Overview

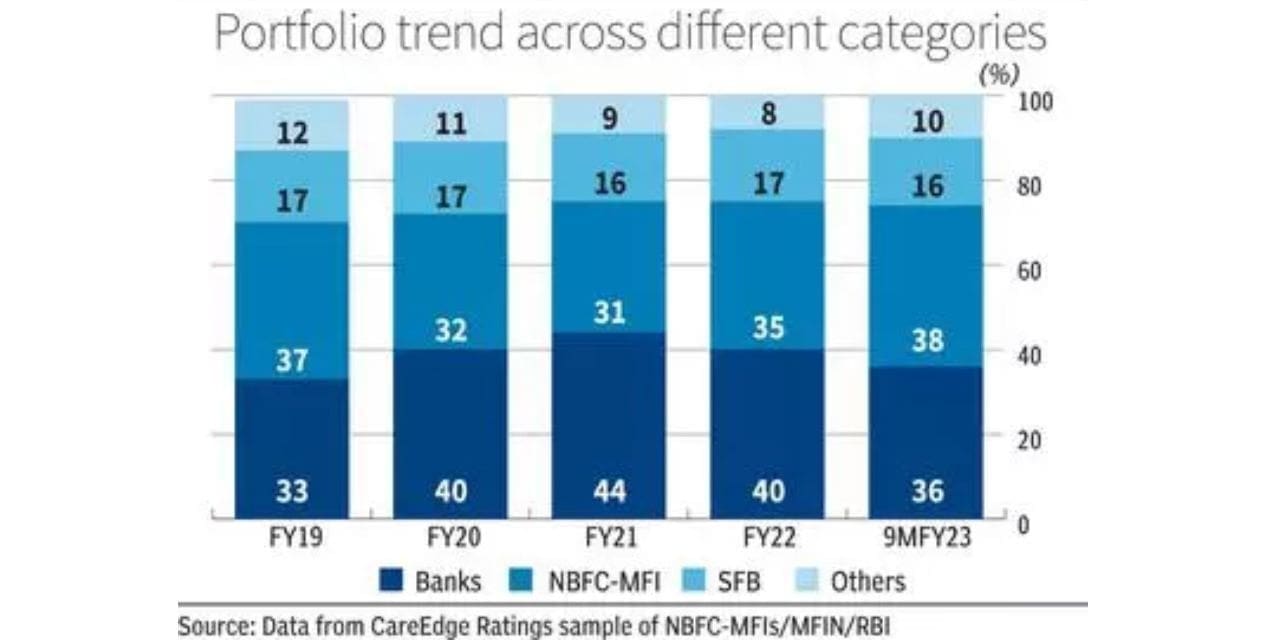

The Microfinance industry (MFI) experienced a growth spurt in 9M FY23, expanding at a rate of 12% Y-o-Y due to a favourable macroeconomic climate and renewed demand from tier-III cities, which has led to a surge in disbursements over the past few months. NBFC-MFIs have surpassed banks in the overall microfinancing landscape, constituting approximately 38% of the total outstanding microfinance loans as of December 31, 2022, compared to 36% for banks.

CareEdge Ratings anticipates growth momentum to continue, with the NBFC-MFI portfolio growing at a rate of 20%-25% over the next 12-18 months. However, an increase in interest rates, high inflation, or another wave of Covid-19 could potentially impede economic growth and, as a result, impact the Microfinance sector adversely.

The removal of the lending rate cap by the Reserve Bank of India (RBI) has enabled MFIs to engage in risk-based pricing, which has boosted net interest margins (NIMs) and, in turn, increased returns on total assets (RoTA). Credit costs have declined from their peak in fiscal year 2021 but still remain higher than pre-Covid levels, with a portion of the restructured book slipping into NPA. We expect NIMs to continue improving, resulting in RoTA rising to approximately 3.25% for fiscal year 2024, aided by controlled credit costs of approximately 2.5% for the same year.

Asset quality, although on an improving trend, still remains moderate as compared to the pre-Covid level owing to additional slippages arising from the restructured portfolio. The MFI sector has taken the cumulative impact on the credit cost of around 13% of average assets from FY21 to H1FY23 due to Covid-19. However, with an improving collection efficiency trend, GNPA is expected to improve to 3.5% and 3% in FY23 and FY24 respectively from a peak of 6.26% for FY22.

In terms of capital structure, NBFC-MFIs have managed to raise ₹3,010 crore of equity in 9MFY23, compared to ₹1,506 crore and ₹1,431 crore in FY2021 and FY2022, respectively, indicating a renewed interest from investors. Nevertheless, due to the current global turbulence, investors are likely to exercise greater caution and selectivity in the future. Additionally, with increased support from investors and rising disbursement levels, the gearing level was 3.7x and 3.6x as of March 31, 2022, and December 31, 2022, respectively. We anticipate that the gearing level for the MFI sector will moderately increase to around 3.9x by March 31, 2024.

NBFC-MFIs Outpace Banks

The microfinance industry has experienced a shift in market share, with NBFC-MFIs overtaking banks for the first time in four years. While banks held a dominant position during the Covid-19 period, the growth rate of NBFC-MFIs has now surpassed that of banks, resulting in NBFC-MFIs commanding a higher market share in the overall microfinance sector. As of 31st December 2022, NBFC-MFIs contributed around 38% to the outstanding overall microfinance loans, compared to banks’ 36%. With a growth rate of around 20% till 9MFY23, NBFC-MFIs are currently leading the industry.

NBFC-MFIs Expected to Grow at 20-25% in Next 12 Months

The microfinance industry experienced a slowdown in growth in FY21 due to the challenges posed by the Covid-19 pandemic. However, growth rebounded in FY22, with NBFC-MFIs growing at 18% Y-o-Y, supported by strong disbursements in the latter part of the fiscal year. This growth momentum is expected to continue, with CareEdge Ratings projecting a healthy loan growth of around 20% in FY23 and 25% in FY24 for NBFC-MFIs.

Joint liability group (JLG) loans currently dominate the loan book profile. However, the growing ticket size across loan products and the new RBI guidelines, which deregulate the maximum cap on interest rates and lower the minimum required share of MFI loans in the portfolio to 75%, may lead to a gradual increase in the share of individual, micro, small, and medium enterprises (MSME) and other non-MFI loans in the portfolio mix in the medium term.

Profitability Indicators Improve with NIMs Expansion, Still Below Pre-Covid Levels The NBFC-MFIs have reported improved net interest margins (NIMs) of around 10.45% during 9MFY23, compared to around 9% in FY21 and FY22, following the removal of the lending rate cap regime in the revised regulations by the RBI and improved collection efficiencies. However, the operating expenses to average assets ratio remain elevated at around 6.3% during 9MFY23. Although the credit cost had increased significantly to 4.6% of the average assets in FY21, it reduced marginally to 3.7% in FY22 and remained similar in 9MFY23. The improvement in margins along with the reduced credit cost has led to an improvement in profitability indicators, with a return on average assets of 1.4% in FY22 (vs 0.7% in FY21), which further improved to 2.3% during 9MFY23.

Looking ahead, profitability is expected to improve further with higher margins, reduced credit costs, and improved collection efficiency. However, it is likely to remain lower than the pre-covid level in FY24.

Post the exacerbating impact of the Covid-19 pandemic on the income profile of low-income groups of the economic society and the resultant increase in delays in debt servicing by the end borrower, asset quality stress spiked for the sector. The Gross Non Performing Asset (GNPA) Ratio peaked at 6.26% on March 31, 2022, compared to 2.05% as on March 31, 2020, owing to a steep rise in slippages. However, with better collection efficiency supported by an improving macroeconomic environment along with substantial write-offs, improvement in NPA trend can be seen, though the GNPA ratio still remains high as compared to pre-covid levels. Further, reduction in the restructured book can also be seen as the book declines from 9.47% as on March 31, 2022 to 5.13% as on September 30, 2022, and is expected to further decline to around 2.5% of the overall book as on March 31, 2023.

In terms of provision coverage, NBFC-MFIs are adequately provided for with a provision coverage ratio of around 70%. Going forward, CareEdge Ratings expects the collection efficiency to remain high leading to improvement in asset quality metrics.

CareEdge View

CareEdge Ratings anticipates the growth momentum in the MFI industry will continue, with a growth rate of around 25% YoY in FY24, driven by steady disbursement growth and an improving macroeconomic environment. We also expect asset quality pressure to ease as the restructured portfolio decreases, and we anticipate that the GNPA ratio will decrease to 3% by the end of fiscal 2024, although it will remain high compared to pre-Covid levels.

We anticipate that return on average assets will improve to 3.25% in FY24, supported by controlled credit costs and improving NIMs. However, we acknowledge that the rising interest rate environment, high inflation, and any new Covid wave could have an impact on the growth of the MFI sector.

During the pandemic, equity infusion into microfinance companies slowed down, resulting in a high gearing of 3.7 times during FY21 and FY22, despite a moderation in disbursements. However, during 9MFY23, there has been a steep rise in equity infusion, reflecting investors’ renewed confidence in the industry. The industry raised ₹3,010 crore in 9MFY23, compared to ₹1,506 crore in FY22 and ₹1,431 crore in FY21. While larger microfinance institutions were able to raise equity from initial public offerings (IPOs) as well as from existing investors, mid and small-sized MFIs were more dependent on bank funding, which led to a rise in total borrowings. For large MFIs, the cost of debt funds ranged from 8% to 13% per annum, while for mid-sized MFIs, the cost of funds was close to 15% per annum.

Given the current global turmoil, investors are likely to be more cautious and selective in the future. Overall, we expect the gearing level of the microfinance sector to remain moderate, at around 3.6x to 3.8x, over the next 12 months.