Study on mapping of human resource skill gaps in

India till 2022

• Current employment pattern

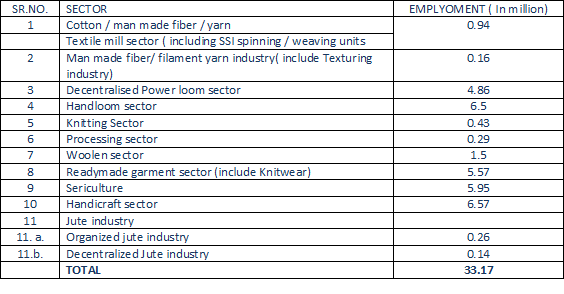

An estimated 33 million people are employed in the Textile sector in India3. This is expected to increase to 45 million by 2012. The Ready Made Garments (RMG) sector, which accounted for 17% of the employment, is estimated to contribute 25% to the total employment in the textile sector.

Employment in different textile sectors

Source: Planning Commission, IMaCS Analysis

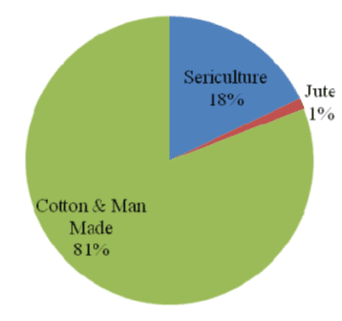

Cotton and man-made textiles account for more than 80% of the employment in the textile sector, as depicted in the following figure.

Share in Employment of different sectors

The employment in fabric manufacturing includes the handloom, weaving, knitting sectors and garmenting accounts for a major portion of the employment in the textile sector on account the labour intensive nature of operations. The share of employment in different activities in

the value chain is discussed later.

• Share of Women in Employment

It is estimated that out of the total number of persons employed in Handlooms, Handicrafts, and Sericulture, about 50% are women. There are more women in the household industry than in the registered small scale or cottage units. However, in the organised sector the percentage of women workers is extremely low, with the exception being garmenting.

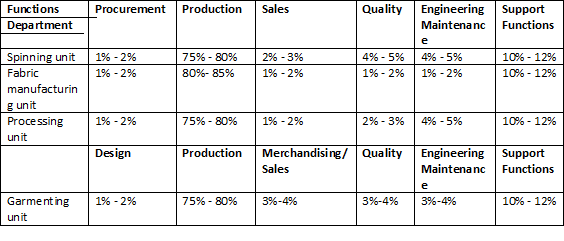

• Profile of human resource in different functions

The textile industry (except the spinning sector) is fragmented in nature on account of policy restrictions relating to labour laws and the fiscal advantages enjoyed by the small-scale units. The textile units mostly engage in job work (sub contracting) and hence a large portion of the employment is in the production activities. Also, the small units do not have explicit demarcation of functions for sourcing, sales, etc.

Functional distribution of human resource across key sectors

Source: Industry inputs, IMaCS analysis

As seen in the above table, majority of the workforce is involved in the manufacturing/production activities.

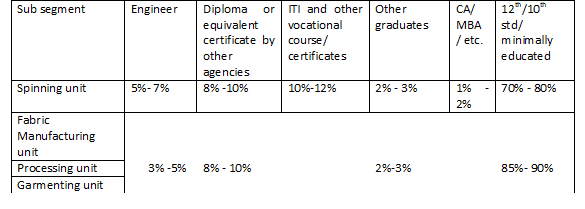

- Profile of human resource across various educational qualifications

The distribution of human resource by education levels is shown in the following table. Most of the human resource is minimally educated.

Distribution of human resource by education level

Source: Industry inputs, IMaCS analysis

- Profile of human resource employed in the textile and Clothing industry

The typical profile of people employed in production function, which is the dominant activity in the textile industry, is shown in the following figure.

• Skill Pyramid for the T&C industry

Given that the industry would required a varied profile of skill sets, the following figure presents an overview of the profile of skill requirements as derived from human resource requirements across different sectors of the T&C industry.

Skill Pyramid within the Textile and Clothing Industry

Skill Level:1 : skills which can be acquired with a short/modular and focused intervention and therby enhancing employability of those with minimal education . It account 85- 86% .

Skill :2 Skills which require technical training inputs, knowledge of complex operations and machinery, skills of supervision. It accounts 10-11 %

Skill :3 : skills which require long drawn preparation as demonstrated by acquisition of degree and involve highly technical people. It accounts 3-3.5 %

Skill 4 : : skills which are highly specialized involving research and design

The skill summary, captures where the textile and clothing industry stands relatively in terms of skills (a function of activity, educational requirements, and amount of ‘preparatory’ time required to inculcate a specific skill) as compared to all other industries.

‘Skill Level 1’, has the highest incremental requirement of human resources. It requires persons who are minimally educated, yet can handle simple and/or repetitive tasks (persons employed in activities such as basic machine operations, knitting, cutting, and stitching/sewing, etc.). Such skills can also be obtained in lesser time duration as compared to engineering or ITI courses. As many as over 15 million persons are required across skill levels 1 and 2 outlined above.

• Current Training/Education Infrastructure

The current training infrastructure is inadequate on both number of people trained and also the quality of training being imparted. Also, very few of the training initiatives are targeted at the shop floor level. The newly inducted workers learn through informal training and learning from the experience of the existing work force.

Training institutes available in India.

Textiles Research Associations (TRAs)

Power loom Service Centers (PSCs)

Indian Institutes of Handloom Technology (IIHT)

Weaver’s Service Centers (WSC)

Industrial Training Institutes (ITI) offering courses related to Textiles

Home Science Colleges offering Textiles & Clothing Courses

Apparel Training & Design Centres (ATDCs)

Institute of Apparel Management

National Institute of Fashion Technology

Sardar Vallabhbai Patel Institute of Textile Management

The availability of trained manpower is a key issue for the garmenting sector.

The ATDC, ITIs and NIFT annually train up to 50,000 workers. A few private sector players also provide training specific to the garmenting sector. A large portion of the requirement of human resource at the operator level is met by on the job training. Hence training at the operator level is a key gap. Acute shortage of skilled man power leads to poaching and acts as a detriment to spending on in house training initiatives.

- Emerging trends in skill requirements

Emerging trends in human resource requirements

- Technology

The changes in technology would significantly affect the profile of people involved. The share of shuttle-less looms in the Indian textiles industry is only 2-3% as against a world average of 16.9%, thereby indicating a low degree of modernization in the Indian weaving industry. Although the Indian spinning sector is relatively more modernized, around 60% of installed spindles are more than 10 years old and open-end (OE) rotors account for only 1% of total installed spindles. In the apparel sector, India has much lower investment in special purpose machines, which perform specific functions and add value to the product. Very few export establishments have invested in cutting machines or finishing machines. The low level of technology and government incentives like TUFS would drive modernization in the industry where as the high power costs would be a detriment.

The technological up gradation would necessitate the human resource to be trained in modern machinery and also greater in house spending on training. The shortage of labor and increasing wage rate would further induce greater automation which will lead to higher productivity. For instance, the operating hours per quintal of yarn have decreased from 77 to 25 on account of modernisation and would continue to fall. Also, the numbers of people involved in post spinning operations have come down on account of automatic cone winding machines.

The modern machinery would require skilled maintenance people who have the requisite knowledge of the same. Proper maintenance would be crucial as machine down time and costly spare parts would significantly affect the performance of the industry.

Quality Processes

There would be increasing focus and adoption of quality and environment related processes, such as: ISO 9001:2008, ISO 14001

Research & Development

The textile industry does not have R&D as a focus area. The industry would have to invest more in both process and product R&D to maintain product and cost competitiveness. This requires industry-academia collaborations as well as individual R&D efforts by the companies.

Labour laws

More flexible labour regulations will positively affect the industry. Currently, Textile and Clothing industry comes under the purview of Contract Labour Act, 1970 which prohibits contract labour for the work that is perennial in nature. The exporters find it difficult to manage the seasonal and order based volatility in demand on account of this. Change in the current regulations can lead to opening up of more employment opportunities. Also, the current regulations prohibit women from being employed in night shifts. Relaxation of the same with adequate safeguards can lead to more participation of women and also help in addressing the skill shortage in the industry.

Human resource related

Modernisation of technology would necessitate more technical skills for operators in the production and maintenance functions across the value chain of the textile industry. The sector also needs multi-tasking/multi skilling at the operator level. The human resource at the higher levels as well as in other functions like procurement would need to possess the knowledge of various types of machines and also keep abreast with the changes in technology.

The garmenting sector would be the key driver of the employment in the textile sector. Majority large portion of the human resource requirement will be for operators who have the adequate knowledge of sewing machine operations and different types of seams and stitches. Although, the industry will continue to have predominantly line system of operations, designer and high end fashion exports would necessitate “make through” system of operations which would require the operators to have the ability to stitch the complete garment. The availability of merchandising and designing skills would be crucial for increasing share in export markets and tapping the potential in new markets.

Regions which will drive human resource requirements

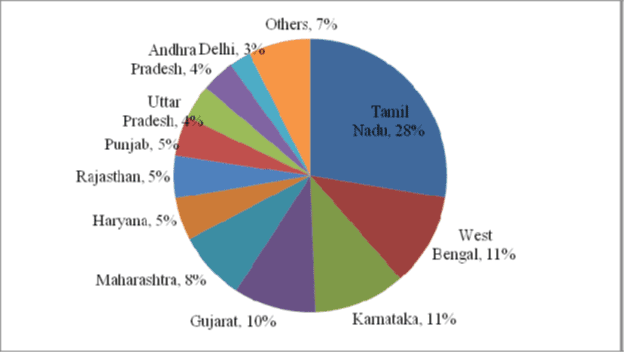

The major centres in India where this employment generation would take place are Tamil Nadu, West Bengal, Karnataka, Maharashtra, and Gujarat. The state of Tamil Nadu will account for around 30% of the employment in the textile sector.

Share of various states of employment in the textile sector

Source: Annual

Source: Annual Survey of Industries, IMaCS Analysis

The poor performance of the industry in the recent past has resulted in the sector not attracting new investments. The cluster development activities of various organizations have not found takers and hence new clusters do not appear likely at this point of time. However,Andhra Pradesh is a likely future destination for new investments, especially in the garmenting sector with the establishment of Apparel Parks. The government initiatives of providing power at a cost of 2 Rs per unit will be a key factor in attracting investments in spinning sector. Also, the state has surplus cotton and would result in lower logistics cost. Availability of raw materials and low power costs will also attract investments in the downstream activities like fabric manufacturing, processing and garmenting.

The scheme of integrated textile parks and various SEZs would also affect the regions availability of labour. States like Uttranchal necessitate that most of the labour force in the units operating in SEZ should be local.

The states of UP, Bihar and Orissa etc would be key catchment areas to meet the labour requirements. Already the spinning sector in Tamil Nadu is seeing more and more influx of labour from these states as the current wage rates in the states are very high.

Environmental concerns would affect the processing sector. The effluent treatment requirements might see units shifting to coastal areas as marine discharge requirements are less stringent.

Projected Human Resource Requirements in the Textile & Clothing Sector

In this section, we shall review the projected human resource requirement in the Textile and Clothing sector based on the projection of industry size.

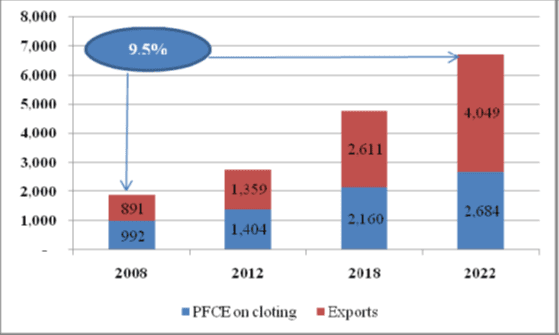

• Projected Size of the Textile and Clothing Industry

It is estimated that the PFCE on clothing will grow at a CAGR of 7.5% between 2008 and 2022. Based on projected growth of GDP and exports, we expect that the exports of textiles will grow at a rate of 11% to 11.5%. Thus, the overall T&C sector will grow at a CAGR of 9.5% to a size of Rs. 6,730 billion. Out of this, the share of exports is expected to increase from just under 50% currently to about 60% in 2022.

Source: IMaCS analysis

Projected human resource requirement

While analysing the human resource requirement, we have categorised the overall Textile and Clothing sector as follows:

1. The Mainstream Textile and Clothing sector – comprising of Spinning, Fabric Manufacturing, Fabric Processing and Garmenting.

2. Other related industries such as:

a. Handloom

b. Woolen

c. Sericulture

d. Handicrafts

e. Jute.

While we expect the human resource requirement in the Mainstream sector to be closely related to market driven textile and clothing industry growth, the human resource requirement in areas such as handloom and handicrafts would have to be supplemented by initiatives from the Government and Industry. The addition of human resource into these other sectors would be at a much lower rate as compared to the Mainstream sectors due to need for significant support for earnings, scope for enhanced technology intervention and automation as compared to current levels, the need to add value, and attractiveness of the sector among the human resource supply.

Keeping in mind the above factors and the growth of the industry, we have projected the human resource requirement for the T&C sector. It is expected that the overall employment in the sector would increase from about 33 to 35 million currently to about 60 to 62 million by 2022. This would translate to an incremental human resource requirement of about 25 million persons. Of this the Mainstream textile sector has the potential to employ about 17 million persons incrementally till 2022.

Reference: NSDC ( National Skill Development Corporation)

Website : https://www.nsdcindia.org