Overview

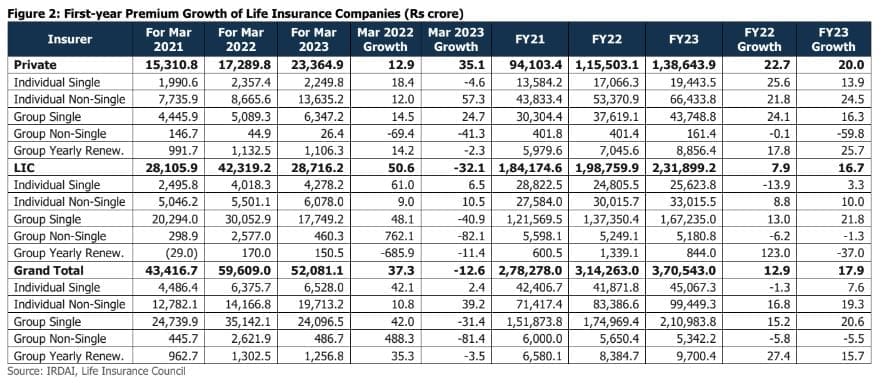

FY23 first-year premium numbers grew by 17.9% vs. the 12.9% growth reported in FY22. The FY23 growth can continue to be attributed primarily to group single premiums and more specifically to LIC and a low base, which saw subdued levels due to the pandemic-induced (Covid-19 second wave) lockdowns. Meanwhile, private insurance companies continue to extend their lead in the individual non-singe premium segment.

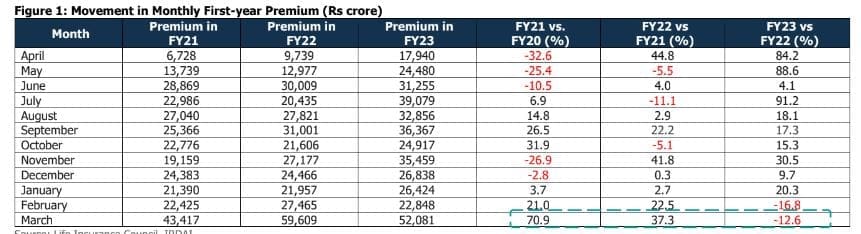

Meanwhile, the aggregate monthly first-year premium of life insurers reported a continued drop of 12.6% to Rs 52,081 crore in March 2023 after a 16.8% decrease in February 2023. Sequentially the premiums more than doubled compared to February 2023. The y-o-y decline for the month can be attributed to group premiums (primarily LIC). Private insurance companies continued their growth momentum as the fiscal year closed (tax saving options) and non-par policies to high-net-worth individuals were pushed aggressively prior to new taxation regime kicked in beginning April 2023.

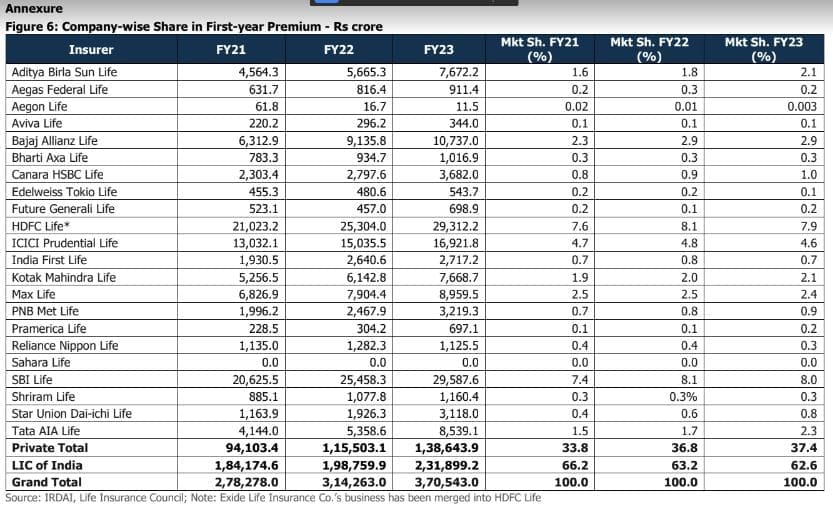

• For FY23, LIC reported a growth rate of 16.7% more than doubled compared to the rate of 7.9% reported for FY22. Meanwhile, the growth rate of its private peers decelerated marginally to 20.0% from 22.7% last year. The FY23 growth can be attributed to group single premiums especially by LIC and individual non-single premiums, more specifically by private companies.

• LIC’s first-year premium fell by 32.1% for March 2023; vs an increase of 50.6% witnessed in March 2022. The drop can be attributed to a decrease in group premiums as well as slower growth in individual single premiums. Meanwhile, private insurers reported a growth rate of 35.1% in March 2023 which is nearly three times the rate reported in March 2022 (12.9%). The monthly increase can be attributed to Individual Non-Single and Group Single premiums, which offset the fall in Group Non-Single and Individual Single premiums. Further, it can also be attributed to private companies pushing large value non-par policies before the end of the fiscal year.

• For March 2023, the growth rate of non-single premiums slowed to 18.6% vs. 27.5% reported in March 2022, while single premiums fell by 26.2% in March 2023 vs. an increase of 42.1% in March 2022. In spite of this fall for the month, single premiums continue to account for a substantial portion of the overall first-year premiums. The share of single premiums has moved from 70% for FY21 to 69% in FY22 and FY23.

• For March 2023, the group premiums dropped by 33.9%, similar to the drop witnessed in February 2023, compared to an increase of 49.4% in March 2022. Meanwhile, individual premiums increased by 27.7% around 1.5 times the last year’s rate at 19.0%. Further, for FY23, growth in group premiums has continued more than the growth in individual premiums. Individual premiums continue to remain smaller in size compared to group premiums.

• For FY23, private companies as well as LIC have continued to report growth in their sum assured. Further, given the preponderance of policies geared towards single premium/ annuity plans, LIC’s share remains small compared to its private peers which focus on protection plans. In March 2023, the sum assured of private companies grew faster as compared to LIC, meanwhile for the same period last year, both segments had reported a drop with LIC

reporting a bigger fall compared to its private peers.

CareEdge View

Insurance demand is positively correlated with economic growth and grows at a multiple to the GDP. The top line of life insurers is anticipated to remain healthy as it would be the first full year without any Covid-related restrictions, an increase in non-par business during Q4FY23, increase in term policies (Protection plans) while the demand for Annuity has continued in the near term coupled with cost management. The final finance bill has revised the tax benefits on all long-term debt mutual funds to the marginal rate of tax, thereby eliminating the benefits of indexation for new purchases after April 1, 2023. Additionally, returns from non-linked policies below Rs 5 lakhs of annual premia continue to remain tax free, hence some incremental flows from the debt mutual funds could flow into such insurance plans, marginally offsetting the impact of slowdown in high value policies. The sector is expected to continue its trajectory after companies tweak their policy mix to drive growth. Further, given the protection gap and insurance requirements, the long-term growth of the life insurance segment remains intact. The growth would also be driven by a supportive regulatory landscape (ease of doing business, Bima Sugan, Bima Vahak, Bima Vistaar,

consolidating the expense of management limits), a push to increase insurance coverage, especially in the rural populace, product innovations/customisation and allowing corporate agents to take on additional companies.