1.OVERVIEW

Over The last 3 years, India has emerged as No.1 producer of both Cotton and cotton yarns.

However, its share in the global Textile and apparel [ T & C ]trade could not go beyond 3 to 3.5% ,due mainly to the rising competition from other key players like Vietnam, Bangladesh and China ,ofcourse. Two major and key reasons, as per our study, have been India s over dependence on Cotton based products while the world demand has been moving increasingly in favour of polyester and its blends with cotton , viscose,others. The other major reason has been India s uncompetitive price parity for most of T & C products vis a vis new but strong emerging competitors like Bangladesh, Vietnam and new garment making hubs of Ethiopia, Morocco, Kenya and others.To add to India s export woes, Covid 19 situation has put further breaks to growth of T& C sectors considering industry s present day low capacity utilisation [amidst ongoing Covi 19 pandemic] mainly due to huge disruptions in both domestic and export demand and,also due to ` serious and reverse` migration of industry s 100 million workers to their rural homes and,with no hope of immediate return till atleast one quarter more.

The situation in India s textile and clothing sectors is indeed dire, with exports down by almost 60% in April 2020;and with nearly 30-35% of smaller and medium size units expected to go under despite some semblance of financial support package to such MSME units by the govt. The key driver at present is drastically reduced retail and export demand, and its earliest revival of which can be the only savior for the industry.In terms of numbers, the market size of India s overall T & C sector is approx. $100 to 110 Billion,and of which only $ 40 billion accrues from exports,which owing to Covid 19 impact took a hit of $10.36 billion for April 2020 alone.In contrast, both Bangladesh and Vietnam too have over the last 10 years inched very closely to approx. $35 billion exports due to the unfair playing ground they got due to GSP+ access to Europe and, incase of preferential access of Vietnam into the USA markets. In addition, Korea and China have been supporting their capacity expansion with huge investments into the textile sector in both B.Desh and ,Vietnam.There is a dire need for India s FTA pacts with EC and Japan.

Despite having 2nd largest polyester fiber ,and its derivatives, production capacity in the world; India has been mired in the cotton intensive approach with political support to its farmers. Polyester has served as cash cow to the Govt. through higher loading of excise duty, GST etc;and which did not allow the domestic millers to go polyester intensive vis a vis Cotton. Globally, the share of polyester has already inched to 63 to 65% of all fibers consumed in the T& C sector; but for India ,it is the cotton that yet dominates fiber consumption with 55% share.It has impacted India making not much dent in non cotton and valued added textiles where polyester leads and has helped countries like China, S Korea, Indonesia and Turkey to surge past India which does have global size and more than adequate capacity for Polyester fiber, yarn spinning and filaments etc . In our expert view, this over affection for Cotton,and the jinx for higher govt tariffs on polyester value chain has to be broken down via increased production and export of polyester textiles from India in large volumes worldwide;and into newly emerging markets esp. Japan, South America and whole of Africa now coming up as single largest common market under the AcFTA consortium of huge 50 countries.

Sectorial working update

GARMENT INDUSTRY

As per the trade body,CMAI, only 22% garment units have resume working despite easing of lockdown by end of May. Most of the smaller and medium units, and to manage their survival,have changed over to making only masks and PPE products to address the domestic consumption for Covid-19 market. As per the Clothing Manufacturers Association ,these resumed factories are operating at an average 25% of their capacity. Considering that the ongoing Summer period is typically a low season for both domestic retail and exports, No substantial capacity enhancement can be expected for atleast next 1 to 2 quarters by when the migrant workers would not be able to fully return back to resume their economic activities to manage the income for homes.

The ongoing low demand season alongwith very low capacity utilisation of 95% of the garment making units in the country, has also impacted the working of fabric making mills as also the fabric dyeing processing units which are also suffering from absence of majority of migrant workers to major processing hubs of Surat, Ahmedabad,Coimbatore.

COTTON ,and YARN SPINNING SECTOR

Globally, ICE Cotton futures surge helped by a positive US federal jobs report rose more than 3% en route to its best week since February 2020, helped by a positive federal report that bolstered for an early economic recovery and in turn, demand for the natural fibre. This was reflected in Cotton contracts for July rising1.82 cent, or 3%, to 61.82 cents per pound.

However, cotton scenario does not augur well for Indian spinning mills.As per recent study by ICRA ,the govt `s politically mooted move of increasing the MSP price for raw cottons does not augur well for leading export segment of Yarn Spinning mills. Higher cotton MSP bodes well for increase in acreage eg. For cotton state of Punjab but unfavourable for spinners. The 5% increase in minimum support price (MSP) of cotton will lead to a rise in sowing of the crop, but is likely to be unfavourable for domestic spinning sector.This may encourage cotton sowing, despite a fall in cotton prices witnessed in the recent months.

RENEWAL STRATEGY & ROAD MAP [POST COVID 19 FUTURE]

RETURN OF MIGRANT WORKERS TO TEXTILE HUBS

With partial lift of lockout conditions, the textile and apparel industry are trying to re open and restart their factory and mills albeit with `minimal` market demand,both domestic and for exports.However , the capacity utlisation are as low as 25 to 35% of the installed capacities due mainly to return of the required complement of `workforce` which is migratory in nature and is staying back yet for sometime in their rural villages mostly in eastern provinces of UP, Bihar, Jharkahnd and Orissa.

Almost 4.5 to 5 million Textile industry workers had no option but to migrate to their villages amidst Covid crisis,and possibly 4o to 50% may not return for atleast next 4-5months.This will not allow the industry s capacity utlisation or output to go beyond 60-55% of installed capacity,even till end of 2020.

SUSTAINABILITY TO BE NEW DEMAND DRIVER

For most of the leading Fashion brands, `sustainability` is now the major future driver of the retail business and to be directed and driven by post Covid consumer preferances.

The Indian Texpreneurs Federation has launched a project called ‘India for Sure’ to develop a sustainability blueprint for textile units in southern state of Tamil Nadu. Its is clear that India s T& C sector has to now realign seriously with the global Sustainability theme especially to its cotton growing and fabric processing sectors.

NEW FTA AND TRADE ZONES TO BE NEW MARKET DRIVERS

India s textile and clothing sector, also has an immediate and dire need to conclude new FTA trade agreements especially with countries like Japan, with the EU towards helping India stay competitive in these markets vis a vis hot competition from B.Desh, Vietnam and others.

Finally, India s textile and apparel products need to move up in the value chain with value added products in Polyester fiber,and to new diversified markets of S.America,Korea and into newly formed mega common markets like ACFTA in Africa and Euroasia_Rusia common market zone.

In summary, the headwinds for India s textile and clothing industry will stay strong and hot for next 2 years; and need new rules of the game and new markets too.

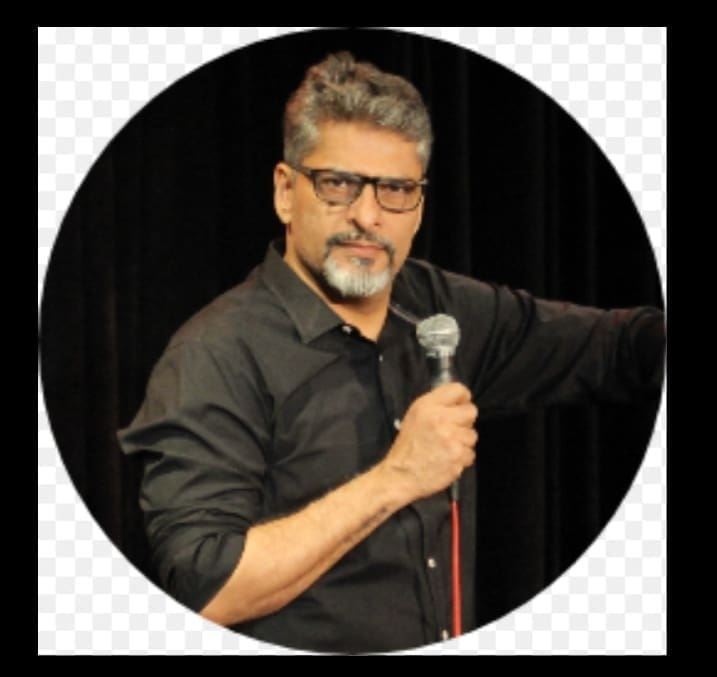

By,Munish Tyagi,

Internation Textile & Apparle industry consultant