Certified market research and consulting firm predicts the global flat glass market is anticipated to reach US$ 445 Bn by the end of the 2022-2032 forecast period, inclining at a CAGR of 4.5%, projects a recently concluded study. Growth of the market is inextricably linked with developments in the global construction and power generation industries respectively. Flat glass is especially deployed in solar power generation.

During the historical period 2015 to 2021, demand for flat glass products surged at a CAGR of roughly 4%, concluding at US$ 274 Bn. Prospects declined considerably during the height of the COVID-19 pandemic, attributed to the downsizing of the global construction industry. Postponement or cessation of key infrastructure development activities negatively impacted flat glass demand. However, since 2021, prospects have begun to rebound, as restrictions on commercial activities ease.

The market is expected to grow over the forecast period with the growing number of solar energy installations across the globe and the increasing penetration of glass technology in both residential and non-residential constructions. Building and infrastructure development are directly related to the demand for flat glass. Recent changes in building architecture have increased the use of flat glass on roofs and facades to maximize natural daylight.

Key Takeaways from the Market Study

- The global market is expected to reach US$ 286.33 Bn by the end of 2022.

- The global flat glass market for new construction application systems was worth US$ 40 Bn in 2021

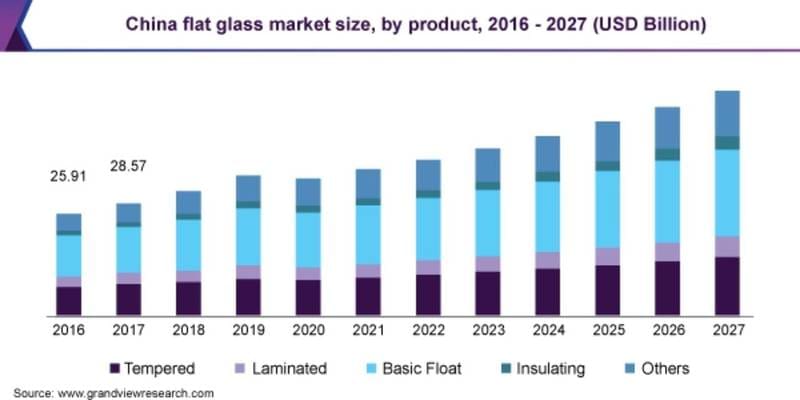

- In 2022, Asia Pacific is expected to account for more than 62% of global revenue.

- More than 45% of volume share will be held by the insulated product segment in 2022.

- The architectural application segment is projected to hold the largest revenue share of more than 73% in 2022.

“Residential and commercial construction companies are replacing brick, cement, and granite with stylish and colorful glass facades and other counter parts. The trend could help develop the flat glass market. Increasing construction and refurbishment spending in India and China, combined with increased investment in the construction industry, could drive industry growth and increase the demand for products,” opines a Senior Research analyst

Competitive Landscape

The market is fragmented and highly competitive due to the presence of several major players. Various strategies are being employed by the companies to recover losses from the pandemic and to strengthen their market positions. In addition to extensive R&D, the companies are striving to make high-quality and cost-effective products in various applications through increased efforts to develop innovative products.

- In September 2020, Guardian Glass opened its second float glass facility in Poland. The newly constructed facility will make high-performance products easier to access for the architect and construction markets.

- AGC Inc. integrated its Architectural Glass Business in Japan with Central Glass Co. by the fourth quarter of its fiscal year ending December 31, 2021.