The latest round of import tariffs imposed by the U.S. administration is set to impact consumer goods, retail, and restaurant companies to varying degrees, with supply chains and pricing strategies coming under significant pressure. Unlike the 2018 tariff cycle, businesses may find it harder to pass on rising costs to consumers due to lingering inflation and already weakened consumer sentiment.

According to a new analysis by S&P Global Ratings, over 24% of retail credits and 19% of consumer credits currently have negative outlooks, signaling increased risks for businesses navigating the evolving trade policies. With the U.S. announcing 25% tariffs on imports from Mexico and Canada, and an additional 10% on goods from China, companies across various subsectors must prepare for cost hikes, potential supply chain disruptions, and tighter profit margins.

Impact on Consumer and Retail Businesses:

The broad-based tariffs will have a disproportionate impact across subsectors, with businesses facing higher supply chain costs, reduced pricing power, and tighter profit margins. Unlike the 2018 tariff cycle, inflation and weak consumer spending make it harder for companies to pass these cost increases on to customers.

Impact on Consumer and Retail Businesses:

The broad-based tariffs will have a disproportionate impact across subsectors, with businesses facing higher supply chain costs, reduced pricing power, and tighter profit margins. Unlike the 2018 tariff cycle, inflation and weak consumer spending make it harder for companies to pass these cost increases on to customers.

Key Takeaways from the Report:

- Tariff Exposure: Over 24% of retail companies and 19% of consumer companies already have negative outlooks, signaling limited ability to absorb additional cost pressures.

- Sector-Specific Challenges: Apparel, home goods, and discretionary retail will be more vulnerable than staple goods. Companies relying on imports from China, Mexico, and Canada face the highest risks.

- Retailers’ Response: Businesses will need to navigate these pressures through supplier negotiations, inventory management, and strategic pricing adjustments. However, the ability to offset costs remains uncertain.

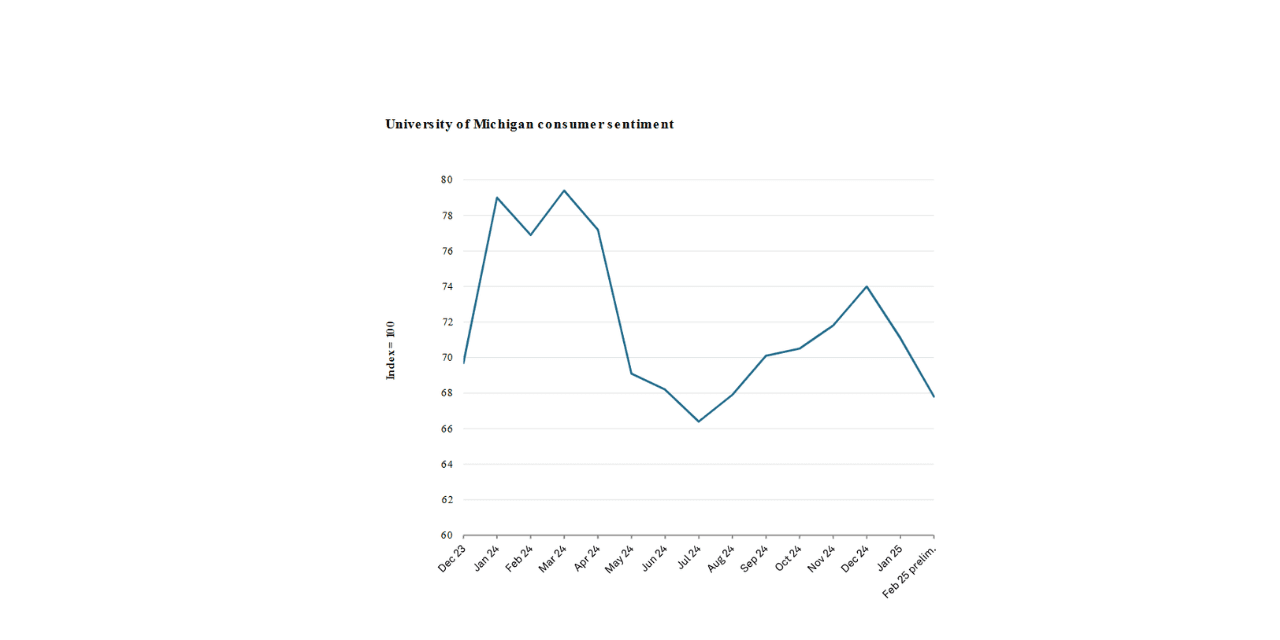

- Consumer Sentiment: Rising prices on essential goods and services, coupled with increasing credit card debt, are weighing on consumer confidence, making discretionary spending more fragile.