Synopsis

In this report, CareEdge Ratings opines on the current state of the Indian Road Sector, the performance of road

projects under Hybrid Annuity Model (HAM) projects, the financial performance of major road developers and the

outlook for FY24. CareEdge Ratings analysed 235 HAM projects awarded between FY16 and FY22, totalling 10,000

km with an aggregate bid project cost (BPC) of ~ Rs 2.74 lakh crore and debt of ~ Rs 75,000 crore. Since execution

of projects awarded post March 2022 are yet to commence, same have been excluded. Of the sample, 31% of the

projects have become operational, 44% of the projects are under construction and 25% of the projects are awaiting

an appointed date till December 2022.

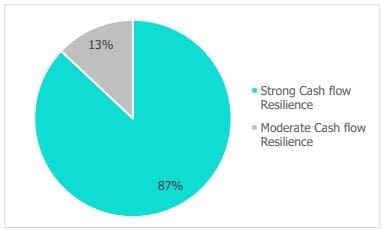

• Operational HAM projects with an aggregate debt of Rs 36,000 crore are expected to exhibit strong cash

flow resilience.

• Likely execution challenges foreseen for HAM projects with aggregate debt of Rs. 6,000 crore which form

part of weak sponsors’ portfolio awarded prior to FY20. Sponsors with moderate credit profiles likely to

face elevated execution and funding risks for their HAM projects, with equity commitment estimated at 3.7

times of cash accruals leading to increased debt levels going forward.

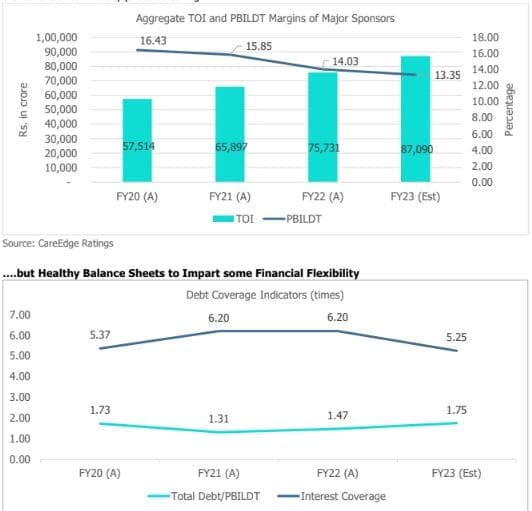

• During the last three years ending FY22, road developers focused on HAM projects have reported healthy

growth in their scale of operations albeit with moderation of around 240 bps in the PBILDT margins to 14%

owing to a disproportionate hike in input prices. With healthy order book position, the scale of operations

is envisaged to grow by around 15% in FY23, however, PBILDT margins might further moderate by 70 bps

due to intensified competition.

• The execution pace of National Highways Authority of India though stable at 30 km per day during FY23,

is lower than the Ministry estimates which is attributable to pending/delayed receipt of the appointed date

and surge in commodity prices. For FY24, pace of roads construction is expected to pick up gradually to

around 32-33 km/day. Despite the uptick, the execution pace shall remain lower than FY21 levels.

Exhibit 1. Operational HAM Roads Portfolio: Debt of Rs. 36,000 crore Exhibit Superior Cashflow Resilience Higher Cash Flow Resilience

• Favourable completion cost of 110-130% of BPC (supported by higher inflation).

• Low project leverage: Debt/BPC of ≤ 40%

• Repo linked term debt structure for few projects.

• Opportunity to unlock equity with fund raise of Rs. 9,000 – Rs. 11,000 crore as top up loans, stake sale, or InvIT.

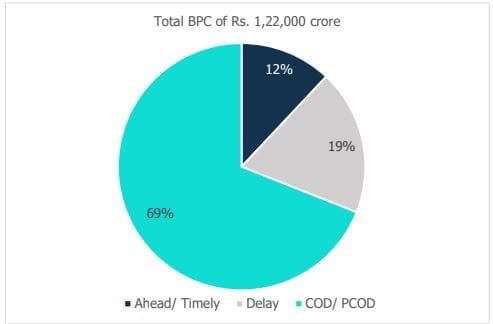

Exhibit 2. Satisfactory Project Completion Status for HAM projects: Analysis of project progress

60% of the delayed projects belong to weak sponsor and hence in CareEdge Ratings opinion, corresponding debt of around Rs. 6,000 crore is viewed to be at high risk. Termination or harmonious sponsor substitution can be probable remedial measures.

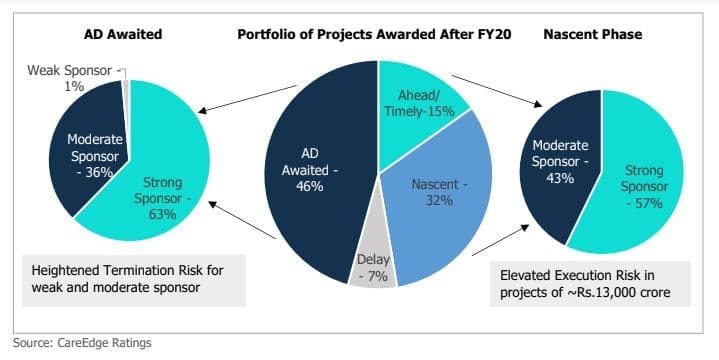

Exhibit 3. Mounting Execution Woes for Projects Awarded after FY20

During March 2020, NHAI relaxed bidding criteria for developers that have intensified competition with foray of

mid-sized sponsors possessing modest credit profiles.

The share of moderate and weak sponsors steadily increased from 22% (for projects awarded before FY20) to 36%(for projects awarded in FY21 and FY22). Correspondingly, the share of strong sponsors shrunk from 78% to 63%. CareEdge Ratings thus believes execution risk has heightened for projects with aggregate BPC of Rs. 13,000 crore due to the moderate credit profile of a new set of road developers, unprecedented surge in commodity prices (post bidding), funding risk (elaborated below) and relatively stricter terms of debt sanction. In view of intense competition in the sector, strong sponsors have shifted to structurally complex projects and forayed into newer geographies where competition is relatively moderate.

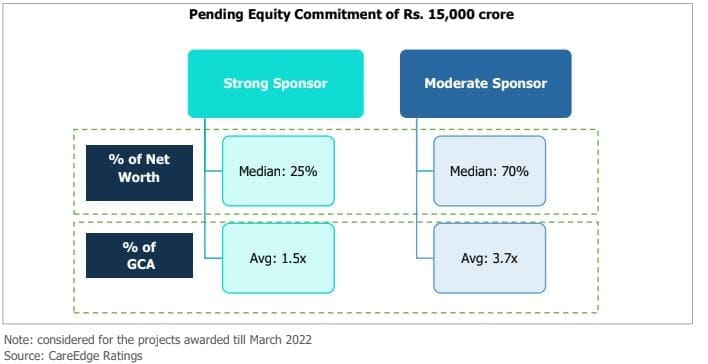

Exhibit. 4. Heightened Funding Challenges for Moderate Sponsors

Equity commitment stands higher at ~3.7x of cash accruals for moderate sponsors against a construction period of 2 years, necessitating increased leverage in the medium term. Financing risk further accentuates for sponsors with a large proportion of the under-construction portfolio.

Exhibit 5. Operating Margins to Moderate in FY23 Despite Buoyancy in Income for Road Developers….

While the input prices have begun to ease, according to CareEdge Ratings, heightened competition shall negate the benefit of commodity prices softening.

Comfortable leverage provides some financial flexibility, especially to strong sponsor for funding their impending equity commitments. However, with higher impending equity commitments, the debt levels are envisaged to rise especially for moderate sponsors lacking operational asset portfolios.

NH Projects: Execution target missed during FY23 The pace of award and execution pace for NH projects has remained stable during FY23. The execution pace though stable, is lower than the Ministry estimates which is attributable to pending/delayed receipt of the appointed date and impending execution challenges elevated by limited financial flexibility of sponsors with moderate credit profile.