Next week’s monetary policy meeting comes amid a sharp spike in vegetable prices, a spatially uneven monsoon,

and a divergent global monetary policy cycle. As seasonal inflationary pressures gather momentum, the Reserve

Bank of India is expected to prolong the pause, thereby maintaining a status quo in both policy rates and stance.

Monsoon Plays a Spoilsport, With No New Major Headwinds to Growth

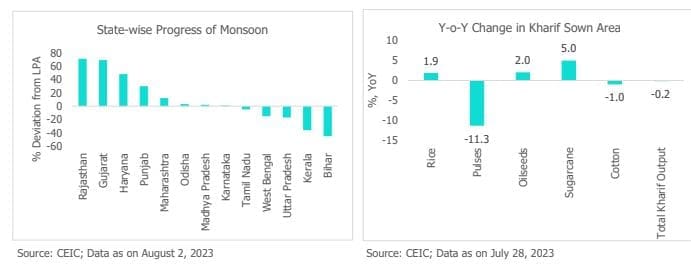

Despite the recent surge in inflation, which can be attributed to transitory factors such as a significant increase in

vegetable prices, there are underlying forces that could sustain elevated inflation levels in the coming months. By

the end of July, the eastern Gangetic plains still experienced significant rainfall deficits, while parts of western India,

including Rajasthan and Gujarat, witnessed an excess surplus of rainfall.

The current progress of the monsoon is not only spatially skewed but is expected to have temporal variations as

well. The monsoon’s progress witnessed a turnaround shift from a 10% deficit in June to a 5% surplus in July.

However, recent reports from IMD predict a below-normal rainfall (less than 94% of LPA) in August. The erratic

monsoon has resulted in lower sowing of certain kharif crops like pulses which could also contribute to growing

inflationary pressures in the coming months. Apart from vagaries arising from monsoon and agriculture-related

issues, a recent spike in international crude oil prices (11% since June) due to supply cuts from OPEC countries

could also put upward pressure on inflation. Factoring for the transient near-term risks from the weather-related

factors, we have increased our projection of inflation for FY24 to 5.3% from 5.1% earlier. The RBI is also expected

to revise its inflation projection higher.

Having said that, contracting WPI along with softness in many global commodity prices will provide some cushion

to the rising inflationary pressures with a lag. Expected moderation in the core inflation will also provide some

comfort. Amid these evolving conditions, MPC members will likely take a wait-and-watch approach to better

understand the nature of inflationary pressures before announcing a change in policy rate and stance. RBI’s MPC

is expected to remain cautious given the lingering inflationary concerns.

While inflationary pressures are up, there are no new major headwinds to growth projections. Stronger than

expected momentum in domestic investments resulted in major international agencies like IMF revising up India’s

growth projections to 6.1% from 5.9% earlier this year. We expect RBI to maintain its growth projections at 6.5%

for FY24. Our GDP growth projection for FY24 is in line with RBI’s projection.

Short-Term Liquidity Measures to Continue

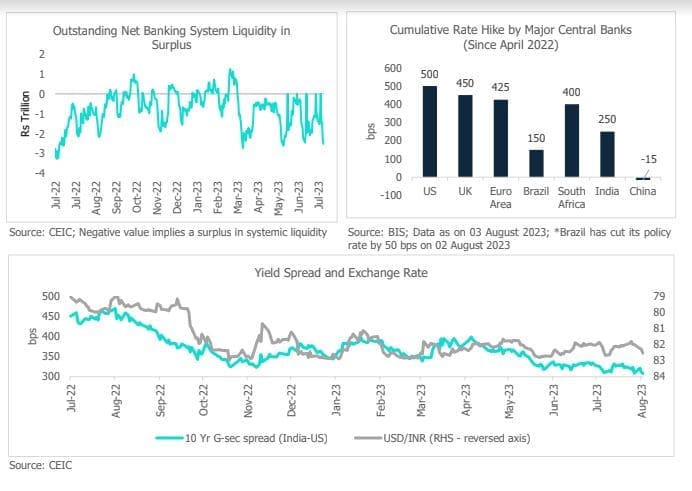

The systemic liquidity currently stands at ~Rs 2 trillion, aided by the government’s spending and the lingering effect

of currency withdrawal. RBI conducted a variable rate reverse repo (VRRR) auction absorbing ~Rs 937.6 billion

against a notified amount of Rs 1.5 trillion. Going ahead, RBI is expected to continue using short-term liquidity

management tools – VRR and VRRR auctions on a need basis to keep systemic liquidity comfortable without adding

to inflationary risks. RBI will be mindful of the increase in rupee liquidity due to large FPI inflows and if FX

interventions are carried out.

Global Policy Decoupling on the Cards

Recent developments show early signs of a monetary policy “decoupling” globally influenced by different

macroeconomic conditions. While major developed market (DM) central banks like the US Federal Reserve, Bank

of England and European Central Bank are still hiking policy rates, some emerging markets’ central banks like China

and Brazil have already started their rate-cutting journey. Last month the US Fed hiked its policy rate by 25 bps,

and the dot plot indicates that a couple of similar hikes are expected going ahead. USD/INR remained largely

stable, trading in the range of 82-83 despite hawkish messaging from the DM central banks. Large FPI inflows and

a narrowing trade deficit have provided stability to the Indian rupee.