Indian export is one of the victims of Sri Lankan, as the island nation battles out an unheard-of catastrophe with the citizens up in arms. India’s trade with Sri Lanka has almost come to a halt very recently, as escalating political and economic crises there have resulted in fresh uncertainties around payments. Indian exporters fear taking fresh orders from Sri Lankan buyers due to swelling default risks. As such, the order flow from Colombo has almost run dry.

Some exporters are apprehending a 30% drop in supplies to Sri Lanka in FY23 from a record $5.7 billion in the last fiscal. This is because authorities there have resorted to import curbs, limiting their purchases to only essential products, that, too, in limited volumes by using the credit lines extended by New Delhi to Colombo. However, the crisis is unlikely to have significant impact on India, given the limited bilateral trade value, a senior commerce ministry official opines.

Surprisingly, in April-May of this fiscal, India’s exports to Sri Lanka surged 55% year-on-year to $1.2 billion, as the island nation managed its imports using the lines of credit. But the situation changed for the worse now, as the credit lines are almost exhausted, said some of the exporters.

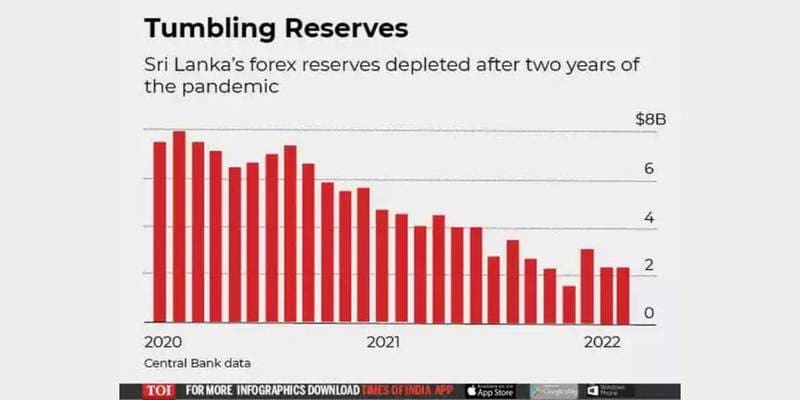

Sri Lanka is facing its worst economic turmoil since 1948, triggered by a foreign exchange crisis, which, in turn, led to a political crisis. The island nation has declared a nationwide state of emergency hours after President Gotabaya Rajapaksa fled to the Maldives. The country has been forced to minimise its imports due to almost-depleted forex reserves. This has led to civil unrest, as millions struggle to buy essential items.

Raja Shanmugham, president of the Tiruppur Exporters Association, India’s largest garment hub, says the bilateral trade has been hurt badly. “Only those companies that are headquartered in Tiruppur and have some production units in Sri Lanka are supplying raw materials like fabric to their facilities there. Otherwise, not much trade is happening.”A major engineering goods exporter, who has been supplying to Sri Lanka in large volumes in recent years, says, “We don’t know how to deal with the situation. There is a lot of political instability there now, which has magnified our difficulties. If the political instability persists for another few weeks, along with economic crisis, trade will crash even further.”

In April, Sri Lanka announced that it was suspending about $7-billion foreign debt repayment due for this year. Its total foreign debt stood at about $51 billion. According to Ajay Sahai, director-general with the Federation of Indian Export Organisations (FIEO), there is no denying the fact that there could be temporary setbacks for Indian exporters due to the situation in Sri Lanka. However, things may improve once political stability returns.Crisis-ridden Sri Lanka had zeroed in on seven categories of goods, apart from petroleum products, for sourcing from India this year, utilising the lines of credit that New Delhi has provided to Colombo. Sahai “at present, goods which are under SBI and Exim Bank’s line of credit are being exported to that country and they includekey raw materials for industry, pharma, fertiliser, food and textiles.

These products include essential food items, medicines, cement, textiles, animal fodder, raw materials for key industries and fertilisers. But some exporters fear supplies of even these products may be affected, given the political instability.Before the latest escalation of the crisis, Lankan importers were placing their goods requirements accordingly with suppliers here. Indian exporters were required to approach State Bank of India, which had signed an agreement to extend a $1-billion credit line to the island nation, for payment.

The island nation has been seeking additional line of credit to tide over the crisis. India has already provided $1.5-billion lines of credit to it since January. These include $1 billion for imports of food, medicine and essential items and another $500 million for petroleum products. On top of these, India’s assistance also includes a $400-million RBI currency swap and a deferral of a $500-million loan repayment.