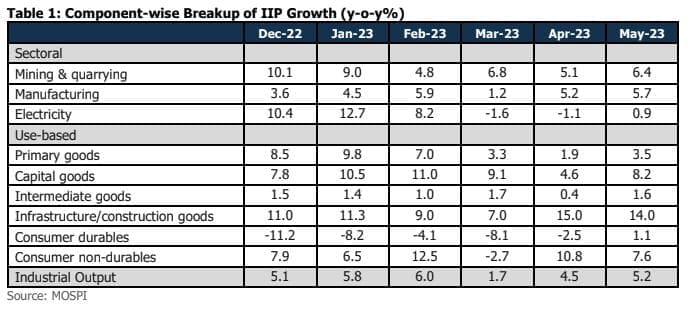

The growth in India’s industrial output accelerated to a 3-month-high of 5.2% in May 2023 from 4.5% in the

previous month. This encouraging performance during the month was anchored by healthy growth in the mining

and manufacturing sectors. Electricity output also picked up following a muted performance over the last two

months supporting the overall IIP growth. Within the use-based classification of industrial output, the highlight was

the improvement seen in the consumer goods segment (both durable and non-durable goods). However, a durable

improvement in consumption demand remains critical for overall industrial activity.

Exhibit 1: Index of Industrial Production (y-o-y%)

The output of the manufacturing sector grew by an encouraging 5.7% in May compared to 5.2% in the previous

month. Within the manufacturing sector, 11 out of 23 categories recorded growth in output on a year-on-year

basis. Among the major components of the manufacturing sector, output of basic metals (having the highest weight

of 12.8% in overall IIP) grew by an upbeat 9.6% compared to 10.2% last month. The impact of sluggish external

demand was visible in the subdued performance of sectors such as textiles (-3.7% growth) and wearing apparel (-

20.9%). Following a dismal performance in the last two months, growth in electricity output inched up to 0.9% in

May. Mining output grew by a healthy 6.4% in May compared to 5.2% in the previous month. Overall, the growth

in industrial output during the month was anchored by the strong performance in mining and manufacturing

segments.

Within the use-based classification, the performance of capital and infrastructure-related goods continued to stay

upbeat with a growth of 8.2% and 14% respectively. The Centre’s continued focus on capital expenditure has

boded well for these sectors. Going ahead, the RBI’s pause in the current rate hike cycle remains positive for the

pick-up in private capex. From the consumption perspective, output of consumer non-durables grew by 7.6% in

May, continuing with a healthy performance for the second straight month. Encouragingly, the growth in output of

consumer durables turned positive after a gap of six months rising by 1.1% in May.

Way Forward

The growth in industrial output remained encouraging in May with the noteworthy aspect being the improvement

in the consumer goods segment. Going ahead, a durable pick-up in consumption remains crucial for the overall

industrial activity as the sluggishness in external demand is expected to persist. The inching up of retail inflation

driven by an acceleration in food prices is concerning given that the recovery in consumption is underway. Also,

any weather-related disruptions could aggravate the risks to the nascent rural demand recovery.