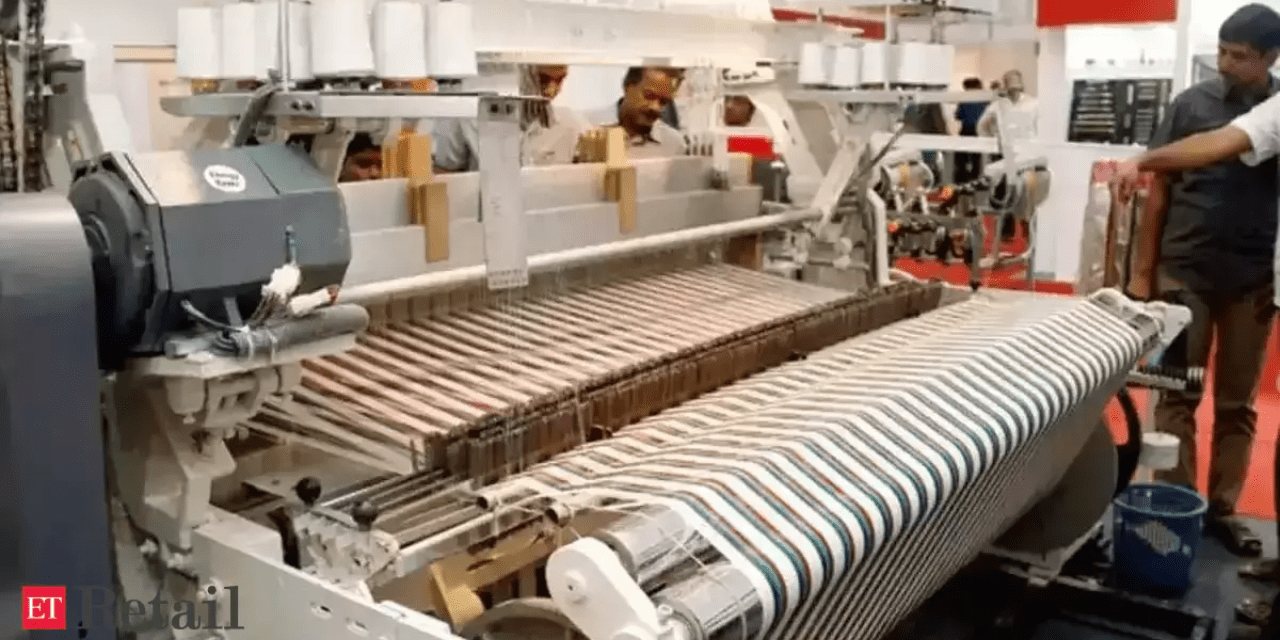

Gujarat, a centre for Indian textile production, anticipates new investments worth Rs 40,000 crore in the weaving industry after the federal government announced that there will be no additional taxes on high-speed weaving machinery.

The Union Budget included provisions for a basic customs tax of 7.5 percent and a 10 percent surcharge on high-speed weaving machines, which worried the textile sector. In a letter to the finance minister Nirmala Sitharaman, textile associations from the state argued that imported machinery should continue to enjoy the benefit of zero duty, as it had for the previous five years, primarily because India does not produce high-speed weaving machines that meet international standards.

Rahul Shah, co-chairman of the GCCI textile taskforce, stated that the weaving industry would receive significant expenditures and that there would be no taxes for the next two years. To Investment in the textile and apparel value chain is anticipated to hit $100 billion, which will be used to serve additional market demand until 2030 and replace outdated machinery. By 2030, it is projected that $65 billion will be invested in primary manufacturing machinery. In the same time frame, these investments are predicted to produce 15 million employment.

Former Southern Gujarat Chamber of Commerce and Industry (SGCCI) president Ashish Gujarati predicted that the textile industry in Gujarat would receive investments totaling Rs 40,000 crore because new projects would be competitive with the duty structure. But there will be some influence from the strengthening dollar and rising interest rates. There is no Technology Upgradation Fund (TUF) programme, which provides a 10% equipment subsidy. The updated notice has provided these’s RPM information. machines, but we insist that it be altered because it is impossible to find any machines with the required RPM. Up until March 31, 2023, the federal government had offered relief through a reduced rate of duty; it has since extended it for an additional two years.