In today’s volatile financial environment, making informed money management decisions is more crucial than ever. Whether you want to pay off credit card debt, establish an emergency fund, or construct a solid investment portfolio, the appropriate tactics can help you achieve long-term financial success. Albert’s assistance simplifies money management, savings goals, and future planning. With the appropriate technique, you may gain financial stability and confidently work toward big goals such as purchasing a house, building a retirement account, or dealing with unforeseen bills.

Personal Finance Fundamentals

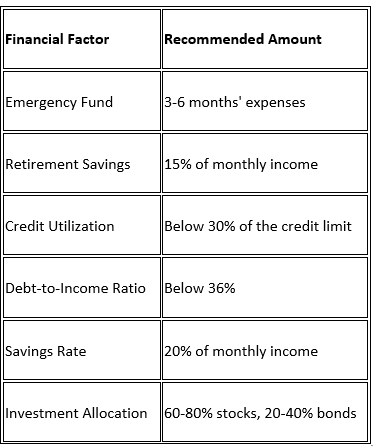

Personal finance includes how people manage their money, such as budgeting, saving, investing, and debt repayment. Consider these essential areas for establishing a solid financial foundation.

- Setting a Monthly Budget

A monthly budget helps track income and spending. Begin by determining your monthly income and dividing your expenditures into fixed (rent, utilities, loan payments) and variable (entertainment, dining out) categories. Monitor expenditures with budgeting tools or personal finance software and alter your behaviors accordingly.

- Establishing Financial Goals

Setting short-term and long-term financial objectives helps you stay focused. Goals might include:

- Creating an emergency savings account to cover unforeseen bills

- Paying off high-interest debts such as credit card charges

- Saving to make a down payment on a property

- Contributing to a retirement plan for future security

- Putting money in an investing account to grow your wealth and next-gen personal finance

Strategies for Managing and Reducing Debt

- Tackling Credit Card Debt

Because of the high interest rates on credit cards, debt may quickly build. Consider the following strategies:

- To prevent late penalties, pay a minimal amount regularly

- Using the debt snowball (paying off the smallest debt first) or the debt avalanche (prioritizing high-interest debt)

- Looking for debt consolidation solutions to reduce interest payments

- Managing Personal and Student Loans

Refinancing, federal loan repayment programs, or employer-assisted repayment can all help relieve financial stress for persons with student or personal debts.

The Value of Savings and Investments

- Creating an Emergency Fund

An emergency fund provides a financial buffer for emergencies like medical bills, auto repairs, or job loss. Experts recommend saving three to six months’ living costs in a separate savings account.

- Selecting the Suitable Savings and Investment Accounts

Savings Account: A simple way to store money with little risk.

Checking Account: Checking accounts are useful for day-to-day activities but generally pay little or no interest.

Investment Account: Investment accounts include equities, bonds, and mutual funds for long-term wealth growth.

Retirement Contributions: Use employer-sponsored plans such as 401(k)s with an employer match to receive free money.

- The Power of Compound Interest

Investing early allows you to profit from compound interest, which causes your money to increase enormously over time. Consider diversifying your investing portfolio according to your risk tolerance.

Tax Planning and Financial Protection

- Smart Tax Planning

Tax-efficient solutions might allow you to retain more money in your pocket. This includes:

- Contribution to tax-advantaged accounts such as IRAs and 401(k)

- Making use of deductions and credit reports

- Planning for tax-efficient retirement savings withdrawals

- Insurance for Financial Security

Proper insurance coverage safeguards against financial risks. Consider:

Health insurance includes dental and vision coverage

Life insurance provides stability for the family

Car loans and auto insurance protect against vehicle-related dangers

Leveraging Technology to Improve Money Management

Personal Finance Reddit and budgeting tools make money tracking easier. Albert and other app offer automatic budget tracking, investment advice, and financial instrument analytics to assist you in making educated decisions.

- Automate Savings and Payments

Setting up automatic transfers guarantees that you make regular contributions to your savings and prevent missing payments. This can be used for:

- Emergency savings contributions

- Retirement contributions

- Debt reduction payments

- Monitor Credit and Net Worth

Monitoring your credit score and credit record with services such as Credit Karma assures financial wellness. Additionally, analyzing net worth over time aids in determining progress toward financial stability.

Planning for Significant Life Events

- Purchasing a Home

Buying a house involves saving for a down payment, managing a mortgage, and keeping a high credit score.

- Saving for Retirement

A well-structured retirement plan includes making consistent retirement account contributions, comprehending financial advice from financial advisors, and taking advantage of full company match advantages.

- Managing Unexpected Expenses

Medical problems, job loss, and unexpected travel expenses underscore needing an emergency fund and practicing prudent spending habits.

Smart Money Habits Promote Financial Stability

- Creating Positive Financial Habits

- Keep track of your monthly costs to avoid overspending

- Budgeting tools can help you get greater financial control

- Reduce financial stress by prioritizing debt payments

- Funding Financial Education

Reading Reddit personal finance literature and obtaining guidance from a financial counselor can increase financial literacy and help you make better decisions.

Conclusion

Taking charge of your financial destiny necessitates cautious preparation, disciplined money habits, and smart tools such as Albert to manage cash properly. Individuals may attain long-term financial success and security by focusing on saving money, investing correctly, and paying off debt.