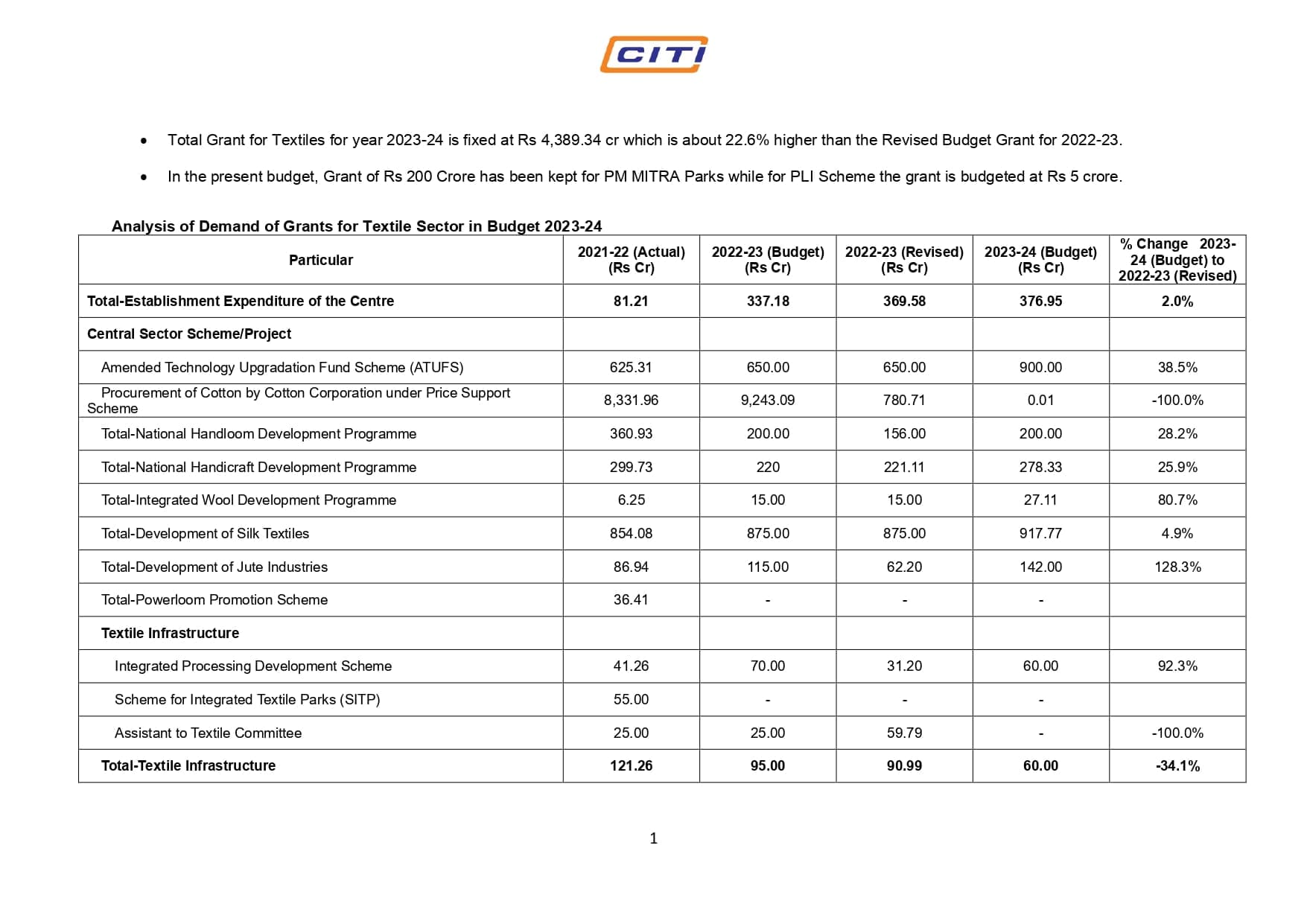

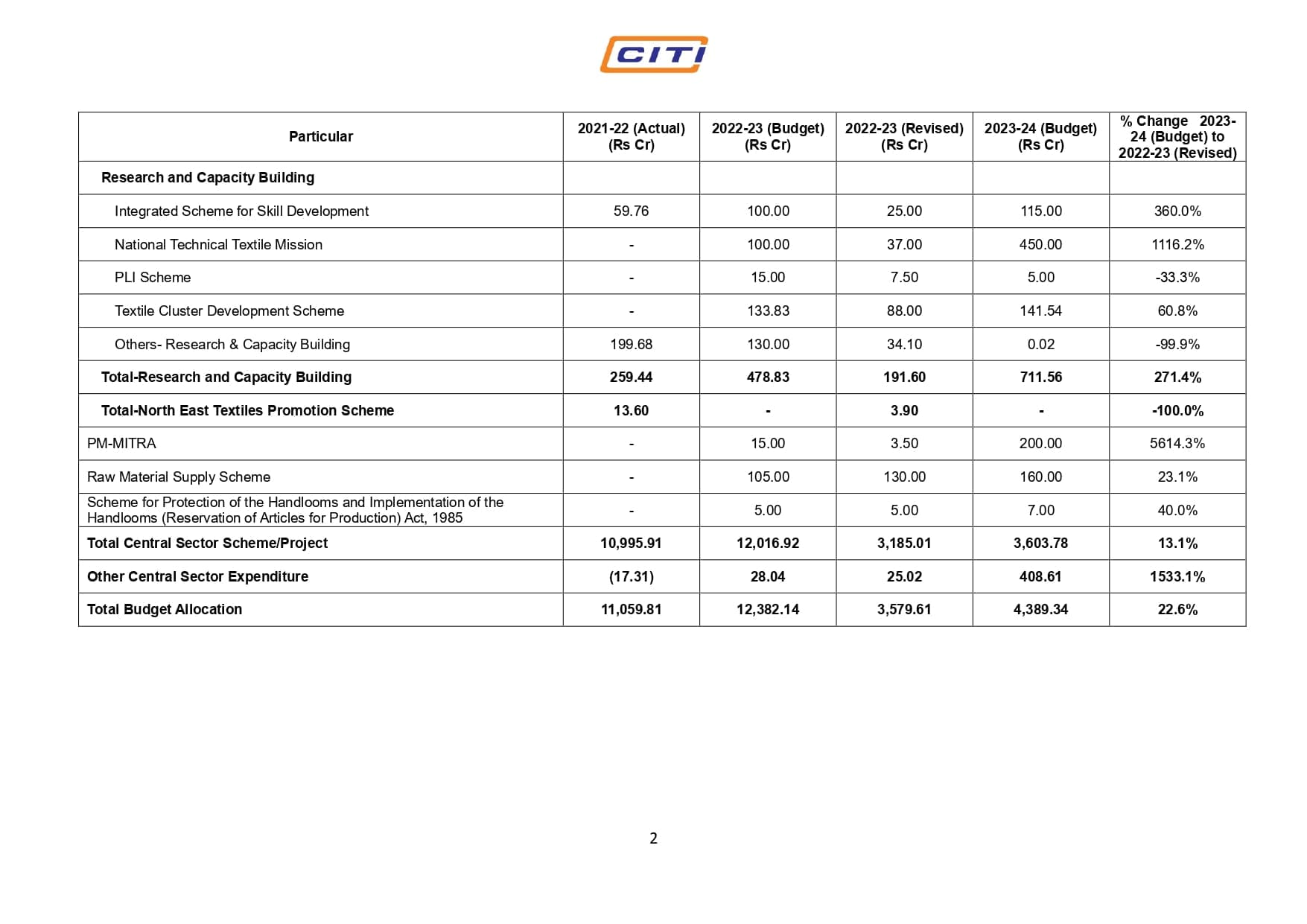

- Total Grant for Textiles for year 2023-24 is fixed at Rs 4,389.34 cr which is about 22.6% higher than the Revised Budget Grant for 2022-23.

- In the present budget, Grant of Rs 200 Crore has been kept for PM MITRA Parks while for the PLI Scheme the grant is budgeted at Rs 5 crore.

Union Budget 2023 has been received positively by the textile industry with a number of measures aimed at supporting its growth. The Finance Minister Nirmala Sitharaman announced the adoption of a cluster-based and value chain approach through public-private partnerships (PPP) to enhance the productivity of extra-long staple cotton, a niche product highly in demand in the industry.

The budget also introduced a ‘Skills India’ digital platform to help the MSME sector, including the textile industry, with further growth. Income tax benefits for start-ups and the simplification of processes with the introduction of centralization of IDs for businesses as unique identifiers were other measures that received positive attention from the industry.

In addition, assistance packages were introduced for traditional artisans and craftspeople, who are an integral part of the MSME value chain and play a crucial role in the production of high-quality products.

Navin Rao, Co-founder, of The Kaftan Company, said, “The overall budget this year has been presented with much optimism and growth-related initiatives. As an entrepreneur, I am happy to see a few key benefits supporting MSME enterprises such as ours, including a ‘Skills India’ digital platform to help the MSME sector with further growth. Income Tax related benefits for start-ups that can further innovative and future solutions for the country as well as the simplification of processes with the introduction of centralization of IDs for businesses as unique identifiers.”

“As an apparel manufacturer, I am especially pleased to see assistance packages introduced for traditional artisans and craftspeople. They are an integral part of the MSME value chain and must be supported with this initiative. I believe that with this initiative, the quality, scale, and reach of products made by these skilled workers reach new heights,” He continued.

Talking about the Green Growth Mission, Mr. Pratik Gadia, Founder & CEO, The Yarn Bazaar, said, “The green growth mission will help the textile industry to get quality raw material. Also, being one of the biggest polluting sectors, initiatives such as bio inputs research centre, and cluster-based approach with public private partnership model will help the textile sector to grow as far as cotton and other natural crops are concerned.”

“Adoption of AI and opening up specialized resource centres will educate the youth of the country, and we have already seen AI in cotton farming. A lot of changes will be seen in the textile industry by integrating AI in the textile industry in the coming times,” he said further.

The reaction from the retail industry towards the Union Budget 2023 is mixed, with some industry leaders seeing it as an opportunity for growth while others expected more direct support measures.

Dinesh Pratap Singh, Co-Founder, WoodenStreet, said, “The new scheme announced by the Finance Minister falling under PM Vishwakarma Kaushal Samman for artisans and craftsman will enable them to improve the quality, scale and reach of their products, integrating them with the MSME value chain. This will further include financial support and also access to advanced skill training, knowledge of modern digital techniques, brand promotion, linkage with local and global markets, digital payments, and social security. It will greatly benefit the Scheduled Castes, Scheduled Tribes, OBCs, women and people belonging to the weaker sections.”

Dr. Deepak Jain, Founder, The Fragrance People, said, “The ongoing make in India initiative, including lower import duties on raw resources used in electronics, cameras, TV panels, and other products, should help increase direct and indirect job creation. This will aid in the promotion of easier credit access, infrastructure development, and increased opportunities for employment benefits. Further reductions in personal taxation slabs should help increase middle-class disposable income with a multiplier effect, boosting the economy and retail sector.”

Ridhima Kansal, Director, Rosemoore, said, “The union budget has announced a fresh corpus of INR 9000 Crores for guaranteed credit support for the MSME sector. This is a very positive step towards supporting the MSME segment, which is one of the critical cogs in the overall economic growth of India. There are close to 6 crore micro, small, and medium enterprises in India and offering them support is not just conducive for the sector but will also foster growth in the overall economy.”

Mr. Sanjay Vakharia, CEO of Spykar Lifestyle, Said, “The proposal in increase spends on capex will keep the wheels of growth in motion. The government’s efforts on bettering yield of cotton productivity will help in keeping volatility in cotton prices at bay. The reduction in personal income tax slab and eliminating deductions will help in bringing in more spends and marginally higher dispensable incomes. Currently we are facing tepid demand due to recessionary pressures; both overseas and in our country. We therefore welcome the budget this year as it is focused on growth, economic progress, modernization and sustainability”

Durga Prasad Chalavadi, Chairman and Managing Director, Sai Silks Kalamandir Ltd, Said, “The Budget 2023 proposals will significantly increase consumption. It has put more money in the hands of the people through relief from Income Tax, which is a very great development. A reduction in income taxes should increase the disposable income of households and promote consumption. All facets of society – women, the middle class, and professionals alike – will profit from the government’s commitment to promoting growth and welfare-oriented measures.”

Mr. V. Srinivasan, Chairman, eMudhra, said, “The emphasis on digitizing India in the Union Budget is commendable. The vision for Amrit Kaal includes a technology-driven and knowledge-based India. The proposed National Data Governance Policy will help in boosting data led development and encourage technological growth. The push to create Centers of Excellence for AI will help create a digital ‘Aatmanirbhar’ India and promote AI based solutions across sectors. The introduction of Entity Digi Locker for business enterprises will facilitate online storing of documents which will accelerate the digital transformation of the country.”

Mr. Manish Bhatnagar, Managing Director, SKF India Ltd, said, “The budget is progressive and growth-oriented given the focus on capital expenditure, green mobility, clean energy, and agriculture. It further defines the roadmap for achieving net-zero emissions by 2070. At SKF, we support India’s aspirations of inclusive and sustainable growth, and we remain committed to achieving net-zero emissions across all our production facilities by 2030 and across our supply chain by 2050. We will continue to develop intelligent and clean products and solutions to meet the evolving needs of industries and further support their decarbonization efforts. Further, the budget will also help the Indian economy reap benefits from local manufacturing, infrastructure development, and technology advancements and will firmly position the country on the path to accelerated growth.”

Mr. Nikhil Agarwal, President-CJ Darcl Logistics said, “This is the first Budget of Amrit Kaal, and we believe that this is a budget aimed at fostering growth. We are sure that the huge rise in capital expenditure by 33% will have an incremental effect on the overall growth of the economy. Infrastructure sector is the backbone of any economy, and the government has been pushing for the sector’s growth for its multiplier effect and linkage effects in terms of job creation. Infrastructure and development are among the seven priorities of the Budget 2023. The newly announced one hundred critical transport infrastructure projects will help the country to ensure energy and food security as these are critical for India as it targets to become the third largest economy in the world in the next 6-8 years. The government has also decided to inject 2.40 lakh crore in railways in order to derive the positive outcome on environment sustainability.”

“As Budget 2023 focuses on promoting coastal shipping, it will play a critical role in the economy’s competitiveness, expansion, and long-term sustainability, which is an under tapped sector at the moment. Also, the announcement of 100 Labs for developing applications using 5G services will bring in changes across the transport sector including increasingly smart and efficient logistics and improved urban transportation with the implementation of Mobility as a Service (MaaS) platforms. The Budget 2023 has demonstrated a good balance between today’s needs and the future’s demand,” he continued.

Shiprocket’s CEO & Co-founder, Saahil Goel, said, “The government’s focus on empowering the MSME sector with the revamped credit guarantee scheme is admirable. We’re also glad to witness infrastructure & reaching the last mile being included in the 7 priorities of this year’s budget. The budget’s focus on transportation and infra projects with the Urban Infra Development Fund will surely give a boost to the logistics sector. The revamped credit guarantee scheme for MSMEs and the Rs 9,000 crore infusion amount in the corpus would further push the entrepreneurial spirit of the country.”

While welcoming the Union Budget, Shri T. Rajkumar, Chairman, CITI termed the budget as pragmatic and futuristic laying strong foundation for India @100! He said, “The Indian economy is a bright star in the global arena with the highest economic growth (7%) among major economies. The government’s wide range of reforms and sound policies have led to consistent growth in the Indian economy and the textile sector.”

Aditya Balani, Co-founder, LetsDressUp, said, “The budget has been well-balanced overall, but some concerns still haven’t been addressed for Startups like us. One of the key concerns for Startups like us is the inverted tax structure. We pay ~18% input tax but get only ~5% output tax. This creates a net input of over 10% which is not credited to us immediately as cash, thus leading to working capital issues. Secondly, the taxation on startup investments is significantly larger than on investments in public markets. It will really help the startup ecosystem if there is parity between the systems. India is a market with potential for disruption and innovation as there is an extensive reservoir of youngsters who would like to explore the path of entrepreneurship. Ease of business and ironing out these concerns will fast-track our economy and industry toward growth”.

However, the industry is concerned to note the increase in import duty of textile machinery to 7.5%, as indicated in the last budget. This will impact the new investments planned in this sector. Addressing the issue Shri Rajkumar said, “The increase in import duty of textile machinery will impact planned investments in this sector. The industry is concerned about the increase in import duty of textile machinery but appreciates the efforts to enhance the ease of doing business.”

Mr. Ravi Sam, Chairman of The Southern India Mills’ Association (SIMA), has expressed appreciation for the government’s efforts towards inclusive growth, skill development, and investment in the textile industry, including a scheme for increasing the production of Extra Long Staple cotton and allocation of funds for MSMEs. However, he has expressed concern over the increase in the Basic Customs Duty on textile machinery, which may impact the industry’s global competitiveness.