.”

“In India retail real estate growth has by far bene the most sensitive to domestic and global conditions. With organised retail still only a fraction of the total retail market in India while having of the largest population base, there is ample scope of growth in the country. Most of organised retail growth in India so far has been based out of mall developments with sales heavily dependent on footfalls and conversions thereafter. The advent of transit retail will provide retailers with captive audience that is willing to spend. Having said this, the transport hubs will have to create appropriate space with prominence and visibility, smart revenue models and correct product mix to ensure that retailers see value in their presence in a transport hub,” continued Shishir.

INDIA TRANSIT RETAIL

“Transport Terminals offer guaranteed footfalls every single day, maybe with different passenger dwell times and different propensity to spend. A good terminal would try to subtly encourage passengers into shops and eating joints on the way as part of their journey. Other than designs related to core travel, it is always better to consider early in planning and design of a terminal, factors such as passenger flow through the terminal, spend profile, layout, size and presentation of the shops/units, product mix, etc. They are very important to enhance the customer’s ever-increasing expectation of journey experience and for the operator a solid window to increase non-fare box revenues,” said Rajeev Vijay Executive Director – Government and Infrastructure Advisory, Knight Frank India.

Saurabh Mehrotra, National Director – Valuation & Advisory, Knight Frank India said, “Transport infrastructure projects involve significant capital expenditure, often requiring budgetary support for development or viability gap funding for PPP Projects. Many of these projects also find it difficult to sustain operations expenditure specifically in the early phases of operation. Land value capture through property development presents an excellent opportunity to improve project viability. Integrated development of retail and F&B can play an important role in enhancing the share of non-box fare revenues, while parallelly enhancing the customer value proposition. Transit retail over the next decade is likely to develop into a Rs 20000 Crore annual income opportunity. This if properly executed can go a long way in easing the burden of future infrastructure development.”

Major Findings for ‘Catch Them Moving’ – report on Transit Retail:

AIRPORTS

- Total retail opportunity for airport is projected to grow to USD 9.3 billion by 2030, from USD 1.4 billion in 2019

- Lease rental opportunity projected to touch USD 1.6 billion by 2030 for the airport operators

- Duty Free accounted for more than 59% of the total lease rental in 2019

- Retail revenue per passenger is highest for Mumbai International Airport at USD 7, followed by USD 6 for Delhi International Airport in 2019

- Air passenger traffic estimated to reach 1.1 billion by 2030 in India, from 349 million in 2019

METRO STATIONS

- Total retail opportunity at metro stations projected to grow to USD 5.6 billion by 2030 from USD 0.6 billion in 2019

- Annual passenger traffic in Metro, which is estimated to touch 7.32 billion by 2030, biggest growth driver for retail

- Lease rental opportunity for airport operators projected to grow to USD 0.8 billion in 2030

RAILWAY STATIONS

- Total retail opportunity at redeveloped railway stations projected to reach USD 1.9 billion by 2030, from USD 0.1 billion in 2019

- Government’s focus on augmenting rail infrastructure and modernising existing stations biggest enabler

- Lease rent opportunity for airport operators projected to hit USD 0.3 billion by 2030

HIGHWAYS

- Total retail opportunity for highway retail in India to reach USD 4.2 billion by 2030, from USD 0.1 billion in 2019

- Lease rental opportunity for airport operators projected to grow to USD 0.5 billion by 2030

- Government’s initiatives and increasing passenger momentum biggest drivers

BUS STATIONS

- Total retail/mixed-use development potential at bus stations projected to reach USD 0.9 billion by 2030, from USD 0.01 billion in 2019

- Lease rental opportunity projected to grow to USD 0.1 billion by 2030