Synopsis

- Credit offtake rose by 3% year on year (y-o-y) for the fortnight ended January 27, 2023. Incremental credit growth has risen by 12.2% so far in FY23. In absolute terms, credit expanded by Rs.14.5 lakh crore from March 2022. The growth has been driven by continued and sustained retail credit demand, strong growth in NBFCs and inflation-induced working capital requirement from sectors such as “petroleum, coal products & nuclear fuels”, and chemicals and chemical products.

- With a higher base, deposits witnessed a slower growth at 10.5% y-o-y compared to credit growth for the fortnight ended January 27, The short-term Weighted Average Call Rate (WACR) has increased to 6.44% as of January 27, 2023, from 3.72% as of January 28, 2022, and from 6.09% as of January 13, 2023. Deposit rates have already risen and are expected to go up even further due to rising policy rates, intense competition between banks for raising deposits to meet strong credit demand, a widening gap between credit & deposit growth, and lower liquidity in the market. The deposit rates rise with a lag effect and are expected to increase the cost of borrowings for the banks.

- RBI increased the repo rate by 25 bps to 6.5% in its last monetary policy held on February 08, 2022. This is the sixth hike by RBI in FY23 due to elevated core The RBI has continued its stance of withdrawal of accommodation and has maintained a hawkish tone.

Bank Credit Growth Remains Strong

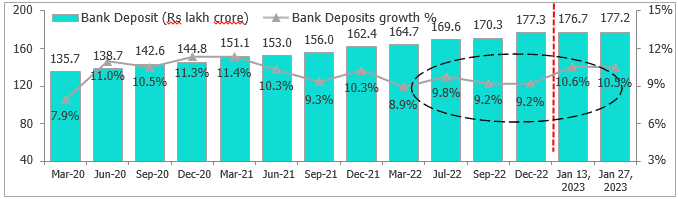

Figure 1: Bank Credit Growth Trend (y-o-y %, Rs. Lakh crore)

Note: Bank credit growth and related variations for all fortnights since December 3, 2021, are adjusted for past reporting errors by select scheduled commercial banks (SCBs). However, RBI has not yet updated these numbers in its database except for fortnightly documents. The quarter-end data reflect, the last fortnight’s data of that particular quarter; Source: RBI, CareEdge

- Credit offtake rose by 3% y-o-y for the fortnight ended January 27, 2023, compared to 8.2% from the same period in the last year (reported January 28, 2022). Sequentially, it increased by 0.5% in the fortnight. In absolute terms, credit outstanding stood at Rs.133.4 lakh crore as of January 27, 2023, rising by Rs.14.5 lakh crore from March 2022 vs 8.6 lakh crore in the same period from the last year. The growth has been driven by sustained retail, NBFCs and inflation-induced working capital requirement by specific sectors.

- Credit growth has generally been trending upward throughout FY23 and remained robust in recent months even amid the significant rise in interest rates. The growth was also broad-based across the segments and is expected to be in the mid-teens in Retail and NBFCs have been the key growth drivers for FY23. Besides, demand for capex too is expected to drive industry credit growth. Meanwhile, a slowdown in global growth due to rising interest rates, and rate hikes in India could impact credit growth.

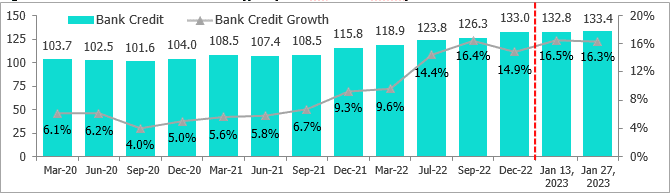

Figure 2: Bank Deposit Growth (y-o-y %, Rs. Lakh crore) – Still Rangebound

Note: The quarter-end data reflect, the last fortnight’s data of that particular quarter; Source: RBI, CareEdge

- Deposits stood at 177.2 lakh crore for the fortnight ended January 27, 2023, registering a growth of 10.5% y-o-y. Time deposits grew by 10.2% y-o-y, while demand deposits rose by 13.2% in the reporting fortnight vs. 8.3% and 12.6% y-o-y, respectively, reported in the fortnight ended January 28, 2022. Meanwhile, in absolute terms, bank deposits have increased by Rs.12.5 lakh crore from March 2022. it also increased by Rs.0.4 Lakh crore from the immediate previous fortnight (reported January 13, 2023). To meet strong credit demand, banks have been focusing on deposits. The rates on deposits have already increased and would go up further.

- The banking system liquidity has generally been trending down with RBI seeking to reduce excess liquidity from the system to manage Moreover, the MPC continued with its hawkish stance in its last monetary policy (held on February 08, 2023) and raised the repo rate due to elevated CPI. The liquidity deficit stood at Rs.18,916 crore (as of January 27, 2023) as against a surplus of Rs.6.4 lakh crore at the beginning of FY23.

- RBI has increased the repo rate by 225 bps to 6.25% (five hikes) between April 01, 2022, to December 31, 2022, followed by one more hike of 25 bps in February This additional increase is expected to be reflected first in the lending rate followed by the deposit rate. WALR on fresh loans increased by 125 bps to 8.88% by the end of December 31, 2022, which is lower than the repo rate, hence rates on fresh loans are expected to go up further.

Figure 3: Credit to Deposit (CD Ratio Trend)

Note: The quarter-end data reflect the last fortnight’s data of that quarter; Source: RBI, CareEdge

- The Credit to Deposit (CD) ratio has been generally trending upward since November 2021 and reached 3% in the fortnight, expanding by ~380 bps y-o-y from the similar fortnight last year due to continued faster growth in credit as compared to deposits. Sequentially, it also expanded by 20 bps from the immediate previous fortnight. The CD ratio has been hovering near the pre-pandemic level of 75.8% in Feb 2020 and 75.7% in March 2020.

Figure 4: Trend in y-o-y Movement

| Jan 31, 2020 | Jan 29, 2021 | Jan 28, 2022 | Jan 27, 2023 | |

| Credit | 7.2% | 4.9% | 8.2% | 16.3% |

| Deposit | 9.9% | 11.1% | 8.3% | 10.5% |

Source: RBI, CareEdge

- In terms of year performance in the current financial year, credit growth outperformed deposits

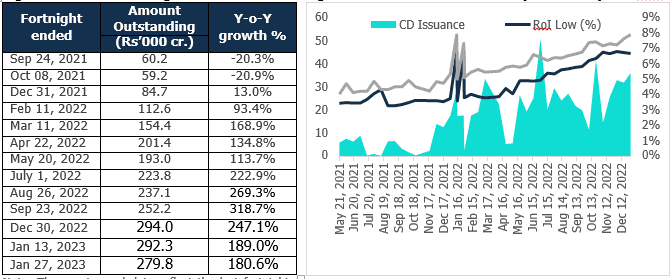

- A part of the funding gap has been met by the mobilisation of Certificates of Deposit (CD). The outstanding CDs stood at Rs 2.8 lakh crores as of January 27, 2023, as compared to Rs.1.0 lakh crore a year ago. The banks are keeping their CD issuance elevated to meet their short-term requirement amid lower liquidity in the banking system and focusing on shoring up the deposits to meet robust credit

- The deposit rates have already begun to rise and CareEdge expects that the rates would increase even further as competition for deposits intensifies and banks focus on sourcing deposits due to high policy rates, strong credit demand, and comparatively lower liquidity in the

Figure 5: Growth in Credit almost Reached Covid-induced Lag (Rs. Lakh Crore)

| Deposit | Credit | |

| March 27, 2020 | 135.7 | 102.7 |

| January 27, 2023 | 177.2 | 133.4 |

| Growth over the period (in abs. terms) | 30.6% | 29.9% |

Source: RBI, CareEdge

- In terms of absolute growth, credit offtake rose by 9% from March 27, 2020, whereas deposit growth came in at 30.6%. Credit growth almost reached deposit growth in the period.

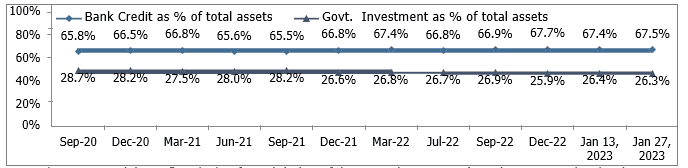

Proportion of Credit to Total Assets Increases, while Govt. Investment to Total Assets Declines Figure 6: Proportion of Govt. Investment and Bank Credit to Total Assets (y-o-y comparison)

Note: The quarter-end data reflect the last fortnight’s data of that particular quarter; 2) Total assets = Cash in hand + Assets with the Banking System + Investments + Bank Credit; Source: RBI, CareEdge

- The share of bank credit to total assets expanded by 70 bps y-o-y to 67.5% in the fortnight, compared to the fortnight ended January 28, 2022, due to higher credit growth compared to deposit It also rose by ~7 bps when compared with the immediate fortnight (reported January 13, 2023).

- Proportion of government investment to total assets declined by 40 bps for the fortnight ended January 27, 2023, compared to the similar fortnight in the last year (reported January 28, 2022). The Govt. investments stood at 51.9 lakh crore as of January 27, 2023, reporting a 13.4% y-o-y growth.

Growth in O/s CDs Remains Robust, O/s CPs witnesses a marginal contraction (y-o-y)

Figure 7: CD Outstanding Figure 8: Trend in CD Issuances (Rs’000, cr.) and RoI

Note: The quarter-end data reflect the last fortnight data of that particular quarter; Source: RBI

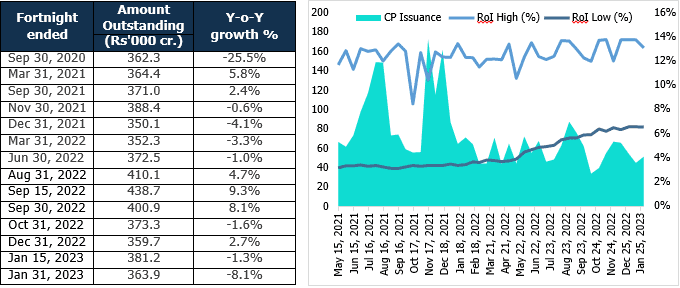

Figure 9: Commercial Paper Outstanding Figure 10: Trend in CP Issuances (Rs’000, cr.) and RoI

Note: The quarter-end data reflect the last fortnight data of that particular quarter; Source: RBI

Select RBI Announcements

| Announcement | Details |

| RBI increased the repo rate and continued with the withdrawal of accommodation | · The Monetary Policy Committee (MPC) increased the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6.50% with immediate effect.

· It also decided to remain focused on the withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth. |

| RBI announcements seek to curb the practice of imposing penal interest by banks | The extant regulatory guidelines on levy of penal interest have been reviewed in the above context.

· Any penalty for delay/ default in servicing of the loan shall be in the form of ‘penal charges’ in a reasonable and transparent manner and shall not be levied in the form of ‘penal interest’.

· Further, there shall be no capitalisation of penal charges (i.e., the same shall be recovered separately and shall not be added to the principal outstanding).

· However, in case of any deterioration in the credit risk profile of the borrower, Regulated Entity (REs) shall be free to alter the credit risk premium under extant guidelines on the interest rate.

· Draft guidelines to the above effect shall be placed on the RBI website shortly, for comments from stakeholders. |