The global direct thermal printing films market is expected to be valued at US$ 219.76 million in 2023. The product demand is anticipated to be driven by the expanding use of POS terminals in warehouses and retail stores.

A promising business environment due to amended government policies and mounting domestic consumption for pharmaceutical and food and beverage products in South Asian countries. The demand for direct thermal printing films is projected to grow at a CAGR of 4.1% between 2023 and 2033, totalling around US$ 328.44 million by 2033.

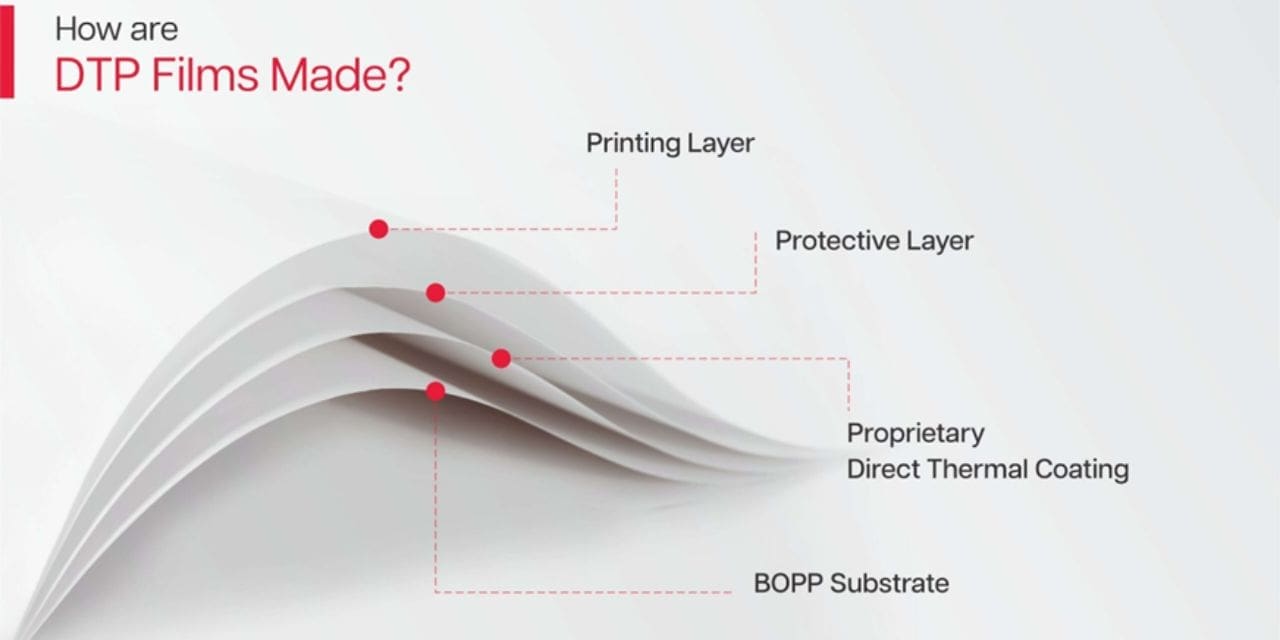

According to Future Market Insights, direct thermal printing films are BOPP films with a proprietary coating that enables image/impression formation on the film upon contact with the print head of the thermal printer. A protective layer is generally applied to protect the coated surface from mechanical abrasion, climatic factors, chemical products, etc. The film thus offers good scuff & water resistance.

The film also lends an excellent paper-like matte finish and produces a dark image on printing while consuming limited energy during the printing process. It is used for many applications like information labelling (airport baggage tags), POS weight, and price labelling.

Direct thermal printing films are highly resistant to heat, water, UV light, chemicals, etc. As a result, the market for explicit thermal printing films has seen substantial growth over the forecast period.

Direct thermal printing films are easily compatible with various printing technologies such as flexography, letterpress, offset, screen printing, gravure, etc. Explicit thermal printing films are mainly manufactured from polypropylene, polyethylene, polystyrene, etc.

Key Drivers Underpin Direct Thermal Printing Films Industry Expansion

Growing Demand for Barcodes Labels in Warehouses & Airports for Luggage Tracking Acts as a Primary Growth Driver

Barcodes manufactured from direct thermal printing films are used in airport bags, shipping, logistics, etc. The increasing need for safe and secure transport and goods logistics positively impacts the market for direct thermal printing films over the forecast period.

Direct thermal printing films are highly resistant and tough. As a result of this, these films have a relative advantage over the usage of other films in thermal printing.

The heat sensitive nature of direct thermal printing films is driving the growth of this market. Direct thermal printing films are cost-effective solutions compared to other types of films and are the few factors increasing the development of the direct thermal printing films market.

Novel product launches by prominent players are increasing the demand for thermal printing films. For instance, In June 2022, Cosmos Films, a well-known name in the specialty films industry for flexible packaging, labeling, and lamination applications as well as synthetic paper, re-launched BOPP-based Direct Thermal Printable (DTP) top coating film with a proprietary coating that enables the formation of an image or impression on the film upon contact with the heated print head of the thermal printer.

Few Challenges in the Direct Thermal Printing Films Industry

Significant Damage from Sunlight May Impede the Market Growth

Despite several benefits, the direct thermal printing films market also witnesses challenges, restricting market growth over the conjecture period. For instance, the use of plastic in direct thermal printing films cannot withstand exposure to sunlight after a long time. As a result, this needs to be replaced in a couple of months, restraining the direct thermal printing films market.

Region-Wise Insights

North America Holds a Significant Position in the Global Market

Regarding regional platforms, North America holds a significant market share in the direct thermal printing films market. The region is expected to accumulate a 23% share in 2023 and is projected to maintain its lead over the forecast period due to its preference for printing by thermal label manufacturers. The United States & Canada account the higher regional revenue contribution.

Increased industrial and manufacturing capacities in countries such as Chile and Peru is estimated to increase warehousing activities, thereby increasing the demand for thermal paper in labels and tags.

The region has witnessed tremendous growth in the retail and logistics industry segment, coerced by renowned market players like FedEx International, A.P Moller- Maersk, C.H. Robinson Worldwide Inc., and United Parcel Service of America, Inc.

These corporations are concentrating on market acquisitions, which helps expand their market reach. For instance, in March 2020, C.H. Robinson Worldwide Inc. announced the acquisition of the outstanding shares of Prime Distribution Services, a retail consolidation services provider in North America, for US$ 222.7 million.

Performance of European Direct Thermal Printing Films Market

According to Future Market Insights, Europe is expected to provide immense growth opportunities for direct thermal printing films, accounting for 16% of overall demand in 2023. This market growth is attributed to the accelerating adoption of thermal paper in the region in various end-uses, such as supplement packaging and labelling, and the gaming industry is expected to help the market growth in the area.

The ever-increasing focus on sustainable products in Europe is anticipated to affect the production and use of thermal paper in the region as manufacturers focus on alternative production methods.

As per the recently published research report by Frontier.org, nearly 100 million tons of foods are wasted annually in the EU, almost 30% of the agri-food supply chain, which leads to substantial environmental impacts (high carbon food print, and blue water footprint, vain land use, etc.). Moreover, inaccuracies in, or misunderstanding of, food date labels are estimated to cause over 20% of the avoidable disposable of still-edible food.

The effective use of direct thermal printing films on food products may reduce food wastage. In addition, the regulations set by European governing bodies is estimated to help adopt eco-friendly coatings, such as powder and waterborne, in producing thermal paper.

Growing Advanced Technology Up surging Asia Pacific Market Size

As per the recent analysis by Future Market Insights, Asia Pacific is anticipated to be the higher-growing region over the forecast period. Asia Pacific region is expected to register the highest growth for the direct thermal printing films market over the forecast period owing to recent spending in the printing industry of this region.

Another growth prospect propelling the regional market is the increasing expansion of retail chains in the region, backed by the rising consumer preference for easily accessible consumer goods and increasing innovations in thermal printing technology.

In October 2021, Fujitsu launched an all-in-one thermal printer. The company is looking to target gaming, logistics, transportation, and parking markets with the new thermal printer.

The flourishing market for FMCG goods in emerging economies has led to an expansion in the production capacities for these goods. Consequently, it piloted an upsurge in the number of transactions at retail stores. Such aspects have directed a significant build-up in demand for thermal paper to produce labels, tags, and POS receipts, boosting the market for thermal paper.

Competitive Landscape

Leading Players in the Global Market

In July 2022, Koenig & Bauer and Celmacch Group, one of the leading manufacturers of high board line flexo presses and rotary die-cutters for the corrugated board industry, signed a contract to collaborate on the development and marketing activities in the growth market for corrugated board.

In October 2022, the ARMOR Group announced the acquisition of International Imaging Materials Inc. (IIMAK). The combined thermal transfer activity is estimated to be called ARMOR-IIMAK, with consolidated revenues of more than US$ 400 million, firmly establishing it as the global market leader in the design and product of thermal transfer ribbons for printing variable traceability data on labels and flexible packaging.

In June 2021, Cosmo Films, a manufacturer of films for packaging, labelling, and lamination applications, expanded its range of direct thermal printable (DTP) products to include standard DTP films, top-coated DTP films, high-temperature DTP films, and DTP paper.