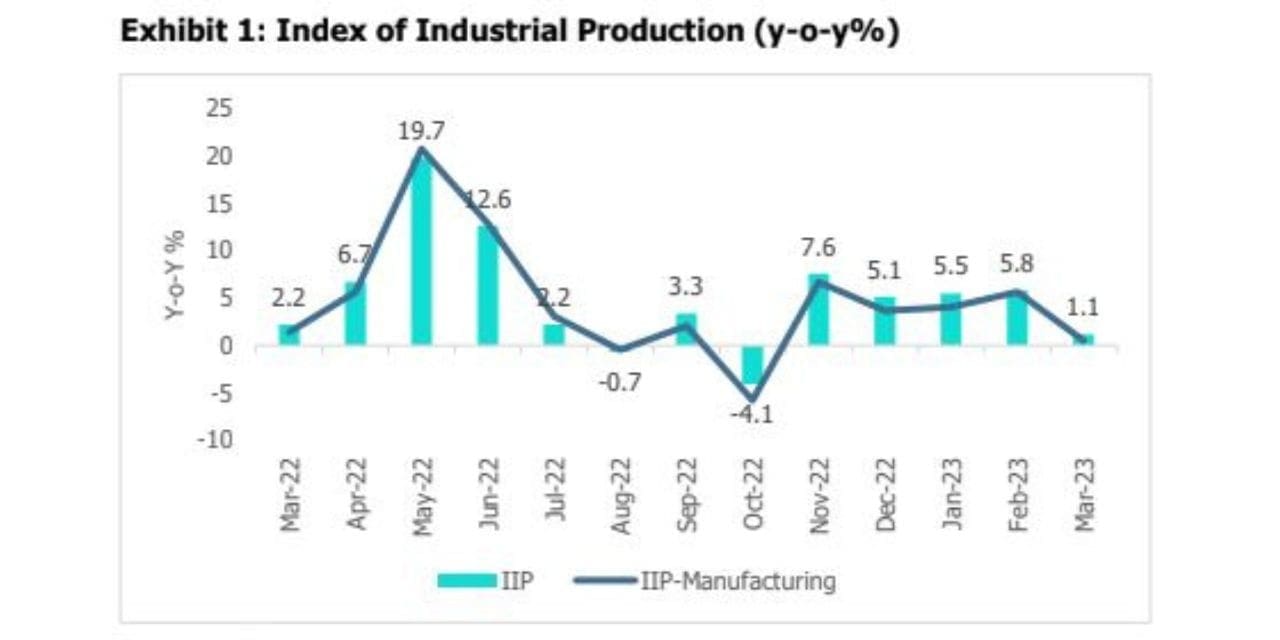

India’s industrial production grew by a dismal 1.1% y-o-y in March 2023 compared to 5.8% in the previous month.

This marks the slowest pace of output growth in the last five months. IIP growth was expected to moderate in March as indicated by the performance of the core sector (accounting for nearly 40% weight in IIP) which moderated to 3.5% in March Vs 7.2% in February. However, the moderation in IIP in March is higher than our estimate of 2.8%.

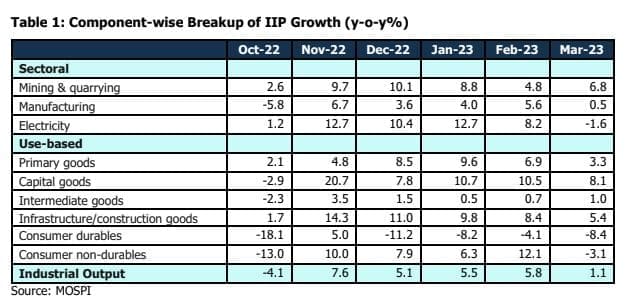

While the mining output recorded healthy growth, the manufacturing and electricity sectors were a drag on the

overall IIP growth. For the full fiscal year FY23, the industrial output has recorded a growth of 5.1% supported by

a favourable base and a rebound in economic activities.

Growth in manufacturing sector output eased to a five-month low of 0.5% in March. Within the manufacturing category, 13 out of the 23 categories witnessed a contraction in output in March when compared to the corresponding month of last year. Particularly, the export-intensive sectors such as textiles, wearing apparel, leather

& related products have consistently remained under pressure recording contraction on a year-on-year basis. It is

important to note that these sectors also happen to be labour-intensive in nature and hence weakness in these

sectors is concerning.

Within the use-based classification, an upbeat trend continued in the capital and infrastructure-related goods segment which recorded growth of 8.1% and 5.4% respectively. The Centre has demonstrated a strong commitment towards boosting capex in the economy. However, the states have lagged in matching the Centre’s efforts due to uncertainties related to revenue. The Centre’s strong capex focus and improving investment intent by the private sector are positives for the capex cycle revival in the economy. The consumer goods segment showed a disappointing performance with both consumer durables and non-durables contracting by 8.4% and 3.1% respectively. Growth in the output of consumer non-durables slipped into the contraction zone after showing a modest performance over the past few months. RBI’s consumer confidence survey (March 2023) pointed to an improvement in consumer sentiment towards non-essential spending with more than a third of the households expecting an increase in non-essential outlay over the next year. This should be supportive of the recovery in consumer durables going forward.

Way Forward

The deceleration in IIP growth in March is concerning. Specifically worrisome is the contraction in the consumer

goods segment. Going forward, it is very critical for the domestic consumption demand to show improvement,

given that external demand is likely to remain weak. Pick-up in investment demand will also be contingent on

continued revival in domestic consumption demand.