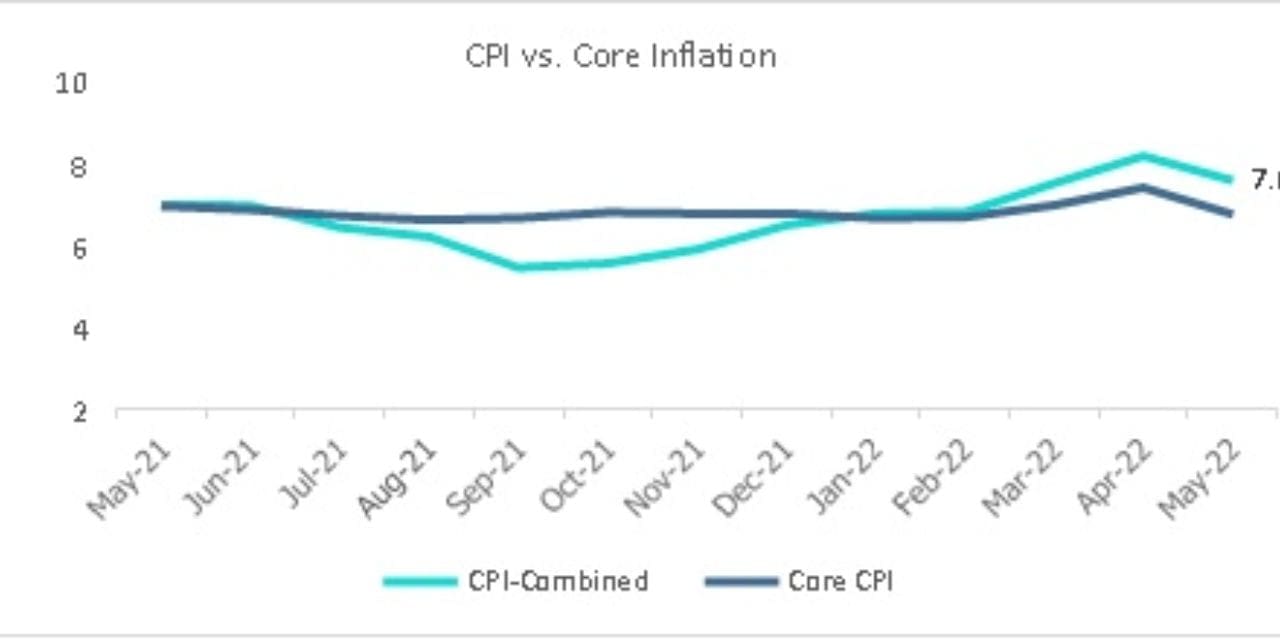

India’s retail inflation softened marginally to 7.04% in May from an eight-year high of 7.79% in April, aided by a favourable base. The core inflation, which is reflective of the non-volatile component of CPI, also eased but was still close to the 6% mark indicating that inflation has become broad-based. The inflation print came in broadly in line with market expectation (CareEdge has projected CPI inflation at 7.1% in May).

Consumer inflation has been on the upward trend since October 2021 and has reversed its trajectory in May after a gap of seven months. Despite the slight moderation, it remained sharply above the RBI’s tolerance level for the fifth straight month, driven by elevated food and fuel prices. Recent supply-side measures announced by the government on May 21 had only limited impact this month and the full impact will be visible in June numbers.

Food continues to remain the main driver with a nearly 50% contribution to total inflation. At 7.84% in May, food inflation witnessed a moderation from 8.1% last month. However, sequentially food prices gained momentum on account of rising price pressures for items like cereals, vegetables and edible oils.

Cereals inflation at 5.33% in May was primarily because of the rise in wheat and rice prices. Retail wheat prices have been trending upwards because of production shortfall due to heatwave conditions while rice prices also increased mirroring wheat price rise on solid demand.

Vegetable inflation accelerated to 18.26% in May compared with 15.34% last month. Among key vegetables, tomato prices rose sharply in May owing to less production due to heatwaves conditions prevailing in key supplier states and high fuel prices. Potato prices also hardened in May. Prices of meat and dairy were higher driven by higher feed costs. Going ahead, expectations of a normal monsoon and the recent supply-side measures taken by the government may help to ease the food price pressures to some extent.

Fuel and light inflation remained elevated at 9.54% in May as a result of a hike in LPG cylinder prices (Domestic: Rs 53.5/cylinder; Commercial: Rs 102.5/cylinder) during the month and electricity tariff revisions by many states. Coal and natural gas prices have skyrocketed in the past few months and have prompted domestic players to raise prices to maintain their margins. Rising fuel inflation has a cascading effect on inflation as it feeds into other categories due to higher transportation and logistics costs.

Transport and communication inflation came in slightly lower at 9.54% in May helped by a high base effect. The impact of excise duty cut for petrol and diesel will be reflected more clearly in June numbers.

Way Forward

With consumer inflation at elevated levels, households’ inflationary expectations have been on the rise. The RBI has been proactively taking measures to bring inflation back within its target range and curb rising inflationary expectations. Considering the broad-based nature of inflation, it has also revised the inflation projection for FY23 up by 100 bps to 6.7%.

For the next few months, we expect CPI inflation to remain above RBI’s upper tolerance limit owing to elevated crude and commodity prices. Also, with expected improvement in the employment situation, there is a risk of a wage-price spiral setting in, which would make the task of reining in inflation even more difficult. In the second half of the fiscal, we could see some cooling of price pressures owing to control measures taken by RBI and the government. Robust Kharif output helped by a conducive monsoon could ease food prices to a certain extent. A likely slowdown in the global economy will also limit the upside to inflation. Considering all these factors, we estimate the CPI inflation to average around 6.5% in FY23, with an upward bias. The protracted war situation and the resultant high crude oil prices pose an upside risk to our inflation expectations.