Business situation and expectation are very good along the global textile value chain

In the first half of November 2021 the ITMF conducted the 11th ITMF Corona-Survey among more than 330 companies around the world in all segments along the textile value chain. For the fourth time since May, companies were asked the same set of questions about their 1) business situation, 2) business expectation, 3) order intake, 4) order backlog, and 5) capacity utilization rate.

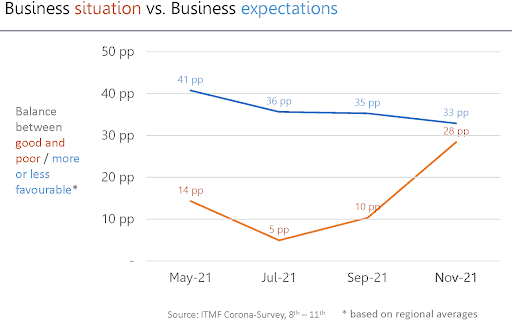

On average across all regions and all segments, the business situation has improved significantly since the 10th survey in September. The balance between companies with a good and a poor business situation jumped from +10 percentage points (pp) to +28 pp (see graph below). When it comes to business expectations in six months’ time (May 2022) the balance is +33 pp. This means that significantly more companies are expecting business to be more favorable than less favorable by May 2022. Nevertheless, expectations were slightly higher in the previous surveys.

A look at the different regions reveals that the business situation improved on average in most regions except for East Asia. Business expectations are optimistic in all regions.

As for the different segments the gap between the upstream segments – fiber producers, spinners, and textile machinery producers – on the one hand and the downstream segments – weavers/knitters, finishers/printers, and garment producers – on the other hand is narrowing.

As far as order intake is concerned the very positive situation (+40 pp) is the source for the above-mentioned very good business situation. Order intake expectations increased again from an already high level to +41 pp.

Order backlog has remained almost unchanged since May and is around 2.5 months. By nature, the textile machinery segment has on average a much longer backlog (6 vs. 1.5 months for spinners). The capacity utilization rate has increased slowly but continuously since May 2021, indicating that the supply chain disruption is still a big – but hopefully diminishing – concern.

For more information, please contact secretariat@itmf.org.