The global nanocellulose market size is set to reach US$ 474.8 million in 2023. Between 2023 and 2032, global nanocellulose sales will thrive at 19.1% CAGR. Total market valuation at the end of 2033 is forecast to reach US$ 2,725.5 million.

In 2022, the worldwide nanocellulose market value crossed US$ 398.4 million. Burgeoning demand for nanocellulose across various industries will drive the global market forward.

In recent years, rising environmental concerns due to high usage of non-renewable petroleum-based materials have prompted people to look for sustainable bio-based materials. This has put nanocellulose market into limelight.

Nanocellulose has emerged as an ideal alternative to various synthetic materials. This is due to its unique properties which include high surface area, excellent mechanical strength, tunable surface chemistry, biodegradability, and renewable nature.

A lightweight solid substance derived from plant matter which comprises nano cellulose fibrils is known as nanocellulose. Nanocellulose is generally derived from the most abundant natural polymer on earth i.e., cellulose.

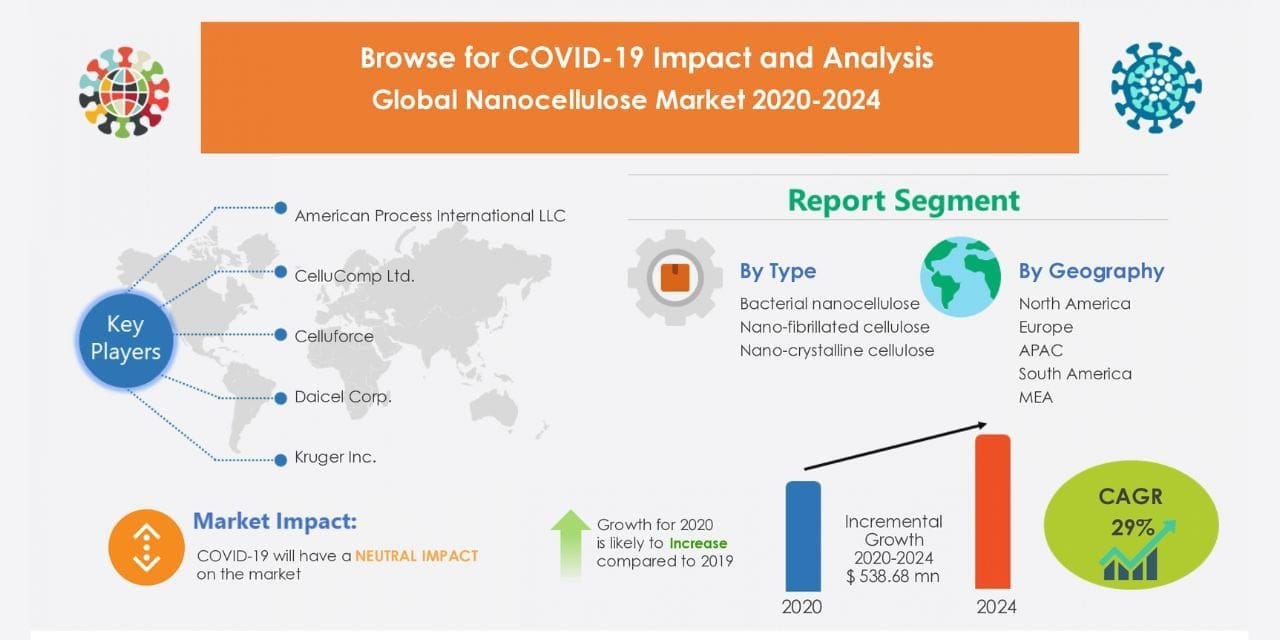

There are generally three types of nanocellulose that are being used across various industries. This includes cellulose nanofibers (CNF), also referred to as nanofibrillated cellulose (NFC), bacterial nanocellulose, and cellulose nanocrystal (CNC).

Nanocellulose consists of extremely small nanoscale fibers or particles with high tensile strength, making it an ideal material for various applications. Its properties, including optical transparency, low thermal expansion, and high mechanical strength, make it suitable for electronics applications.

Similarly, its biocompatibility, non-toxicity, scalability, and unique properties make it an attractive material for biomedical applications. This includes tissue engineering, drug delivery, and personalized medicine.

Growing demand for sustainable products with better features is likely to bolster nanocellulose sales through 2033. Rapid expansion of packaging industry coupled with rising need for environmentally & sustainable friendly packaging solutions will foster market development.

Widening applications of nanocellulose in paper industry will boost the global market. Nanocellulose is being increasingly used in paper manufacturing to enhance the fiber-fiber bond strength. It is also gaining popularity as a barrier in grease-proof type papers.

Nanocellulose enhances the mechanical properties of resins, rubber latex, starch-based matrixes, etc. As a result, it has become a suitable material for reinforcing plastics and other composites.

Nanocellulose has also become an ideal low-calorie replacement for carbohydrate additives in various food items. It is useful for manufacturing wafers, fillings, soups, gravies, etc. Thus, growing applications in food industry will elevate nanocellulose demand.

Widening applications in healthcare, pharmaceutical, and cosmetic sectors will create growth opportunities for nanocellulose manufacturers. Further, growing usage in electronic devices and textiles will trigger nanocellulose sales.

Which Factors are Shaping the Market for Nanocellulose?

The growth of the nanocellulose market can be attributable to a variety of reasons. This includes rising global demand for environmentally friendly and sustainable materials.

As customers become more environmentally concerned, there is an increasing demand for environmentally friendly products, and nanocellulose provides a feasible alternative.

Because of its remarkable mechanical properties, biodegradability, and non-toxic nature, it is an intriguing option for traditional materials such as plastics and metals. Its distinct qualities make it a great material for environmentally friendly and sustainable goods in industries such as packaging, textiles, building, and electronics.

Another factor driving the market is increasing government regulations on the use of non-biodegradable materials. Governments around the world are implementing regulations to reduce plastic waste and encourage the use of sustainable materials.

The use of nanocellulose in various industries, such as packaging, can help reduce plastic waste and offer a more sustainable alternative. The versatility of the product has also made it a promising material in the development of advanced technologies, such as nanocomposites, nanoelectronics, and biomedicine, further driving its demand.

The growing trend of startups in the market is driving innovation and growth in the industry. New startups focus on developing new applications for the material, customizing it to meet specific needs, and creating new business models to cater to changing market demands.

They are also developing bio-based materials for use in the automotive and construction industries and medical devices that mimic the properties of human tissue, among others.

By developing new applications and customizing the material to meet unique needs, startups are increasing demand and profitability in the nanocellulose industry.

What Factors are Limiting Market Expansion?

The limited commercialization of nanocellulose production is hindering the market growth of this promising material. Despite its potential applications in various sectors, including packaging, textiles, construction, and biomedicine, the commercialization of these applications remains limited.

The lack of standardized and scalable production processes is one of the main reasons for this limited commercialization. The production process is complex and involves several stages, such as raw material pretreatment, chemical or mechanical treatments, and drying.

The absence of standardized production processes and quality control measures is a significant hindrance to large-scale production and limits the material’s commercialization potential.

The limited commercialization of the product can also be attributed to the lack of awareness and understanding of the material’s properties and potential applications. As a relatively new market, certain potential customers are not aware of the unique properties and benefits of nanocellulose. This is slowing down demand for nanocellulose-based products and subsequently limits the market expansion.

Overcoming these challenges by developing standardized production processes and increasing awareness of the material’s unique properties could help unlock the full potential of the product and drive its market growth.

Why is the United States Considered a Key Market for Nanocellulose?

Rising Applications of Nanocellulose in Pharmaceutical & Biomedical Sectors to Boost Sales in the USA

North America, spearheaded by the USA, commands a significant market share of around 25% in the global market. This is attributable to the rising commercialization of low-cost production facilities for the product and considerable investments in research & development to develop novel applications.

Canada is rapidly emerging as a leading producer of nanocellulose, while the USA has positioned itself as the primary consumer in various industries.

As per Future Market Insights, North America market is set to thrive at 18.1% CAGR through 2033. The United States will hold a prominent share of 17.7% of the global nanocellulose industry in 2023.

Rising usage of nanocellulose in pharmaceutical and biomedical applications will drive nanocellulose demand in the USA. Similarly, growing popularity of nanocellulose in packaging sector is likely to boost sales.

Competitive Landscape

Nippon Paper Industries Co. Ltd., Sappi, CelluForce Inc., Anomera Inc., and GranBio are among the leading manufacturers of nanocellulose.

The nanocellulose market is evolving due to the growth of start-ups that are driving innovation, customization, and new business models aligned with the increasing demand for sustainable materials.

These start-ups are developing new applications for the material, such as bio-based materials for the automotive and construction industries, and medical devices that mimic human tissue. Further, they are exploring circular economy models to create a more sustainable and profitable future for the market.

Key Developments:

In March 2022, final acceptance of its first commercial Sunburst (CNC) unit was received by Sweetwater at the Sweetwoods project in Tallinn, Estonia.

In July 2022, Anomera, Inc. started production of CNC at its 170 tpy carboxylated CNC facility in Canada.