After reporting healthy growth with a quarterly average of 8.9% in 2022, the Mauritian economy is expected to

witness a slowdown in 2023. The National Statistics Office and Bank of Mauritius expect real GDP growth to slow

to 5% in 2023, on account of waning momentum in the manufacturing sector. The estimate is however higher than

the International Monetary Fund’s (IMF) projection of 4.6%.

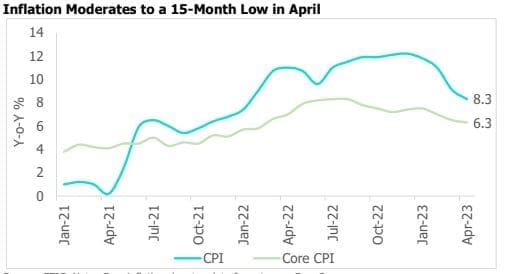

Inflationary Pressures Ease in April

The consumer price index (CPI) inflation moderated to a 15-month low of 8.3% y-o-y in April from 9.1% in the

previous month. On a sequential basis, retail inflation declined 0.1%, posting its first contraction since August 2021.

The main contributors to the change in the index between March 2023 and April 2023 were vegetables and culinary

herbs. Core inflation, which excludes food, beverages, tobacco, mortgage interest, energy, and administered prices,

eased to 6.3% from 6.5% in March. For 2023, the central bank forecasts inflation within the 5-6% range for the

year. This would still be at the upper end of the inflation target for the country that has been defined to be in a

range of 2-5%, with the aim to achieve 3.5% in the medium term.

Trade Deficit Widens in March

In March 2023, the trade deficit in Mauritius widened for the second consecutive month, reaching MUR 15.9 billion,

which is 11% higher than the corresponding period last year. Exports (excluding ship’s stores and bunkers) rose

5% y-o-y to MUR 7.9 billion, with the increase largely led by the ‘food and live animals’, ‘crude materials’ and

‘manufactured goods’ categories. Meanwhile, imports declined 6% y-o-y to MUR 23.8 billion in March. UAE, China,

and India were the top three import partners, while the top three export destinations were South Africa, France,

and the United Kingdom.

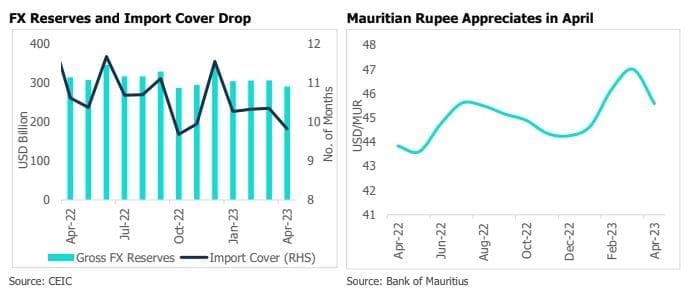

Forex Reserves Decline to a 7-Month Low; Currency Finds Support

In April 2023, the gross official international reserves in Mauritius decreased to a 7-month low of MUR 290.9 billion, which is MUR 16 billion lower than the previous month. As a result, the import cover dropped to 9.8 months, the lowest level in six months. The Mauritian Rupee however appreciated 3% over the last one month to 45.6 per USD in April. Over the past 12 months, however, the currency has weakened over 4% against the USD. Bank of Mauritius intervened in the forex market via dollar sales worth USD 10 million at around MUR 45.25 levels in April to defend the local currency. Recent dollar appreciation on account of safe-haven demand amidst protracted debt ceiling negotiations is likely to have weighed on the Mauritian rupee over the last one month.

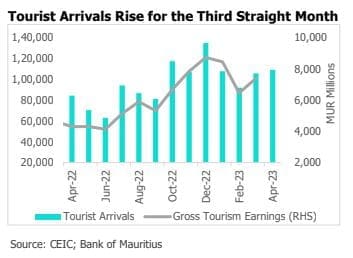

Tourist Arrivals Support Economic Recovery

Domestic recovery in 2023 continues to be supported by the tourism industry, generating favourable spillovers for other sectors, such as wholesale and retail trade, transportation, construction, and real estate. Tourist arrivals reached 1,09,031 in April, rising 3% over the previous month and nearly 30% over the same period a year ago. Meanwhile, gross tourism earnings have nearly doubled to MUR 22 billion in the first three months of 2023, compared to the year-ago period. Going ahead, the government’s efforts to promote ecotourism will help achieve the target of attracting one million tourists for the year.

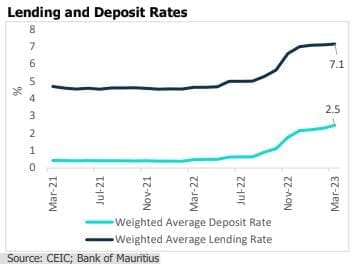

Interest Rates on Upward Trajectory

The weighted average lending increased to 7.14% in March from 4.65% a year ago. During the same period, the weighted average deposit rate has gone up to 2.5% from 0.48%. The rise in lending and deposit rates is reflective of the tightening of monetary policy since March 2022. Bank of Mauritius has raised its policy rate by 265 basis points to 4.50% since the start of its tightening cycle.