Synopsis

• India’s coal production reached a new milestone of 892 Million Tonne (MT) during FY23, a 14.7% y-o-y growth,

driven by a 12.9% y-o-y increase in production by Coal India Limited (CIL). The power sector continued to be

the largest consumer of domestic coal, accounting for the total despatches of 737.9 MT during FY23, an

increase of 9.1% y-o-y.

• Total coal imports surged by 26.18% y-o-y to 227.93 MT during 11MFY23 (April 2022 to February 2023) with

non-coking coal accounting for 65% of the imports.

• The Ministry of Coal launched auctioned 87 coal mines to date under six tranches. The estimated revenue generated by these auctions is approximately Rs. 33,200 Crores. About 106 fully explored, partially explored,

coking, non-coking, lignite etc. coal mines are being offered under the 7th round of auctioning which commenced in March 2023.

• “The Coal Ministry has set a target for domestic production of 1 billion tonnes in FY24, a 13% growth y-o-y,

which will be driven by ramp up in the production of state-owned CIL and NLC India Limited, and incremental

output from existing and new captive mines. CareEdge Research expects despatches to the power sector to inch up further from 84% of total supplies as seen in FY23, with continuously rising demand from coal-based power plants. While the imports have increased compared to last year due to higher blending requirements, the government’s initiatives to increase domestic production would lower dependence on imported coal in the medium-long term. The international coal prices are expected to be higher than pre-Covid years’ averages as the global demand continues to remain high owing to increased demands especially in China and India,” Tanvi Shah, Director, CareEdge Advisory & Research, said.

Domestic Production to Reach 1 Billion Tonnes During FY24

Domestic coal production crossed 892 MT during FY23, registering 14.7% y-o-y growth. CIL continued to be the

largest producer of coal accounting for 78.8% of the total production during FY23. CIL’s production grew by 12.9%

y-o-y to 703.2 MT during this period.

Coal production from captive mines increased by 35.1% y-o-y in FY23, contributing 13.7% to total coal production

during FY23, vs. 11.6% during FY22. Steady growth in captive coal production was led by the government’s support

and commissioning of four new mines during FY23. The government has also permitted the sale of up to 50% of

the annual production from existing operational captive coal mines in the open market. The production from

Singareni Collieries Company Limited (SCCL) remained relatively flat y-o-y.

The Coal Ministry has set a target of domestic production of 1 billion tonnes in FY24, a 13% growth y-o-y, which

will be driven by ramp up in production of state-owned CIL and NLC India Limited by engaging Mining Developers

cum Operators (MDOs). Further, Incremental output is also expected from the operational and new captive mines.

The government’s initiative including the amendment of the Mines and Minerals Act, of 1957 which allows the

captive mines to sell up to 50% of their annual coal production in the open market after meeting the end-use plant

requirements, production through MDO mode, increase in use of mass production technologies, expansion of

existing projects and privatization of coal blocks, 100% Foreign Direct Investments, Single Window Clearance etc.,

will continue to boost domestic coal production in the medium term.

Power Sector Consumed 84% of Total Coal Supplies in FY23

Total coal despatch increased by around 7.1% y-o-y in FY23, supported by higher production and steady increase

in availability of railway rakes during the period. The aggregate coal despatch to the power sector was 737.9 MT

during FY23, an increase of 9.1% y-o-y. Power sector accounted for 84% of the total coal despatches during FY23.

This increased supply to the power sector is majorly on account of the higher coal requirement from the sector due

to increased demand for electricity on account of seasonal changes and warmer temperatures.

The despatches to captive power plants grew by 8.1% y-o-y and declined for other sectors as the power sector

was prioritised.

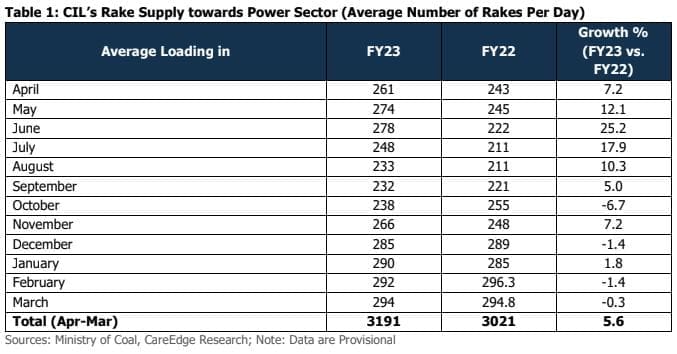

Overall, rakes available to the power sector increased by 5.6% y-o-y during FY23. The Ministry of Railways has

purchased 1 lakh wagons1 to increase the railway connectivity from coal mines areas to the power plants. Further, the Ministry of Coal will be adding 19 First Mile Connectivity (FMC) Projects by FY26-27 to the existing 55 projects

with an additional capacity to transport 330 MT of coal. These projects are being undertaken by the Ministry of

Coal to develop National Coal Logistic Plan to strengthen rail networks from pitheads to dispatch points and overall

rail networks for coalfields.

Plant Load Factor for Coal-based Power Plants on the Rise

The overall energy requirement in the country has increased to 1,182 BU during FY23 from 1,078 BU during FY22.

The power sector consumed 663.5 MT of domestic coal and 50.8 MT of the imported coal in FY23 (April 2022-

February 2023), a y-o-y growth of 10% and 110.5%, respectively. Coal-based power generation accounted for

more than 74% of total power generated in FY23. The PLF2 of coal-based power plants improved to 64.15% in

FY23 from 57.23% during the same period in FY22, primarily due to a ramp-up in domestic coal supply to meet

the high demand for coal-based power plants.

As of March 31, 2023, the coal stock at non-pithead power plants has improved to 12.9 days from around 7 days

in April 2022, which is well above the critical stock levels of below 7. As per CEA, pithead power3 plants have around

93% of their normative stock available as of March 31, 2023, while non-pithead plants4 have only around 48% of

their normative stock available.

Inter-ministerial Secretary-level meetings are being held regularly to monitor the coal stocks in plants. The

Government has also issued revised coal stocking norms which mandates the power plants to stock sufficient coal

of about 12 days at all the time to support any contingent situation.

Coal Imports Increased in FY23, Led by Non-coking Coal

Coal imports increased by 26.18% y-o-y to 227.93 MT in FY23 (April- February). Non-coking coal, mainly used in power generation, cement and metals sectors, accounted for 65% of the total coal imports. Over 70% of the non-

coking coal is imported from Indonesia and South Africa while coking coal is majorly imported from Australia.

In January 2023, the power ministry has directed the thermal power plants to import coal to achieve imported to

domestic coal blending at the rate of 6% for the remaining period of the current fiscal and H1FY24. The move is

targeted to reduce the coal shortfall anticipated during the summer months. However, to reduce dependence on

imported coal over the medium-long term, the Government has been taking various initiatives including auctioning

of coal blocks for commercial mining, FDI under the automatic route, expansion of existing mines, opening of new

mines under CIL and development of evacuation infrastructure.

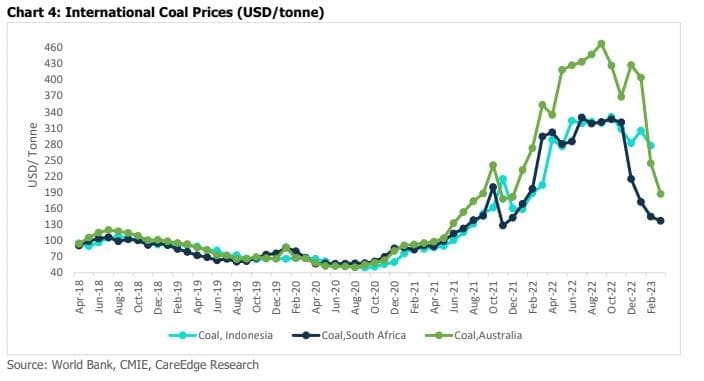

International Coal Prices Softened in Q4FY23

During FY23, the average coal prices for Indonesian coal, South African coal and Australian coal were 108%, 72%

and 99% higher, respectively, as compared to prices during the previous year. Coal prices have been softening

since November 2022 as the increase in supplies from South Africa and Columbia have alleviated the demand

crunch in European countries caused by reduction of coal imports from Russia. Further, the winter in CY22 has

been warmer compared to previous years. These factors have led to a reduction in international coal prices.

International coal prices of major global benchmarks are expected to be lower in FY24 compared to FY23, however,

they will continue to be higher than pre-Covid years’ averages as the global demand continues to remain high

owing to increased demands especially in China and India.