Introduction

Nepal’s economy has been recovering slowly from the aftermath of the pandemic as reflected by the growth rate of 5.8% in 2021/22 compared to the growth rate of 4.3% in the previous year. But the cloud of global uncertainty still lingers around due to which international institutions like the Asian Development Bank (ADB) have made a downward revision to their projections for Nepal’s growth rate to 4.7% from 5% in 2022/23. Downside risks to growth may arise from rising inflation, weakening of domestic currency and volatility in commodity prices. Keeping these concerns in mind, we have looked at the performance of various macro-indicators for the Nepalese economy.

Inflation Moderates Slightly but Still Elevated

Retail inflation moderated marginally to 8.5% in the month ended mid-October compared with 8.6% in the previous month. This was the fifth consecutive month in which retail inflation has remained above 8%. While non-food and service inflation remained close to 9%, food inflation was nearly unchanged at 8.1% compared with 8.2% in the previous month. The main contributors to the food inflation were cereals, fruits, hotels and restaurants.

Going ahead, Nepal’s retail inflation is likely to ease further on account of a favourable base, tighter monetary policy, and lower oil prices. Wholesale inflation also moderated to 13.7% in the month ended mid-October from the peak of 14% in the previous month. The wholesale inflation has remained in double digits for the past nine months. In the coming months, easing of commodity and oil prices could further help in lowering wholesale inflation.

Trends in Retail Inflation

Trade Balance Improves; Weak Currency Remain a Concern

Nepal’s merchandise exports declined 37.5% to Rs 13.1 billion in the month ending mid-October, as against an increase of 98% in the same period of the previous year. For the same period, merchandise imports decreased 22.3% to Rs 127.3 billion against an increase of 45% a year ago. The total trade deficit decreased to Rs 114.3 billion in the month to mid-October compared with an increase of 39% in the corresponding period of the previous year. Nepal is heavily dependent on the import of items like petroleum products, edible oils, and machinery

products. Moderation in the prices of these items in international market and weakening of domestic demand could have helped in bringing import bills down.

The decline in trade deficit and improved remittance inflows have helped in improving the overall Balance of Payments. Remittances continue to register double-digit growth for the fifth consecutive month in October 2022. Moreover, it also remained 23% above compared with the pre-pandemic period of October 2019. However, a weaker Nepalese rupee continues to pose challenges to the country’s external balance, inflation, and foreign debt.

Monetary tightening in the US led to a strengthening in the US dollar. As a result, currencies of developing economies have been weakening against the dollar and Nepal is no different. The Nepalese rupee against the US dollar has depreciated by nearly 9.5% in the past year.

Weakening Pressure on Currency Continues Remittances Continue to Improve

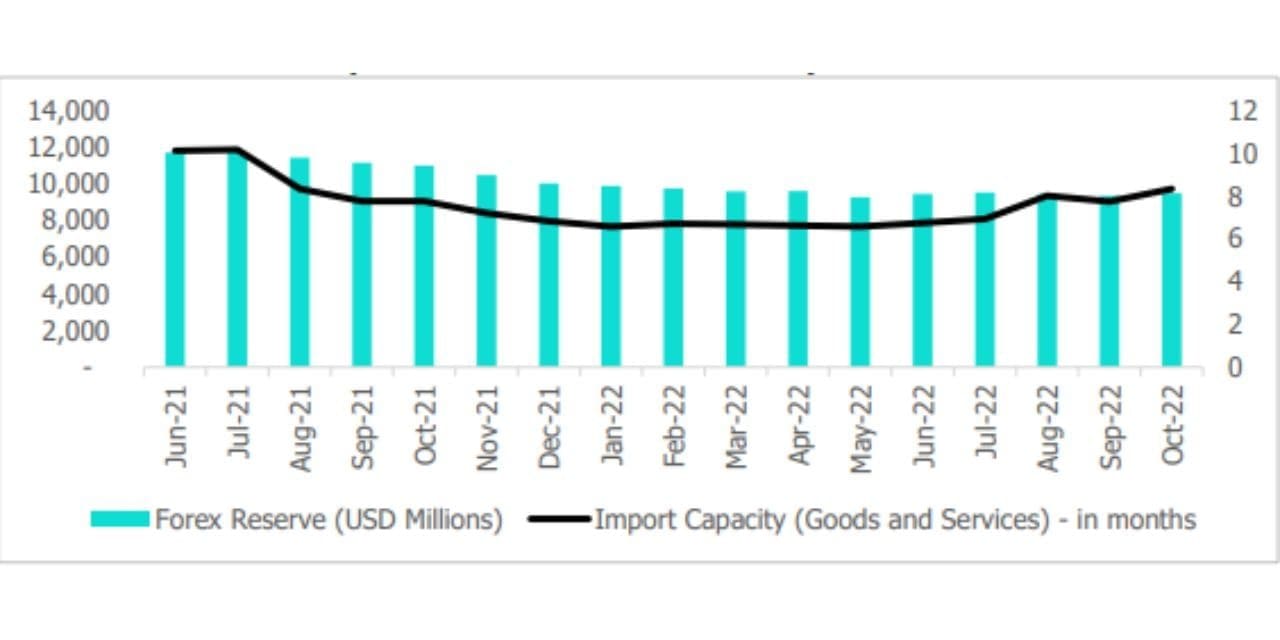

Forex Reserves and Import Cover on Path of Recovery

Nepal’s foreign exchange reserves increased by 1.4% (m-o-m) to USD 9.5 billion in the month that ended mid October but remained almost 25% less when compared with pre-pandemic level (October 2019). The current level of forex reserve is sufficient to cover imports of goods and services for 8.3 months (higher than the target of 7 months). However, it remained less when compared to average import cover of 12.4 months in 2020/21. The healthy growth in tourist arrivals is encouraging development which is expected to have a positive impact on foreign

exchange reserves.

Interest Rates on the Upward Trajectory

The weighted average lending increased to 12.2% in October from 8.7% a year ago. During the same period, the weighted average deposit rate has gone up by more than two percentage points to 8.2% in the month ended mid October 2022. Higher deposit rates will continue to attract deposits amid the ongoing liquidity crunch, but higher lending rates could put pressure on credit demand in the economy and dampen the investor’s sentiment.

Rising remittances inflow and growth in tourist arrival will support Nepal’s growth rate amid global uncertainty. Tourist arrival is expected to rebound to pre-pandemic levels as there is pent-up desire among people to travel again and Nepal offers various destinations. Moreover, going forward policy consistency in the economy following the national elections in November would also remain important to provide stability to the economy.

Monthly Data of Key Economic Variables

| Indicators (Mid-Month) | October

2021 |

August

2022 |

September

2022 |

October

2022 |

| Consumer price inflation (y-o-y%) | 4.2 | 8.3 | 8.6 | 8.5 |

| Wholesale price inflation (y-o-y%) | 3.8 | 12.6 | 14.0 | 13.7 |

| Export growth (y-o-y%) | 98.2 | -28.7 | -40.4 | -37.5 |

| Import growth (y-o-y%) | 44.6 | -12.9 | -13.1 | -22.3 |

| Trade deficit (Rs billion) | 143.0 | 116.5 | 128.4 | 114.3 |

| Worker’s remittances (Rs billion) | 83.9 | 92.2 | 94.8 | 94.0 |

| Foreign exchange reserves ($ billion) | 11.0 | 9.4 | 9.3 | 9.5 |

| Domestic credit (y-o-y%) | 29.7 | 13.8 | 11.7 | 10.5 |

| Deposits (y-o-y%) | 17.2 | 8.6 | 7.4 | 8.2 |

| Bank rate (%) | 4.95 | 8.02 | 8.5 | 8.5 |

| Weighted average deposit rate (%) | 5.43 | 7.64 | 7.81 | 8.16 |

| Weighted average lending rates (%) | 8.69 | 11.94 | 12.06 | 12.19 |